Advantages Of Resident Status In Malaysia

42 Tax treatment of resident and non-resident individuals. Expatriate and Dependants Permanent Residency Status Expatriates and children of expatriates who have obtained approval for Permanent Resident status.

Answer 1 of 5.

Advantages of resident status in malaysia. Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income. MM2H visa permit- Benefits Incentives. Flexibility to change employers without having to renew the pass.

I taxable incomes of resident individuals are subject to. BENEFITS OF THE RP-T. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia.

Apply for long-stay visas for your parents. This includes but not limited to. 4 marks b Puan Sheila a Singaporean citizen works as a financial consultant in Mutual Fund Berhad.

And A non-resident is also free to repatriate divestment proceeds profits dividends or any income arising from these investments in Malaysia provided it is foreign currency FC. Income earned by residents are subjected to a scaled income tax rates from 0 to 28. 5 year Social Visit Pass with Multiple Entry will be.

That means no more applying for visas and a range of benefits which arent available to expats on short term permits and passes. Well first you can enjoy many privileges reserved only to the citizens like free or cheap depending on how you look at it medical services unless you want to go to the private sector. Company letter 2Form IMM12 2 sets.

Resident Status Question a Explain briefly four 4 benefits for an individual having a resident status in Malaysia. There are many benefits of expat living and retiring in Malaysia. While there are many advantages to having a Malaysian PR there are obvious obligations for a holder.

Resident to invest in Malaysia and repatriate any profits and divestment proceeds abroad. Resident status is determined by reference to the number of days an individual is present in Malaysia. Below are the benefits of holding a Malaysian permanent residence as well as the limitations that comes with it.

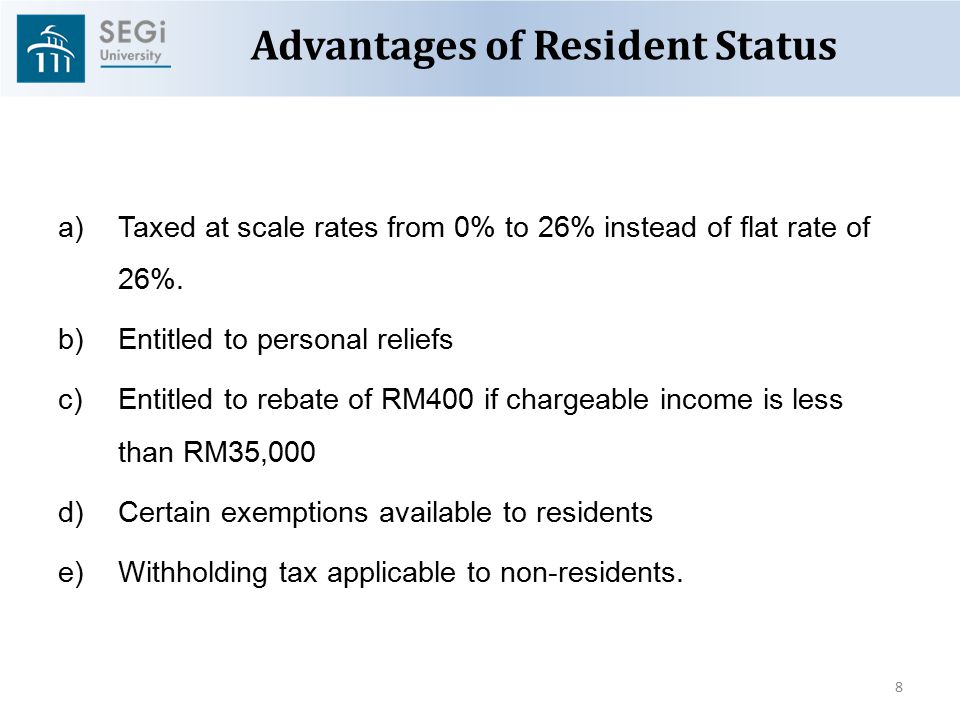

The status of individuals as residents or non-residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. Last reviewed - 14 December 2021. If a person stays in Malaysia for at least 182 days not necessarily consecutive in a calendar year he would be treated as a resident.

Here is an overview of income tax and taxable benefits in Malaysia as a guide to get you started and suggestions on getting the help you need to stay in compliance. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. Question 3 3 Advantages of an individual being tax resident in Malaysia are as follows.

Youll receive a Blue Card which acts as your identity document. Benefits of a Malaysian PR i Exemption from visa and Immigration requirements to enter and exit the country. Personal income tax in Malaysia ranges from 0-28 for residents and non-residents pay a flat 28.

Generally a company is regarded as resident in Malaysia if at any time during the. But its mostly benefits your children than it on you since they are considered as citiz. A company is tax resident in Malaysia in a basis year normally the financial year if at any time during the basis year the management and control of its affairs are exercised in Malaysia.

Corporate - Corporate residence. Compulsory 90 days stay per year between spouses. For individual foreigners to eligible for resident status eligibility he is required to stay in Malaysia for more than 182 days in a calendar year.

Significance Of Residence Status 41 Residence status for income tax purposes Residence status is a question of fact and is one of the main criteria that determines an individuals liability to Malaysian income tax. The resident tax rate is reasonable range from 0 to 28 with applicable to many incentives and rebates as opposed to a flat rate of 28 for non-resident status. Expatriates and children of expatriates who have obtained approval for Permanent Resident status while waiting for the Entry Permit Documents required.

Include your spouse and unmarried children under 21 in the PR application. A non-resident is free to invest in any form of ringgit assets in Malaysia. Holders of a Permanent Residency PR are able to stay and remain in a country indefinitely seek employment freely own a business acquire properties and enter and exit the country in way that is similar to Malaysian citizens.

Malaysian Permanent Residents are foreigners who have the right to live indefinitely in Malaysia. The top reason for most of us who live here is that life is easy affordable and relatively low-stress. In fact the cost of living is so low that many Westerners are able to retire early here sometimes a decade sooner than anticipated.

If you are deriving income from employment or business in Malaysia there are several benefits that you would enjoy if you have a tax residency of Malaysia. 42 A resident and a non-resident company in Malaysia is taxed in the same. Personal Income Tax Rates in Malaysia.

Resident Status of Individuals. Being a Malsyian PR is not the same as being a Malaysian citizen however. Significance of Residence Status 41 Residence status is a question of fact and it is one of the main criteria that determines the tax treatment and tax consequences of a company or body of persons.

Ability to live and work in Malaysia for up to 10 years. Once your application is successful there are various benefits incentives provided as below. For tax purposes the tax residence status is determined by the duration of stay in Malaysia and is not bound by reference to the nationality or citizenship.

However Malaysian resident status is still applicable for purposes of the general application of the domestic law so that the income of companies. Through the RP-T these individuals are able to remain in the country and contribute towards Malaysias goal of becoming a high-income nation. Liability to tax is determined on a year to year basis.

If your children are school-aged they are high on the priority list behind citizens to enter public schools of your own choosing.

Question 3 3 Advantages Of An Individual Being Tax Resident In Malaysia Are As Follows I Taxable Incomes Of Resident Individuals Are Subject To Course Hero

What Are The Advantages Of Having A Permanent Residence In Malaysia Quora

Masters Of Financial Planning Ppt Video Online Download

Want To Know How To Be A Permanent Resident In Malaysia Propertyguru Malaysia

Posting Komentar untuk "Advantages Of Resident Status In Malaysia"