Personal Income Tax Relief 2021 Malaysia Lifestyle

The GoBear Complete Guide to LHDN Income Tax Reliefs. Malaysian personal tax relief 2021.

Crowe Malaysia Updated The Tax Relief For Parental Facebook

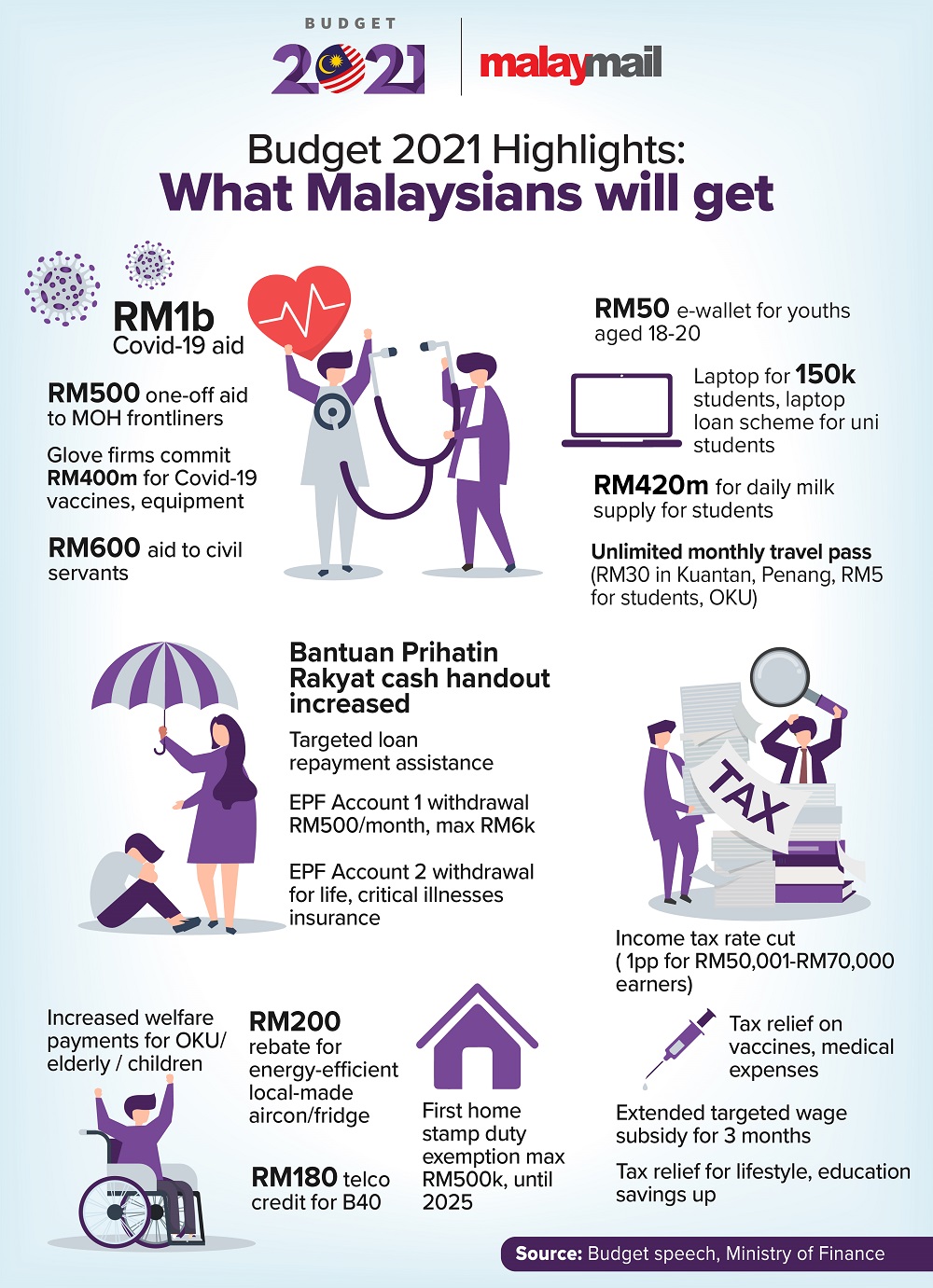

A reduction of 1 in the income tax rate in Malaysian Budget 2021 is expected to help the Middle 40 M40 income group with their financial difficulties next year.

Personal income tax relief 2021 malaysia lifestyle. From expanded medical tax reliefs to an anticipated income tax reduction here are the personal income tax highlights from Budget 2021. The scope of this lifestyle income tax relief for printed daily newspapers to include subscriptions for electronic newspapers with effect from YA 2021. 19 rows Special relief in addition to lifestyle relief for purchase of mobile.

Per child below 18 years old 2000. From year of assessment 2021 6. Disabled individual - additional relief for self.

Purchase of basic supporting equipment for disabled self spouse child or parent. RinggitPlus Everything you should claim as Income Tax Relief. 26 rows Malaysia Personal Income Tax Relief 2021.

The scope of lifestyle relief includes. 45 Tax Relief for Contribution to Private Retirement Scheme PRS Presently individual taxpayers are entitled to claim income tax relief of up to RM 3000 annually for their contribution to. The tax highlights of Budget 2021 include.

Based on reports its proven to be effective in encouraging Malaysians to save more for retirement. The above special tax relief will be extended until 31 December 2021. 28 rows Smartphones.

Disabled spouse - additional spouse relief. Resident individuals who are within the chargeable income band of RM50001 to RM70000 will enjoy a 1 income tax reduction. During todays live address Prime Minister Muhyiddin Yassin has introduced an additional aid package PERMAI to help Malaysians cope with the impact of COVID-19.

Personal Tax Reliefs in Malaysia. One of the notable announcements is the extension of the previous tax exemption for the purchase of smartphones tablets and computers for Work For Home arrangements. Malaysias government has introduced several income tax amendments that will impact individual taxpayers for 2021.

BUDGET 2021 The government has announced a slew of tax relief incentives under Budget 2021 including reducing the personal income tax rate by one percentage point to 13 percent for those. Companies are not entitled to reliefs and rebates. CompareHero 7 Tax Exemptions in Malaysia to know about.

LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing. Per child over 18 years old. The RM3000 yearly tax relief for the Private Retirement Scheme PRS which was supposed to end in 2021 will be extended until the year 2025 assessment based on reports from The Star.

Individual and dependent relatives. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8000 Restricted 3.

Reduction in personal income tax rate by one percentage point for tax resident individuals for chargeable income in the band of RM50001 to RM70000 Preferential 15 personal tax rate for. YA 2021 RM Self. Save for your kids future Credit.

The maximum income tax relief amount for the lifestyle. The special tax relief for purchase of handphone notebook and tablet made. EXPANSION OF TAX RELIEF FOR LIFESTYLE Current Treatment Income tax relief of up to RM2500 is given to a resident individual taxpayer.

A Purchase of books journals magazines printed newspapers and other similar publications in. The special tax relief is provided on top of the existing tax relief for lifestyle purchases where taxpayers are allowed to claim up to RM2500. Income tax reduction for RM50001 to RM70000 band.

It was subsequently extended to 31 December 2021 under the Permai stimulus package. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. The individual income tax has been reduced from 14 to 13 percent for resident taxpayers in the 50000 ringgit US12375 to 70000 ringgit band US17325.

Receiving full-time instruction of higher education in respect of. RinggitPlus Malaysia Personal Income Tax Guide 2020. One of the most prominent measures in the Malaysian Budget 2021 is the reduction of the income tax rate for those in the income bracket of RM50000 to RM70000.

This income tax reduction is estimated to. The lifestyle relief which also provides for the purchase of a personal computer smartphone or tablet among other purchases or payment for personal use of the taxpayer spouse or child. - diploma level and above in Malaysia.

Personal Tax Relief 2021 L Co Accountants

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Relief 2021

Posting Komentar untuk "Personal Income Tax Relief 2021 Malaysia Lifestyle"