Income Tax Rules Malaysia

Deduction of tax from special classes of income in certain cases derived from Malaysia 109 C. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Deduction of tax on the distribution of income of a unit trust 109 E.

Income tax rules malaysia. Sub-Rule 3 1 of the Rules permits a qualifying person to deduct the following expenses collectively. Now lets get started and find out whats chargeable income. With this simple and easy-to-understand Malaysia income tax guide 2021 you will be filing your tax like a whiz in no time.

This is about RM2833 net per month after EPF. The Malaysian Income Tax Act 1967 MITA and the TP Rules 2012 and the extent of documentation required to be maintained by taxpayers with related party transactions. Income tax in Malaysia is territorial in scope and based on the principle source regardless of the tax residency of the individual in Malaysia.

A 3542021 PU. A 3772021 Rules were gazetted on 4 October 2021 and are deemed to have effect from the year of assessment 2020. Must e income tax.

The Rules provide that in ascertaining the adjusted income of a person from its business for a YA there shall be allowed a deduction capped at RM300000 for the costs of renovation and refurbishment of a business premise incurred by the person from 1 March 2020 until 31 December 2021 and used for the purpose of its business. A 3532021 applies where the tenant of a business premise is a small and medium enterprise SME and is deemed to have come into effect from the year of. 1 Corporate Income Tax 11 General Information Corporate Income Tax.

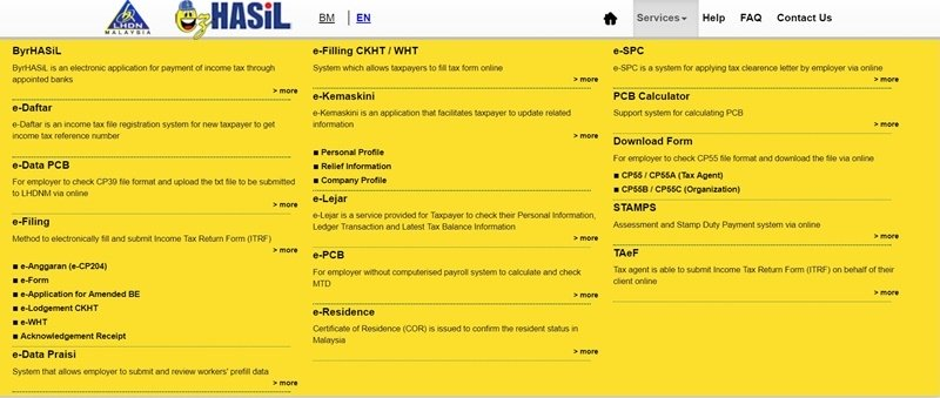

Individu Pemastautin Yang TIDAK Menjalankan Perniagaan boleh mengemukakan e-BE Tahun Taksiran 2020 melalui httpsmytaxhasilgovmy Sistem e-Filing akan dibuka mulai 1 Mac 2021 dan tarikh akhir penghantaran adalah pada 30 April 2021. If the tax and penalty is not paid within 60 days a further penalty of. The source of employment income is the place where the employment is exercised regardless of where the employment contract is signed or remuneration is paid.

Income Tax Special Deduction for Reduction of Rental to a Tenant Other Than a Small and Medium Enterprise Rules 2021 PU. Income that a non-resident derives from Malaysia from special classes of income is subject to tax in Malaysia. CITATION AND COMMENCEMENT 11 These rules may be cited as the Income Tax Transfer Pricing Rules 2012.

Malaysia Personal Income Tax Rate. This is effective from YA 2021. Individual Income Tax in Malaysia for Expatriates Malaysia adopts a territorial principle of taxation meaning only incomes which are earned in Malaysia are taxable.

Other rates are applicable to. INCOME TAX TRANSFER PRICING RULES 2012 PU A 132 7 May 2012 IN exercise of the powers conferred by paragraph 1541b of the Income Tax Act 1967 Act 53 the Minister makes the following rules. Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident.

The prevailing WHT rate is 10 except where a lower rate is provided in an applicable tax treaty. Deduction of tax on the distribution of income of a family fund etc. The individual has been.

Under Part II Section 7 of the Income Tax Act 1967 the Malaysian government considers any individual regardless of their nationality a tax resident if the individual fulfils any of the underlying conditions. Individual - Taxes on personal income Individual - Other taxes. If you pay your taxes late a penalty of 10 will be imposed on the balance of tax unpaid after the deadline of 30 April 2020.

What Income Is Taxable In Malaysia. If you earn less than RM34000 after EPF deductions you will need to register a tax file. Income tax comparably low and many taxes which are raised in other countries do not exist in Malaysia.

13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. Here are a few of the ways you can pay your income taxes in Malaysia. The life insurance premium component is excluded from the formula in determining the amount of monthly tax deduction effective from YA 2019.

The 2021 amendments take into account the following. Deduction of tax from gains or profits in certain cases derived from Malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Expatriates working in Malaysia for more than 60 days but less than 182 days are considered non-tax residents and are. The special classes of income are those listed in. The income tax with the highest rate only recently being at 28 has been cut down now to.

Deduction of tax from interest paid to a resident 109 D. Given the focus by the MIRB multinational companies MNC should ensure that their transfer pricing practices are consistent with the arms-length principle and that appropriate documentation is. Malaysia is a very tax friendly country.

The tax rate reduction of one percentage point from 14 to 13 for resident individuals with chargeable income between RM50001 and RM70000. Corporate tax rates for companies resident in Malaysia is 24. IMoneys Income Tax calculator.

The Income Tax Deduction for Costs of Implementation of Flexible Work Arrangements Rules 2021 PU. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share.

Malaysian Tax Issues For Expats Activpayroll

Tax Guide For Expats In Malaysia Expatgo

Individual Income Tax In Malaysia For Expatriates

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

Posting Komentar untuk "Income Tax Rules Malaysia"