Is Profit From Share Trading Taxable In Malaysia

Generally restrictions apply only to a resident with domestic ringgit borrowing. Capital gains on shares are not taxed.

Esos What You Need To Declare When Filing Your Income Tax

Those who occasionally trade cryptocurrencies and shares make profits that are not taxable.

Is profit from share trading taxable in malaysia. Thus Bryan is not liable to pay income tax on gains derived from his ESOS investments into MEGA shares in both 2017 and 2018. The shares were acquired with the dominant purpose of resale at a profit or. This is subject to tax in Malaysia as business income.

Government already earn from stamp duty and 6 service tax. The fact that it is paid in a foreign currency and in a foreign country does not change its Malaysian-derived nature. For instance it is good to know that the dividends of companies in Malaysia are not taxed which is why shareholders can enjoy the 100 share profit.

Forex income is taxable in Malaysia as income tax but Forex capital gains are exempt from tax. Trade on Shares Online with Globally Regulated Brokers Buy Sell UKEU US Shares. The profits made by individuals who occasionally trade cryptocurrencies or shares may be viewed as capital gains which is not taxable in Malaysia.

Foreign exchange administration rules have been relaxed or eliminated except for trade with certain countries. The investor is in the business of dealing in shares or. Ad Trade on EU UK US Shares With Regulated Share Trading Accounts.

Trade on Shares Online with Globally Regulated Brokers Buy Sell UKEU US Shares. The net profit gained from the share market is taxable if the transaction is done repeatedly. Is Forex Trading Taxable in Malaysia.

June 13 2021 Leave a comment Leave a comment. When is the gain income and when is it capital. Income accrued in or derived from Malaysia will be taxed at the time of accrual or derived notwithstanding the fact that the income may not have been received in Malaysia.

Out of the capital gains of Rs. Non-taxable gains from sale of property shares and financial instruments The following gains are generally not taxable. He should report the net income from the sale of the fruits in his annual tax return in Malaysia.

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. In Malaysia foreign exchange income is taxed as income but foreign exchange capital gains are not. Therefore it may be advantageous to use a Malaysian holding company to hold a foreign investment as foreign-sourced dividend income including trading profits from a foreign branch and gains on the sale of subsidiaries are generally not subject to tax.

Firstly capital gains realized or unrealized from share trading activities including ESOS are not taxable in Malaysia. Compare Choose Yours. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock.

10 ie 110-100 is not taxable. So the answer is no capital gains from cryptocurrency is not taxable but profit from trading is taxable. Use a foreign broker.

Open a trading account in the country where the respective stocks originate from. The repatriation of capital profits and income which includes dividends interest royalties rents and commissions is freely permitted. However as one reader wrote in most people are of the view that capital gains from stock investing in Malaysia are not taxable a perception that is propagated on the Internet.

This means that if you trade with a swap-free Islamic account and are held to not be deriving an income from your trading any gain should be tax-free. The proceeds must be brought to tax in Malaysia. Is Trading Income Taxable In Malaysia.

Is profit from share trading taxable in malaysia. In the history of Msia no individual has been taxed on trading profits. However gains from trading in properties may be taxable.

There are basically two methods you can trade in foreign shares. 10 is taxable as Capital gains 10 without indexation. The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax.

20 ie 120-100 Rs. Compare Choose Yours. How to Trade Forex Legally in Malaysia.

While income is taxable in Malaysia capital gains on shares are not subject to tax. The Inland Revenue Board LHDN has clarified that cryptocurrency investors who actively trade their assets at the digital asset exchange DAX are required to declare their gains for their annual income tax. For instance if you want to invest in an American company open a trading account in the US to buy shares at the New York Stock Exchange NYSE.

The intent when purchasing the shares needs to be to make a gain when sold. However if the activity of trading in shares is frequent enough the Malaysian Inland Revenue Board IRB may treat the gain as a revenue gain which will be taxable. Are Forex Trading Profits xable in Malaysia.

Ad Trade on EU UK US Shares With Regulated Share Trading Accounts. As far as I know there will be no tax if your main source of income is not coming from stock trading. 4 Taxation of Gains in case of Shares held for the Purpose other than for Investment-In intraday stock trading traders earn money by buying or selling stocks on the same day.

Section 3 of the ITA extends its territorial scope to include foreign source income received in Malaysia from outside Malaysia. But the profits earned by individuals who trade frequently may be viewed as revenue and thus deemed as taxable income. In Malaysia only income is subject to tax.

The investor enters into a scheme or undertaking to make a profit from shares. Which i consider to be sufficient.

Govt Mulls Capital Gains Tax On Shares One Off Higher Tax Rate For Businesses With Windfall Profits The Edge Markets

Taxplanning What Is Taxable In Malaysia The Edge Markets

Thewall Profited From Trading Bitcoin Find Out If You Need To Pay Taxes The Edge Markets

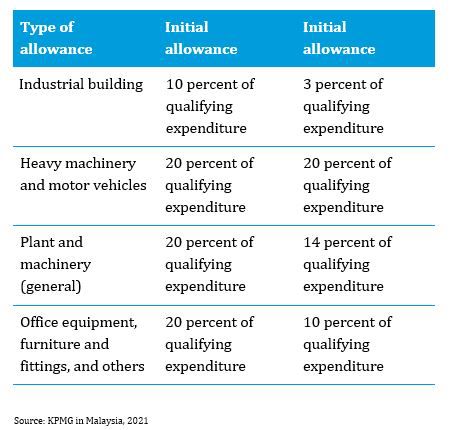

Malaysia Taxation Of Cross Border M A Kpmg Global

Tax And Investments In Malaysia Crowe Malaysia Plt

Posting Komentar untuk "Is Profit From Share Trading Taxable In Malaysia"