Types Of Islamic Capital Market

Primary market is the market for new shares or securities. Companies and governments use the Islamic Capital markets to raise funds for their operations or expand ongoing activities eg.

Islamic Capital Markets Structures And Innovations Finance And Banking Uk

Presently market for Islamic capital market instruments is segmented across countries and regions this reduces the effective available size and risk-return spanning possibilities for investors.

Types of islamic capital market. In the ICM Sukuk can be classified into two different categories. 121 writers online. This type of deferment is usually allowed as an exception to the general rule when there is a need for such a contract for example.

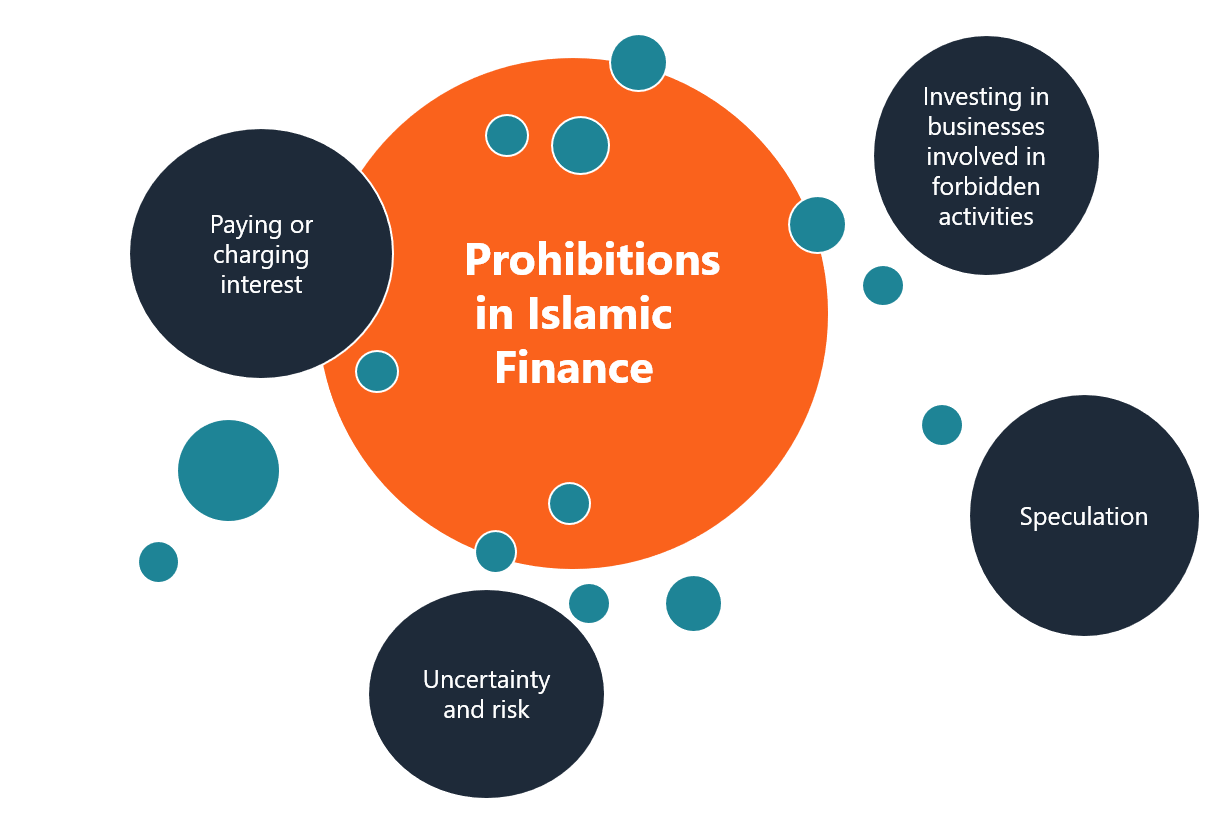

A primary market is one in which a company issues new securities in exchange for cash from an investor buyerIt deals with trade of new issues of stocks and other securities sold to the investors. As has been the experience with nascent fast-growing markets various regulatory issues need to be assessed on a timely basis. The Islamic capital market is free from activities that are not allowed by Islam such as interest riba excessive uncertainty Gharar gambling Maysir short sales and financing any activities that.

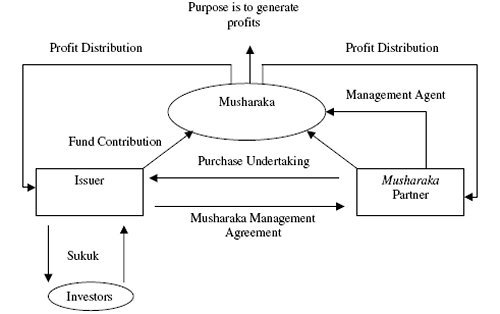

This chapter provides a general discussion on the types of Sukuk particularly their classification and structures in the Islamic Capital Market ICM. Under AAOIFI guidelines a minimum of 33 of the underlying interests represented by the sukuk must be tangible assets in order for the sukuk to be tradeable at a value other than par. The book explains each topic from both the conventional and the Islamic perspective offering a full understanding of Islamic capital markets processes and instruments.

A system of Islamic Depository Receipts is therefore proposed to expand the market for Islamic products. Includes Shariaacompliant stock andor sukuk markets. The capital market is divided into two parts.

11 Functions of capital market Capital market play very important functions in the financial system that listed below. Certificates representing ownership in investments managed on the basis of Mudaraba. Islamic Capital Markets FY 2018 Bloomberg League Table Reports Page 1 Sukuk Islamic Financing Sukuk Islamic Financing FY 2018 FY 2017 Firm Rank Mkt Share Volume USD Mln Deal Count Prev Rank Prev Mkt Share Mkt Share Chg HSBC 1 7519 4970 38 3 7471 0048 CIMB 2 7090 4686 114 2 9632 -2542 Standard Chartered Bank 3 6617.

Islamic capital markets and instruments. Types of Capital Market. An essential form of profit-sharing in Islamic finance Mudaraba sits on a foundation made by agreement between capital providers and entrepreneurs or essentially the executioners.

In the ICM market transactions are carried out in ways that do not conflict with the conscience of Muslims and the religion of Islam. Types of Capital Market. Whether a sukuk is tradeable depends on the underlying Islamic finance structure.

It supports both private and public offerings. 603 2732 6437 THE ISLAMIC CAPITAL MARKET CONTENTS AN OVERVIEW 2 THE ONSHORE ISLAMIC CAPITAL MARKET 5 Bursa Malaysia Role of Shariah Advisory Council SAC. A Comparative Approach 2nd Edition looks at the similarities and differences between Islamic capital markets and conventional capital markets.

They do this in two ways by selling equity in the form of stocks and debt in the form of Sukuk. Investing in Shariah-compliant securities is not limited to only Muslims as Shariah-compliant securities are. Introduction Preview Definition of Islamic Capital Markets Development of Islamic Capital Markets - Sukuk.

Islamic Capital Markets 09m 06s. In an Islamic capital market market transactions are done in ways that do not conflict with the inner voice of Muslims and the religion of Islam. One of the key features of any capital markets instrument is liquidity.

Overview of global Islamic capital market developments. Following are the 7 key Islamic Capital Market products. Describe the role of the Islamic capital market ICM.

Islamic Capital Market ICM04-Islamic Structured Products Khairuddin Zakaria BScEng MBA CIFP RFP. This programme specially tailored for Islamic capital markets will provide you with unique insights and understanding including key market structures and applications. 603 2034 7000 Fax.

No previous knowledge is needed but a basic knowledge of business concepts is advantageous. Increasing liquidity Construction of diversified portfolios is. Capital market can be divided into two types when the securities are offered for the first time it is called primary market all the subsequent trading are occurred in the secondary market.

The Islamic Capital Market exists for Islamic corporations and Muslim countries to raise capital in a Halal way following the laws of the Shariah. Capital market consists of two types ie. Identify essential components of Islamic.

The first classification is based on the type of structure such as asset-based or asset-backed whereas the second classification is based on specific. What are the Islamic capital markets. Islamic Capital Market Islamic Investment funds Islamic Capital Market Bursa Malaysia SlideShare uses cookies to improve functionality and performance and to provide you with relevant advertising.

Outline What is Structured Product. Under equity market Shariah compliant securities transactions such as Islamic unit trustMutual Funds Islamic Real Estate Investment Trust REIT Islamic indices Islamic Exchange Traded Fund or ETF and the Islamic venture capital or Private Equity are taking place. Shariah framework Regulatory framework Corporate and Shariah governance Risk management Accounting and taxation Sukuk Islamic equity market Islamic unit trust REITs and ETFs Islamic private equity and venture capital Islamic derivatives and hedging and Islamic structured investment products.

If you continue browsing the site you agree to. Primary Market- Also know as New Issue Market it is the first time market trading of new securities and later available for institutions and individuals. An organisation provides securities to the public to accumulate funds and.

In the Sukuk market different types of Shariah compliant products are being structured in line with Islamic financial. The Islamic Capital Market ICM functions as a parallel market to the conventional capital market in Malaysia. The Conventional Capital market exists.

You will also learn about the challenges of Islamic financial and capital market development. In this economics and finance course you will learn about different types of Islamic financial markets and their key features and principles. What is islamic capital markets.

A company may undertake an IPO. Any market in which Shariaacompliant securities are traded. This mandate represents an important initiative taken by capital market regulators to study the area of the Islamic capital market in order to gain a better understanding of its specific.

Islamic Capital Market Ppt Video Online Download

Islamic Finance Principles And Types Of Islamic Finance

Islamic Finance An Overview Sciencedirect Topics

Islamic Capital Market Saraycon

Posting Komentar untuk "Types Of Islamic Capital Market"