Income Tax Deductions For Fy 2021-22 Pdf

Reduce your tax deductions for tax savings investments etc. The calculator is made using simple excel formulas and functions.

Income Tax Comparison New Vs Old Fy 2021 22 Wealthtech Speaks

Income Tax Rates FY 2020-21 if tax deductions.

Income tax deductions for fy 2021-22 pdf. Download Income Tax Calculator in Excel for FY 2020-21 AY 2021-22 Comparison Old and New Regime. TS Teachers Income Tax Software for Teachers Income tax Slab rates Employees Income Tax Calculation Financial year 2021-22 Income Tax Assessment year 2020-2021 80c Saving limit FY 2020-21 AY 2021-22. Sum of All heads of Income Gross IncomeGross Income Deductions Taxable Income.

Income Tax Software 2021-22 by Alrahiman. Make Section 80C your best friend. Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh.

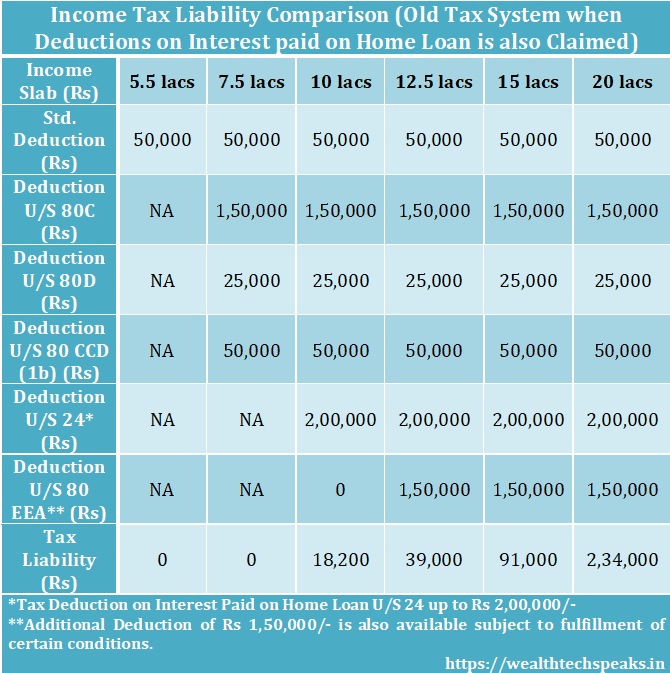

The left-hand side of the table given below shows the old tax regime which comes with deductions and tax exemptions. Deductions are allowed under section 80 of the Income Tax Act Section 80C to 80U. Income Tax Software 2021-22 TS AP Teachers IT Calculator with PRC Arrears Form 10E Download.

Section 80C can take off INR 150000 from your Gross Income. Arrive at your total income after reducing the tax deductions. Excel Tax calculator ready To help taxpayers here is a simple excel based Income Tax Calculator for the financial year 202021 AY 2021-22.

The maximum rebate under section 87A for the AY 2021-22 is Rs 12500. We will be comparing income tax rates and slabs under the new and old tax regimes for individuals senior citizens super senior citizens for FY 2021-22 and FY 2022-23 Effective from April 1 2022. Declare your gross income and tax deductions in ITR.

The more you make use of the deductions allowed the lower your tax shall be. Updated AP Teachers Income Tax Software 2022. How to Install Alrahimans Tax Software 2021-22.

Easy software to calculate income tax of the financial year 2021 -22 or the assessment year 2022 -23 is published here. The tool is designed to prepare Income tax statements for the financial year 2020-21AY 2021-22 The version is suited to select the best choice of tax planning that is whether to choose the Old Regime or New Regime of Tax rate considering the special provision introduced in the new budget. FY 2021-22 or AY 2022-23 Income tax return e-filing exemptions deductions e-payment refund and excel calculator IT twitter IT helpline number IT act law ITAT IT department Finance bill.

Before using Alrahimans Income Tax software 2022 there are certain things that the user must know. Latest Income Tax Slabs.

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Income Tax Rates For Ay 2021 22 Capital Gains Tax Rate 2021

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Posting Komentar untuk "Income Tax Deductions For Fy 2021-22 Pdf"