Resident Status For Individual In Malaysia

110 MYR 5 per person. In certain situations the physical presence for the basis years preceding and following a particular.

Resident Status In Malaysia Fundacionfaroccr

Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident.

Resident status for individual in malaysia. Individual Investor with minimum USD 2 million Fixed Deposit FD in Malaysia High Net Worth Individual Having a Fixed Deposit with an amount of minimum USD 2 million in at any Bank in. Note that spending part of a day in Malaysia counts as being physically present for the whole day - for example someone who arrives in Malaysia at 11pm and leaves at 3am the next day will be considered as having stayed in. In Malaysia for at least 182 days in a calendar year.

Under the Income-tax Law an individual will be treated as a resident in India for a year if he satisfies any of the following conditions iemay satisfy any one or may satisfy both the conditions. Objective This Public Ruling PR provides an explanation on the determination of the residence status of companies and bodies of persons. My company is not resident in Malaysia.

¾ Residency status of applicant in Malaysia according to Financial Services Act 2013 FSA ¾ A citizen of Malaysia or a person who has obtained a permanent resident status in Malaysia and residing in Malaysia or body corporate or incorporate which is registered or approved by any authority in Malaysia. Expatriates and foreign workers without permanent resident status voluntary of contribution of employees wages minimum Employer. A resident in Malaysia and does not intend to seek residence status in Malaysia.

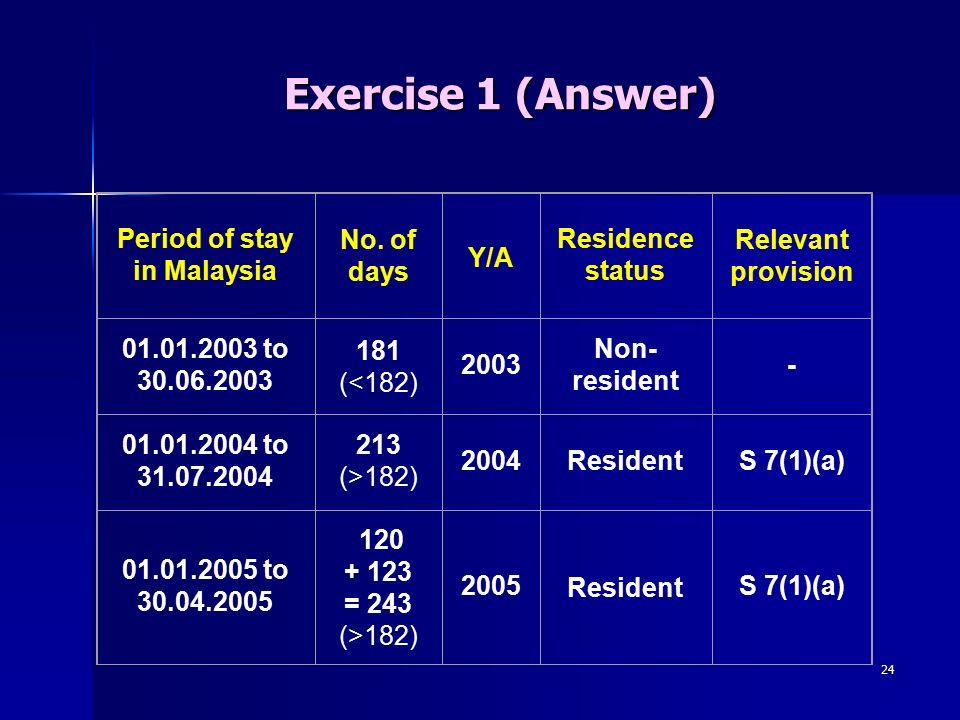

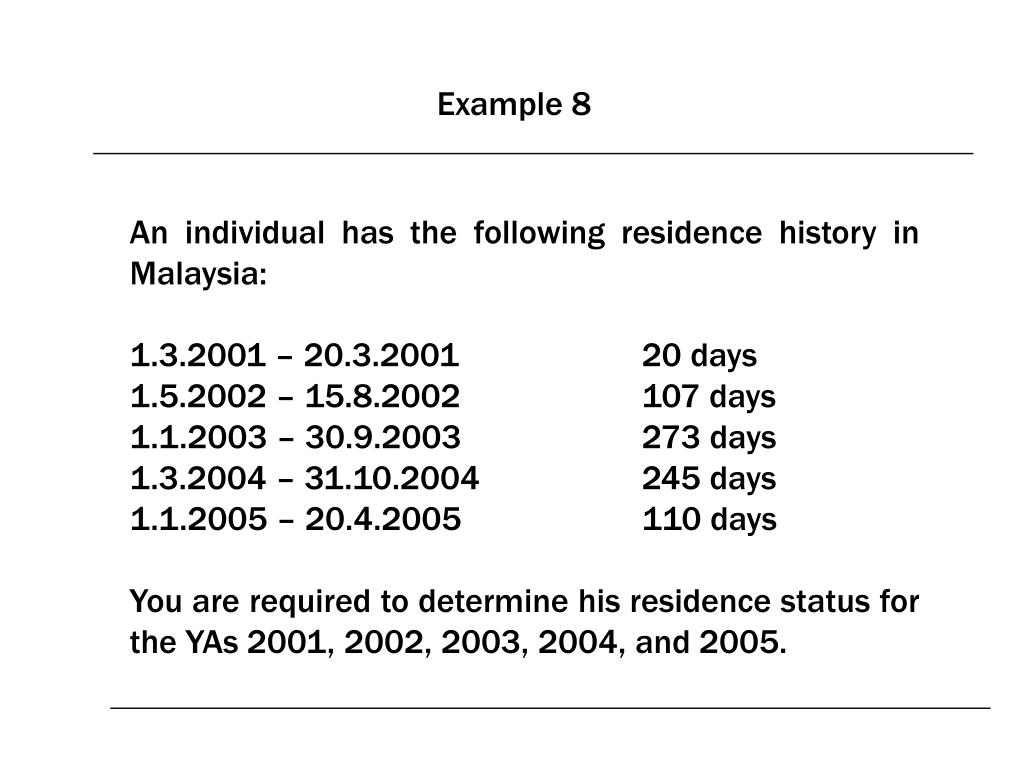

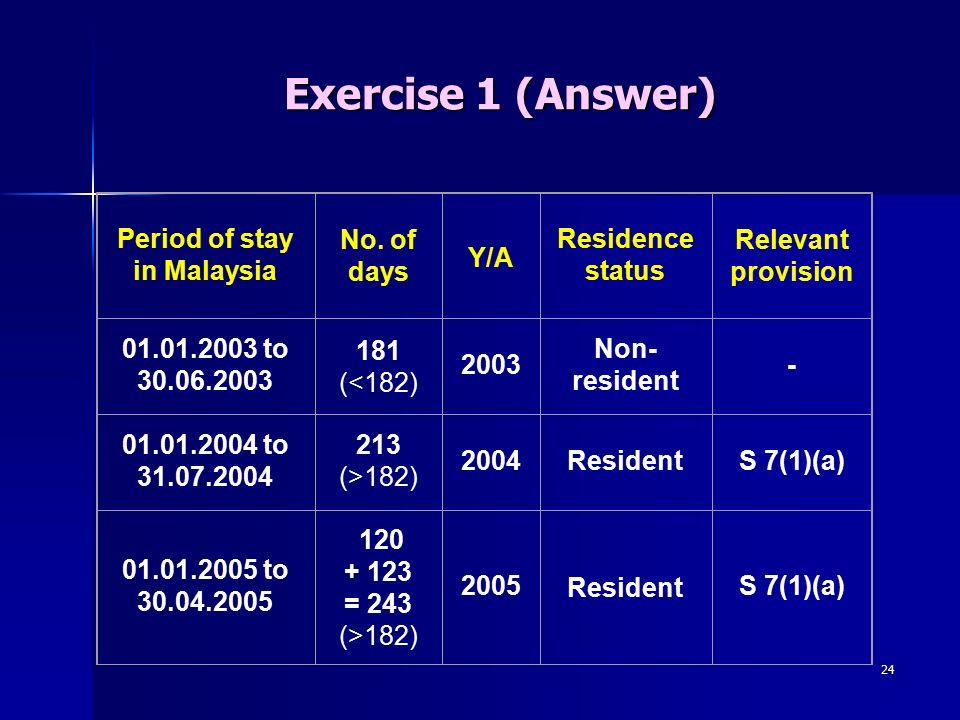

Individual - Taxes on personal income. In Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence of 182 or more consecutive days in the following or preceding year. Resident status is determined by reference to the number of days an individual is present in Malaysia.

Determining whether resident or non-resident. Just living in the country for a designated amount of time doesnt always qualify you for permanent residency. An individual is tax resident in Malaysia if he or she stays more than 182 days per year in the country.

The Certificate of Residence COR is issued to confirm the residence status of the taxpayer enabling them to claim tax benefit under the DTA and to avoid double taxation on the same income. Resident Status of Individuals For tax purposes the tax residence status is determined by the duration of stay in Malaysia and is not bound by reference to the nationality or citizenship. The COR is applied for in person with tax authorities and the employee must present their passport and documentation of travel in and out of Malaysia for the past year.

Income MYR 5000. In Malaysia for less than 182. Resident status is determined by reference to the number of days an individual is present in Malaysia.

The 182 days period can be consucative period or not. In Malaysia in a tax year for 182 days or more. An individual is regarded as tax resident if he meets any of the following conditions ie.

For individual foreigners to eligible for resident status eligibility he is required to stay in Malaysia for more than 182 days in a calendar year. There are four rules to determine tax resident status of an individual in Malaysia. Headquarters of Inland Revenue Board Of Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

If a person stays in Malaysia for at least 182 days not necessarily consecutive in a calendar year he would be treated as a resident. If the individual is Resident in regard to Malaysian Tax Law the individual is subjected to normal income tax. Due to COVID-19 with many international assignees in Malaysia performing duties in respect of their overseas employmentassignments and their employers concerns about the impact that their temporary presence and additional unplanned days spent in Malaysia may have on their Malaysia tax residency status cross-border employment income and the.

51 Generally the resident status of an individual for a basis year for a YA is determined by reference to the physical presence of that individual in Malaysia and not by his nationality or citizenship. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more. In certain situations the physical presence for the basis years preceding and.

Generally residence status for tax purposes is determined based on the number of physical presence 182 days or more of that individual in Malaysia in a basis period for a year of assessment and not by his nationality or citizenship. For instance under Section 71a of Income Tax Act ITA 1967 if he stays in Malaysia for a total of 182 days or more in one year he is qualified as a tax resident in Malaysia and thus enabling him to enjoy the tax benefits stated above. The resident tax rate is reasonable range from 0 to 28 with applicable to many incentives and rebates as opposed to a flat rate of 28 for non-resident status.

B he is in Malaysia in that basis year for a period of less than one. The Certificate of Residence COR is used to verify your tax residence status and can allow you to claim credits under tax treaties with Malaysia. Determination of the Residence Status.

However if the individual is Non-Resident in regard to Malaysian Tax Law the income tax. Income MYR 5000. 150 Last Update.

If an individual resides in Malaysia permanently the question of determining his residence status would not arise. A persons residency status is determined based on the number of days he is physically present in Malaysia in a year. Generally residence status for tax purposes is based on the number of days spent by the individual in Malaysia and is independent of citizenship.

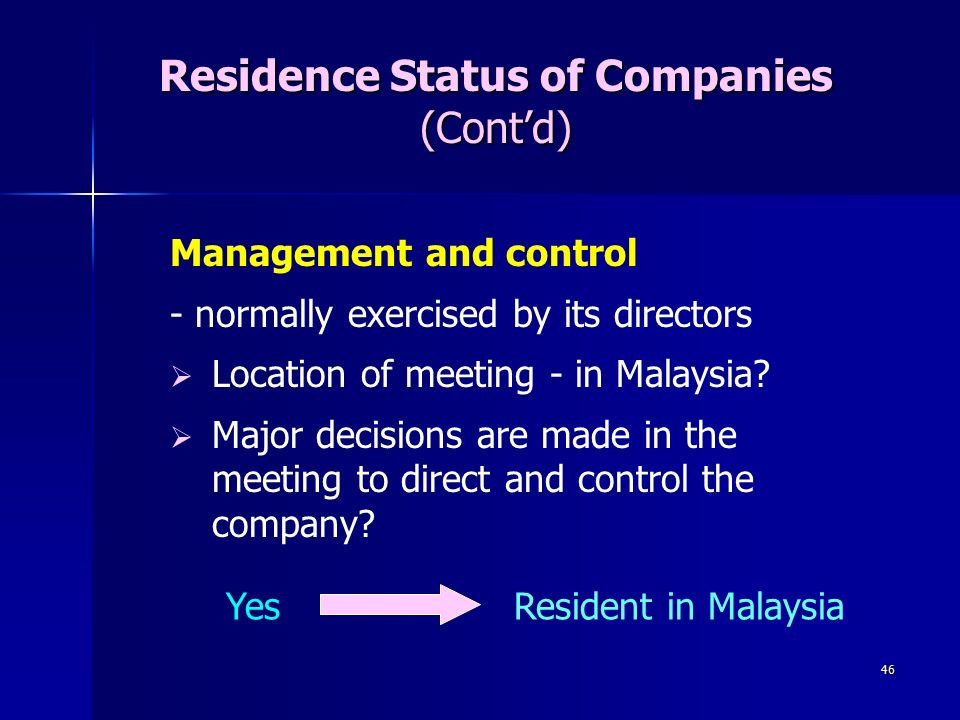

The Permanent Resident Status is subject to Revocation at any Time if deem Necessary by the Government. LHDNM is prepared to presume that the company is not a Malaysian resident if the company is required to hold BOD meeting in Malaysia due to COVID-19 travel restrictions. RESIDENCE STATUS OF COMPANIES AND BODIES OF PERSONS Public Ruling No.

6 December 2019 Page 1 of 19 1. Please refer to the definition. 1 He is in India for a period of 182 days or more during the previous year.

Determination Of Residence Status 51 Generally the resident status of an individual for a basis year for a year of assessment is determined by reference to the physical presence of that individual in Malaysia and not by his nationality or citizenship. 92019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Age 60 and above.

Hence a COR is issued for these purposes and with Malaysias treaty partners only. New Eligibility for Malaysia Permanent Resident Status.

Tax Guide For Expats In Malaysia Expatgo

Ppt Chapter 2 Resident Status For Individuals Powerpoint Presentation Id 6980906

Are You A Tax Resident In Malaysia Do You Need To Pay Tax

Resident Status In Malaysia Fundacionfaroccr

Posting Komentar untuk "Resident Status For Individual In Malaysia"