E Wallet Usage In Malaysia 2021

Results 41 Measurement model. Hey if Im an e-commerce platform Id make an e-wallet too.

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

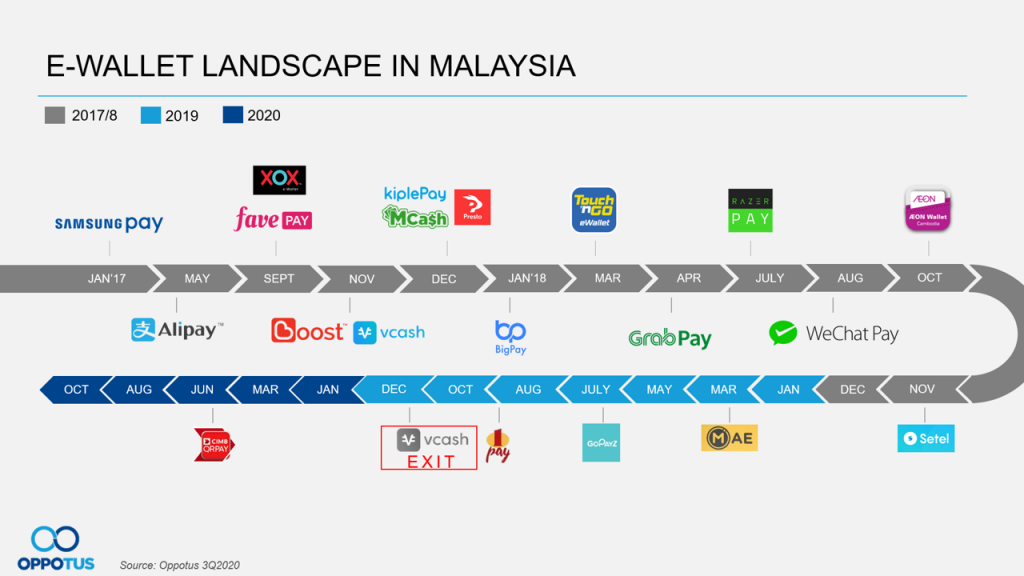

E-wallets have been mushrooming in Malaysia over the last few years with new platforms surfacing every now and then.

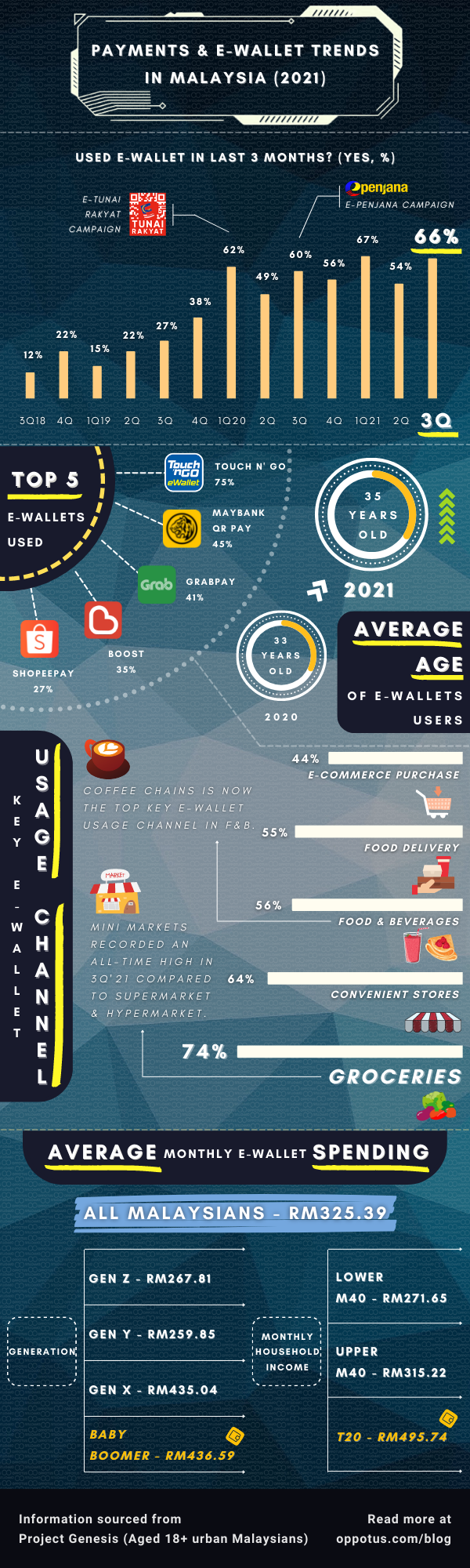

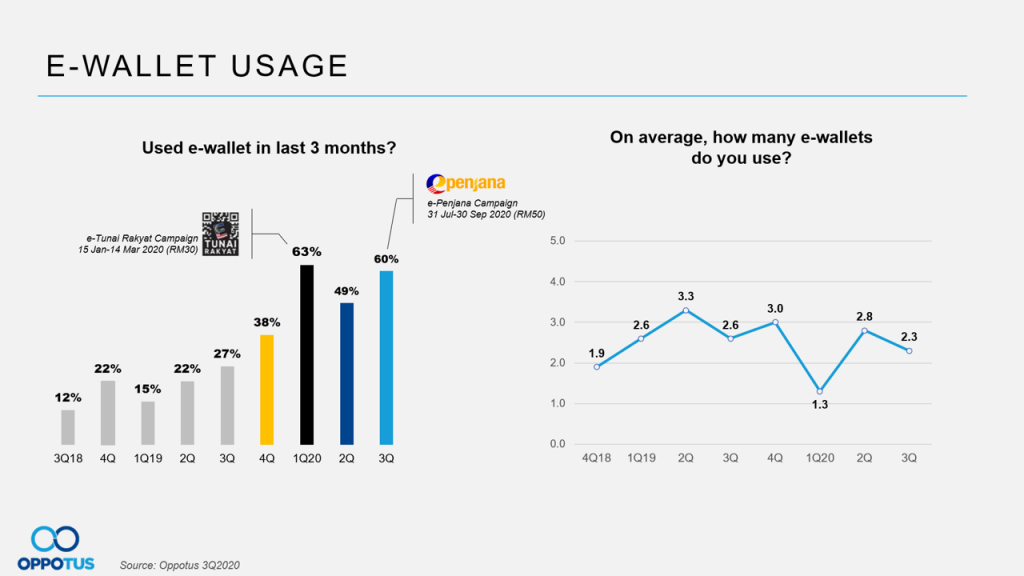

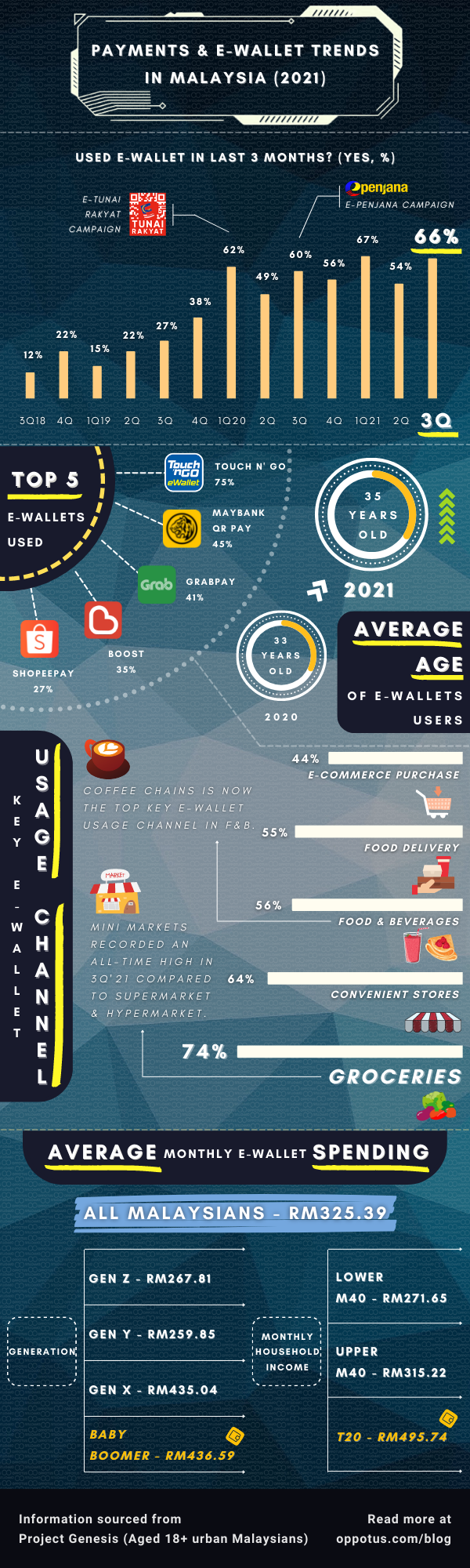

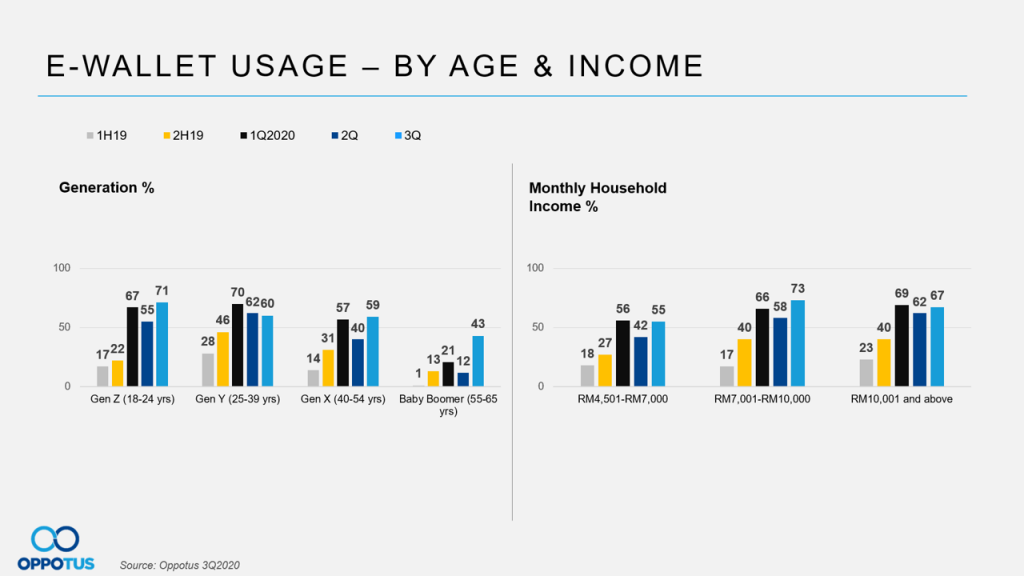

E wallet usage in malaysia 2021. The study also revealed that on average Malaysian customers used 2-3 e-wallets during Q3 2020. Compared to 2019 statistics e-wallet usage has risen 8 across SEA nations ranking at third place 22 right after credit and debit cards 227 and cash 34 among. Digital finance adoption on the rise.

In the year 2019 the government provided a one-off RM30 incentive for all eligible Malaysians in Budget 2020 and RM100 incentive for the youths in Budget 2021 to accelerate e-wallet adoption in the year 2020 Bank Negara Malaysia 2019. E-Wallet Usage Trends in Malaysia 2021 COVID-19 has brought significant changes to consumer lifestyles especially influencing Malaysian e-wallet usage in the past 2 years. Erstwhile Malaysians perceived that using e-Wallets is troublesome and worthless.

Towards the end of 2020 Malaysian e-wallet usage saw a slight decline to 56 as there was a possibility of another lockdown due to rising COVID-19 cases causing consumers to cut back on their spending. With businesses across all sectors now slowly getting back on track and the Malaysians are ready to live in The New Normal we find e-wallet usage rising once again 66 3Q21. Global trends demand that Malaysia turn cashless into king but heres the problem for e-walletsMalaysia already has an existing.

THE Covid-19 has resulted in more than 80 growth for e-wallet usage in the country as limited movement pushes cashless payments among Malaysians in the past 18 monthsBased on Googles e-Conomy South-East Asia 2020 report e-wallets transactions rose to an average of 25 post-Covid-19 indicating that consumers will continue to use digital. This paper applied TCT as the key theoretical framework to examine the determinant factors of e-wallet continuance usage in Malaysia. Malaysias growing e-wallet landscape.

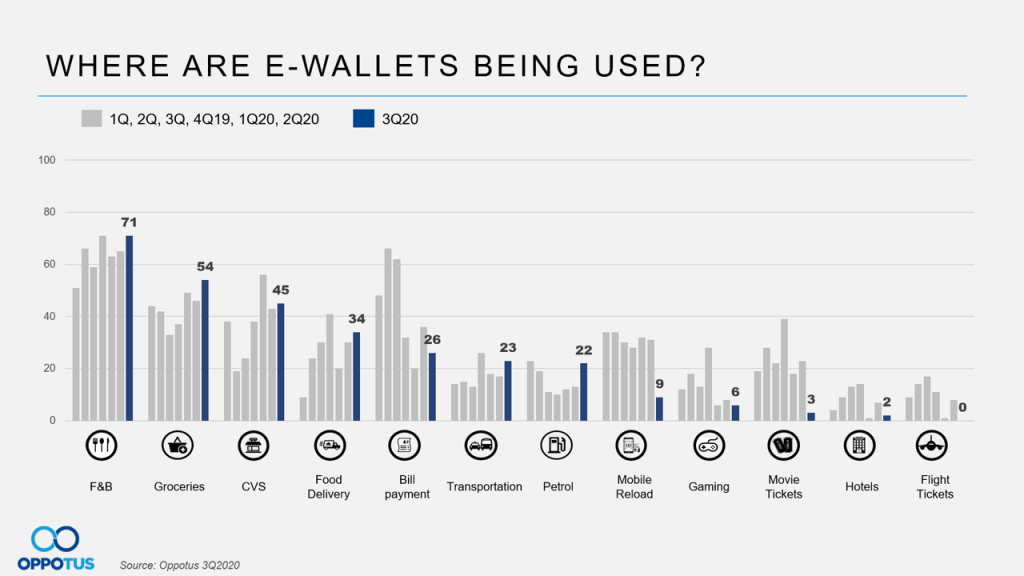

Use it for. Yumiko Kijima 081221 8 minute read. Concerning frequent usage of e-wallet services the majority of the respondent 344 stated that they have spent monthly usage on e-wallet services followed by weekly usage 238 daily 139 and lastly quarterly 102.

Another study regarding e-wallet trends in Malaysia by Oppotus found that 60 of the Malaysian customers have used an e-wallet in Q3 2020 which is more than double the number from 27 in Q3 2019. The same is happening in Malaysia. During this time we found that consumer.

Users can use the e-wallet app to pay transfer money split and pay bills at. With these e-wallets in Malaysia we can access the needed goods and services with just a few clicks. Not including The Big Three in 1 probably FavePay 5 E-wallets by e-commerce platforms.

The buying and selling of goods and services through the internet became even more important when the global pandemic hit. The MasterCard Impact Study 2020 revealed that Malaysia leads the SEA in e-wallet usage which stands at 40 compared to the Philippines 36 Thailands 27 and Singapores 26. An E-Wallets Competition Isnt Just Another E-Wallet.

To date there are a total of 53 e-wallets in the country with the industry occupying 19 of Malaysias fintech space according to a. Goverment of Malaysia 2020. However e-wallets made a comeback at the start of 2021 as usage reached an all-time peak of 67.

A customer using an e-wallet to pay for her purchase at a pasar tani in Putrajaya recently. Nants of e-wallet continuance usage intention in Malaysia by enhancing the richness of tech-nology continuance theory TCTwith four variables namely price benet trust habit and operational constraints. Today financial technologies have become increasingly adopted but E-Wallet services are surprisingly not frequently applied in Malaysia yet based on past studies Pooi Khalid Factors Influencing the Use of E-Wallet among Millennium Tourist 72 Nadarajah 2018.

Getting users to spend all the money in the e-wallet ONLY in my platform is a great strategy. Cashless payment is the way forward and e-wallets are at the forefront. E-wallet use in Malaysia growing.

45 Use of this method is forecast to continue to grow at a compound annual growth rate of 25 percent to 2021 when it is expected to retain its top position and account for 48 percent of the e-commerce payments. Full guide to the best credit cards in Malaysia 2021 - lower fees better rates and top rewards plus how to cut foreign transaction fees with Wise. With numerous e-wallet providers such as Boost GrabPay Touch îN Go TNG MPay Razer Pay Corresponding Author.

While queueing to pay for my drinks at a coffee outlet recently I observed 80 per cent of customers paid by just waving their bank cards while some used their mobile phones to scan a QR code that. Numerous e-Wallet applications have been developed such as GrabPay Touch n Go eWallet and Boost. Best e-wallet in Malaysia in this category.

Based on the MasterCard Impact Study 2020 we lead Southeast Asia in e-wallet use at 40 per cent take-up compared with the Philippines 36 per cent Thailand 27 per cent and Singapore 26 per cent. The Covid-19 pandemic and enforcement of the Movement Control Order have also boosted adoption. Supporting this statement a market report by JP Morgan stated that The use of cash is expected to be overtaken by digital wallets by 2021 Commenting on the outlook of the e-wallet sector for year 2020 and beyond CEO of TNG Digital Ignatius Ong said Bank Negara released its Financial Sector Blueprint 2011-2020 which charts the direction of the financial system over the next ten.

1682 respondents across all major demographic groups employment status and income groups participated in the survey. The technology-driven era has encouraged Malaysians to use e-Wallet rather than paper money in their daily transactions. In Malaysia the usage of e-wallets has increased and continues to grow among Malaysians as a way to replace the traditional method of paying for goods and services with cash Haroon 2020.

It is a particular focus in BNMs ICTF which has just taken effect early this month and should impact key e-wallet functions like remittances e-payments and QR codes. Use AliPay like other digital wallet products to scan and pay for goods in stores or when youre shopping online. This builds on a rapidly maturing e-wallet industry which counts over 40 non-bank providers among which Touch n Go Malaysias biggest e-wallet with 5 million users and 300000 merchants Boost which serves some 88 million users and over 231000 merchants and BigPay which boasts 14 million users.

Bank transfers are the most-used e-commerce payment method in Malaysia accounting for almost half 46 percent of all transactions or 18 billion in 2017. Meanwhile the rest of the respondents earned over RM5001- RM7500. By Izwan Ismail - April 18 2021 901am.

In September 2021 PwC Malaysia carried out a nationwide survey to assess the usage of e-wallets during the COVID-19 pandemic lockdown. Career Resources - When e-commerce rose to popularity so did the e-wallet payment systems to use with them. What Is E Wallet In Malaysia.

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Malaysian E Wallet Usage 2021 Infographic

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Covid 19 Accelerates Mobile Wallet Adoption Across Asia Pacific Finds Globaldata Globaldata

Posting Komentar untuk "E Wallet Usage In Malaysia 2021"