Epf Account 2 Withdrawal For Second House

I already wrote a detailed post on EPF partial withdrawal rules. You cant withdraw to buy overseas properties.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

This withdrawal allows you to withdraw your Account 2 savings to finance the purchase of a residential house only.

Epf account 2 withdrawal for second house. Employees Provident Fund EPF Withdrawal To Purchase A House. 30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical. PF withdrawals within 5 years of opening an account are taxable 2.

Upto 75 of total PF balance. However if you are planning to migrate you may withdraw all the money in your EPF accounts. Should you wish to apply for a second home this is only possible once you have disposed of your first property.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. These rules will come into effect from 12th April 2017. The application must be made within 3 YEARS of signing the SPA.

You may buy a second house but only after you have sold off the first one. This is the second time that the state-run pension fund manager has made this announcement in a bid to help citizens amid the ongoing coronavirus pandemic. As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the.

But that will be the extent of your withdrawal options for a home purchase. Once your application is approved you will receive an SMS requiring you to be present at any EPF counter for thumbprint verification. You cant withdraw to buy overseas properties.

Repayment of home loan 6. 6 Buying a third house You may buy a second house but only after you have sold off the first one. Buying a Third House.

Upto 90 of total PF balance. You are allowed to withdraw from EPF Account 2 to finance the downpayment purchase of a house. Withdrawal to purchase first house.

There are many circumstances and conditions for the maximum amount allowed but the withdrawal guideline is either 10 of the house price or all of Account 2. The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. This type of withdrawal involves you withdrawing money from your Account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one.

These changes are called as Provident Funds Fourth Amendment Scheme 2017. EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members. The Employee Provident Fund Organisation EPFO will allow its members to make another withdrawal from the EPF account due to COVID-19 second wave as a non-refundable advance.

Malaysians can start applying starting 1st April 2020 and lucky for you we have. You cant withdraw PF balance from your current job. EPF changed certain rules in relation to EPF withdrawal for house flat or construction of property.

You must submit the proof of transfer of ownership. But that will be the extent of your withdrawal options for a home purchase. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house.

PF withdrawal for a particular purpose. Savings in Account 2 can be withdrawn under specific conditions. Withdrawal within one year before retirement.

April 23 2017. You can withdraw from your EPF to service a home loan if youre purchasing residential property. EPF Withdrawal to purchase a second house is allowed after the first house purchased utilizing EPF has been sold or disposal of ownership of property has taken place.

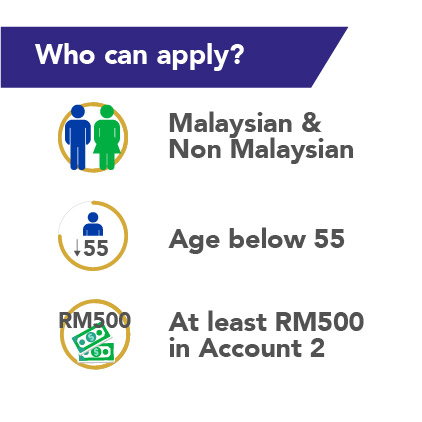

Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. Withdrawal for purchase of house flat dwelling house additionalteration of house and repayment of loan for the purpose. The whole process of withdrawing from your EPF Account 2 to buy a house takes less than 3 weeks from the day of application to the point of the money being deposited into your account.

Withdrawal is only valid for one property house at any one time. Amid the COVID-19 wave in the country the Employees Provident Fund Organisation EPFO has allowed its members to opt for a second advance from the Employees Provident Fund EPF account. PF Withdrawal to purchase a second house is allowed after the first house purchased utilizing EPF has been sold or disposal of ownership of property has taken place.

Contributors need to go to the EPF to apply for the monthly withdrawal only once and subsequent payments would be directly credited to their personal accounts. PF withdrawal conditions to keep in mind. Withdrawal for second house Effective from 2nd January 2001 applicants can also withdraw from Account II to purchase or build their second house on condition that the first house which was funded from their EPF savings has been sold.

To qualify you would. Owning your dream home is now made easier with EPF withdrawal. Effective from 2nd January 2001 applicants can also withdraw from Account II to purchase or build their second house on condition that the first house which was funded from their EPF savings has been sold.

EPF members can utilize the fund accumulated in their EPF account to facilitate their housing needs after three years of account opening. Withdrawal to purchase second house is allowed after the first house is sold OR disposal of ownership of property has been place. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house.

Buying a house. Construction of house or land purchase 4. A few years before retirement.

However if you are planning to migrate you may withdraw all the money in your EPF accounts.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Kwsp Housing Loan Monthly Installment

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

39 Kwsp Account 2 Withdrawal For House Renovation Pictures Kwspblogs

Posting Komentar untuk "Epf Account 2 Withdrawal For Second House"