How Much Money Needed To Retire In Malaysia

Life After Work FoR study nearly 67 of Malaysian parents are supporting their adult children financially. We accept no responsibility for giving any recommendation or advice based on the Financial Planning.

Retire In Malaysia 17 Ways To Stretch Your Retirement Fund

Lets first talk about the top cities in the United States that you should consider retiring in followed by the best cities in the world that you can retire comfortably on a retirement fund of 250000 to a million.

How much money needed to retire in malaysia. But a few countries do offer special retirement visas that you can obtain through proven pension income. In 2020 unemployment soared to 69 but has since stabilized some now at 51. Annual pre-tax income needed to be in the 1.

Annual pre-tax income needed to be in the top 10. RM 950 month. You have RM0 more than you need to retire comfortably at for the next year s.

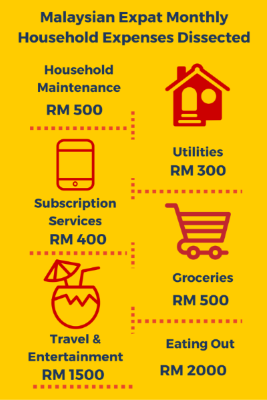

Assuming you retire at the age of 60 your monthly expenses are as follows. For example a 25-year old person who saves RM5000 a year for a decade will accumulate more wealth in their retirement years compared to a 35-year old person who saves the same amount until they retire. Numbeo estimates that a single person in Kuala Lumpur would need around 470 a month to live excluding rental costs.

You need RM 228000 in 20 years. The first step is building your retirement fund. 1 year is equal to RM 11400.

You have just enough to retire at for the next year s. By age 64 your retirement nest egg Sheltered Taxable Tax Free will have grown to 192938. With the above scenarios in mind you need to prepare for your retirement early to ensure adequate savings in your old age.

Whether you want to live in Central America Asia or in Europe there will be many countries where your money will allow you to retire without any financial worries. In 2019 its annual GDP was 135621 billion. The cost of living in Malaysia varies enormously based on the type of lifestyle you lead and where you choose to live.

The capital Kuala Lumpur also pulls in huge numbers of working expats looking for an adventure. Another is by investing your EPF Employee Provident Fund in approved unit trust funds. If you have the government pension then the deposit wavers.

The calculator is straightforward to use. Basic expenses clothing food and accommodation. As the saying goes make your money work for you and take advantage of compound interest early on.

You may be better off with renting which we advise to do anyway at least for 6 to 12 months. Many expats chose to live on the island of Penang off the nations west coast. But is Malaysia good for retirement.

Australia has been a pioneer in economic freedom since the dawn of the of Economic Freedom Index in 1995. Anyone over 50 years of age must deposit RM150000 34883 into a bank in Malaysia of your choice Citibank HSBC and Standard and Chartered seem the most popular or prove you have a monthly income of RM10000 2350 from a government pension. 4 inflation is an estimation.

According to HSBCs The Future of Retirement. Assuming life expectancy of 75 years old heres a rough estimate of the total retirement savings that you need. First 5 years Independent living at RM36000 a year.

Following the crisis unemployment rates will rise and many may be forced to retire early. For those aged below 50 wishing to enjoy early retirement a 10-year visa except in Sarawak requires liquid assets of at least 500000 MYR 160400 SGD a monthly income not derived from Malaysia of at least 10000 MYR 3200 SGD and a fixed deposit of at least 300000 MYR 96300 SGD. This assumes a partial Age Pension.

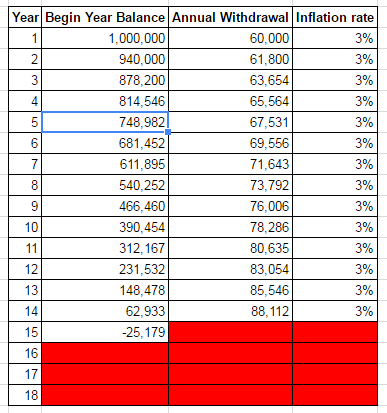

If youve ever considered retiring in Malaysia you will have heard about the Malaysia My Second Home Program MM2H. Last year the Employees Provident Fund EPF raised the minimum savings target to RM228000 by the age of 55. Based on the building block information provided in Table 1 we can now see that you will not have sufficient money needed to retire at 65.

ASFA estimates that the lump sum needed at retirement to support a comfortable lifestyle is 640000 for a couple and 545000 for a single person. This means a monthly retirement income of the only RM950 per month assuming a life expectancy of 75 years old. In Thailand generally you will need 65000 baht 2175 per month plus an 800000 baht 26760 security deposit.

With an average savings of RM194000 assuming one lives until 75 with no major medical expenses or outstanding debt that amounts to about RM810 per month which is RM25 a week. Malaysias low cost of living and high quality of life means that many expats choose to relocate here. Malaysia is slightly more at 10000 Malaysian ringgits or 2500.

What you want to achieve when you retire is to not have to rely on the money you have saved up over the years to fund your living expenses. ASFA estimates that a modest lifestyle which covers the basics is. The Malaysian government has encouraged foreigners to retire in Malaysia as a fixed income can go a long way here.

With those numbers in mind you would probably need RM68000 per year on a low side to RM150000 per year on the high side to retire comfortably. According to the calculation of the EPF the basic cost of retirement is RM 950 per month. Financial requirement wise you are required to lock in at least RM Ringgit Malaysia 150000 at any Malaysian bank under MM2H or Malaysia My Second Home program for retiring in Malaysia.

All you need to do is fill in your gender age expected retirement age the number of years of income you require after retirement your desired retirement lifestyle your future expenses and your existing provision when you retire. How much money do I need to retire in Malaysia. Find out more about renting and buying real estate in Malaysia Visa Requirements Residency.

If thats not shocking there are other alarming statistics reported last year. One of it is by ensuring you have a 23 replacement income ratio of your last drawn salary. According to a recent report by The Star newspaper current EPF savings for most Malaysians are barely enough for a decent life after retirement.

So how much do you really need during retirement.

How Much Do Malaysians Really Need For Retirement

Retire In Malaysia 17 Ways To Stretch Your Retirement Fund

How Much Do Malaysians Really Need For Retirement

What S The Magic Number How Much Do You Need To Retire The New Savvy

What S The Magic Number How Much Do You Need To Retire The New Savvy

Posting Komentar untuk "How Much Money Needed To Retire In Malaysia"