How Much Tax Will I Pay 2021

The ATOs tax withheld calculator applies to payments made in the 202122 income year. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown.

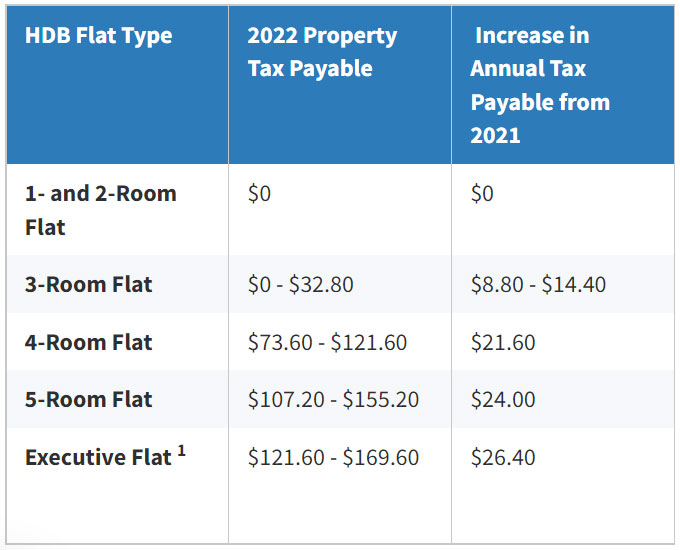

Hdb Flat Owners To Pay Higher Property Tax In 2022 Mothership Sg News From Singapore Asia And Around The World

The rate consists of two parts.

How much tax will i pay 2021. Income Tax NI Calculator. Terms and conditions may vary and are subject to change without notice. For information about other changes for the 202122 income year refer to Tax tables.

The ATO advises you will have to pay income tax on every dollar over 18200 that you earn. Read a full breakdown of the tax you pay. Our salary tax calculator will be updated following the Budget Speech in February 2022.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly. Using the 2021 standard deduction would put your estimated taxable income at 35250 60350 less 25100 placing you in the 12 tax bracket for your top dollars. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387.

IRS Federal Taxes Withheld Through Your Paychecks As entered by you in the Income section from your W-2 or as an estimate. The self-employment tax rate is 153. The IRS considers unemployment benefits taxable income When filing for tax year 2021 your unemployment checks will be counted as.

The calculator provides an approximate figure of your income tax liability by taking into account various data such as. The standard deduction amounts for the 2022 tax year and their increases from the 2021 tax year are. Your average tax rate is 222 and your marginal tax rate is 361.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. How much do you have to earn to pay tax. Estimate your Earned Income Tax.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 220 and your marginal tax rate is 353. Just enter in your salary and find out how much income tax and National Insurance youll pay.

For more information refer to Tax table for working holiday makers. If you employ working holiday makers other tax tables apply. A penalty of 10 will be imposed on the balance of tax unpaid after the deadline of 30 April 2021.

Restart Enter the following Tax Payment amounts you made during Tax Year 2021. This handy calculator will show you how much income tax and National Insurance youll pay in the 2022-23 2021-22 and 2020-21 tax years as well as how much of your salary youll take home. What happens when you pay your income tax late in Malaysia.

There are many other possible variables for a definitive source check your tax code and speak to the tax office. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Use tab to go to the next focusable element.

This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202122. That means that your net pay will be 40568 per year or 3381 per month. The total federal tax that you would pay is 6155 equal to your income tax on top of your Medicare and Social Security costs.

A further penalty of 5 will be imposed on the amount owed if the tax and penalty is not paid within 60 days. Its so easy to use. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty andor interest to the IRS that you would otherwise not have been required to pay HR Block will reimburse you up to a maximum of 10000. As a result they will increase your tax refund or reduce your taxes owed. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

Earnings below that are tax-free. In addition to the rates in the table above most taxpayers are also charged a Medicare levy of 2. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2022 is 147000 up from 142800 in 2021.

Youll pay 10 on the first 20550 of taxable income and 12. Do you have to pay taxes on unemployment. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. So for 2022 any income you earn above 147000 doesnt have Social Security taxes withheld from it.

Tax and NI Calculator for 202122 Tax Year. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. 12950 for single filers up 400 12950 for married taxpayers who file their taxes separately up 400 19400 for heads of households up 600 25900 for married taxpayers who file jointly up 800.

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech. This marginal tax rate means that your immediate additional income will be taxed at this rate.

With all this in mind the total amount that you would take home is 33845. Enter your Salary and click Calculate to see how much Tax youll need to Pay. Loan pension contr etc Calculations verified by StriveX Accountants on 15 March 2021 at 1403.

An Income tax calculator is an online tool designed to calculate how much income tax you are liable to pay in any given financial year.

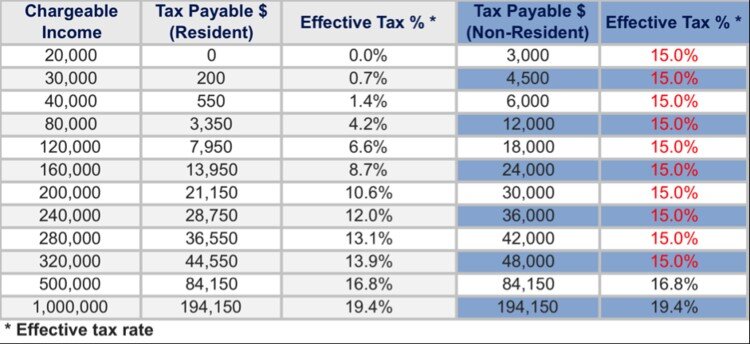

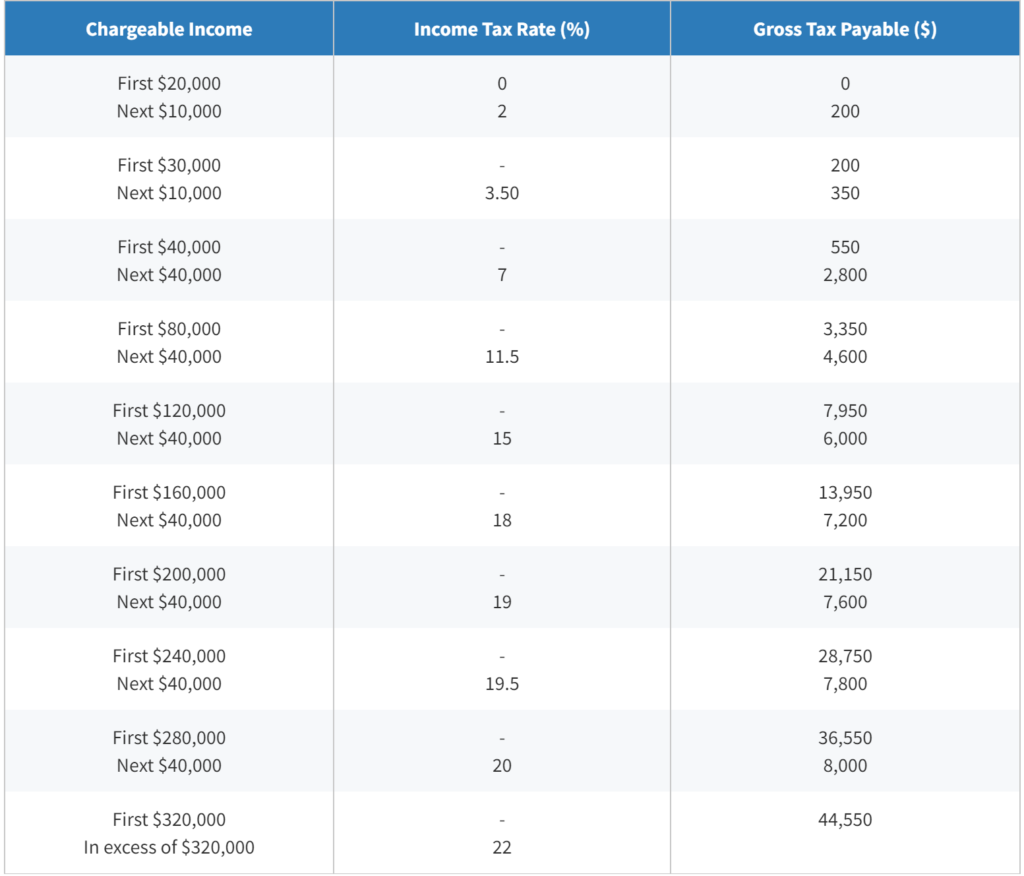

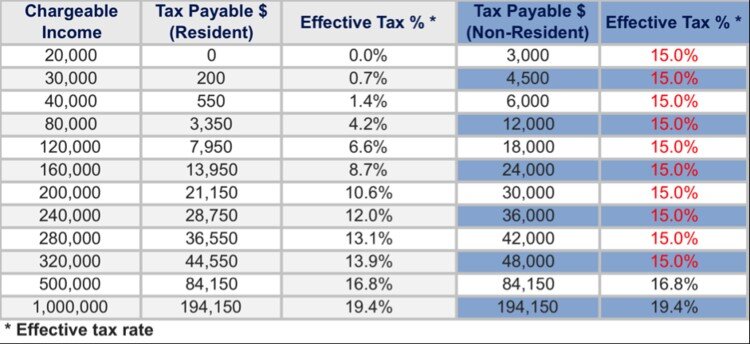

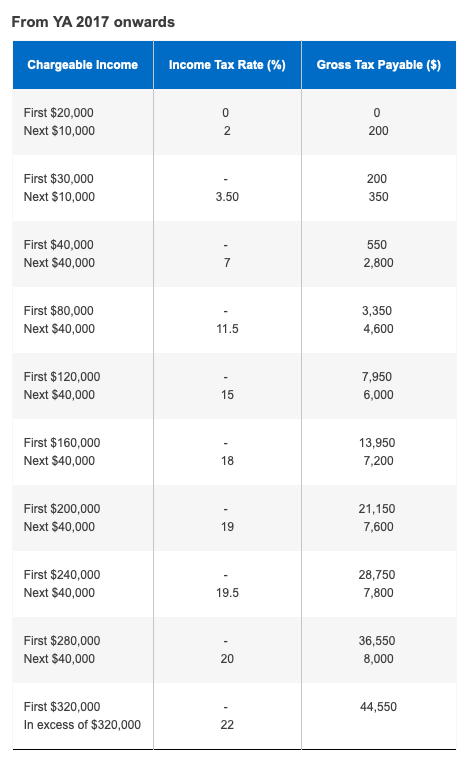

Personal Income Tax In Singapore All You Need To Know Singsaver

What Is The Singapore Personal Income Tax Rates In 2021 Infographics

Singapore Personal Income Tax Guide For Locals And Foreigners Piloto Asia

All You Need To Know About Income Tax In Singapore Nestia

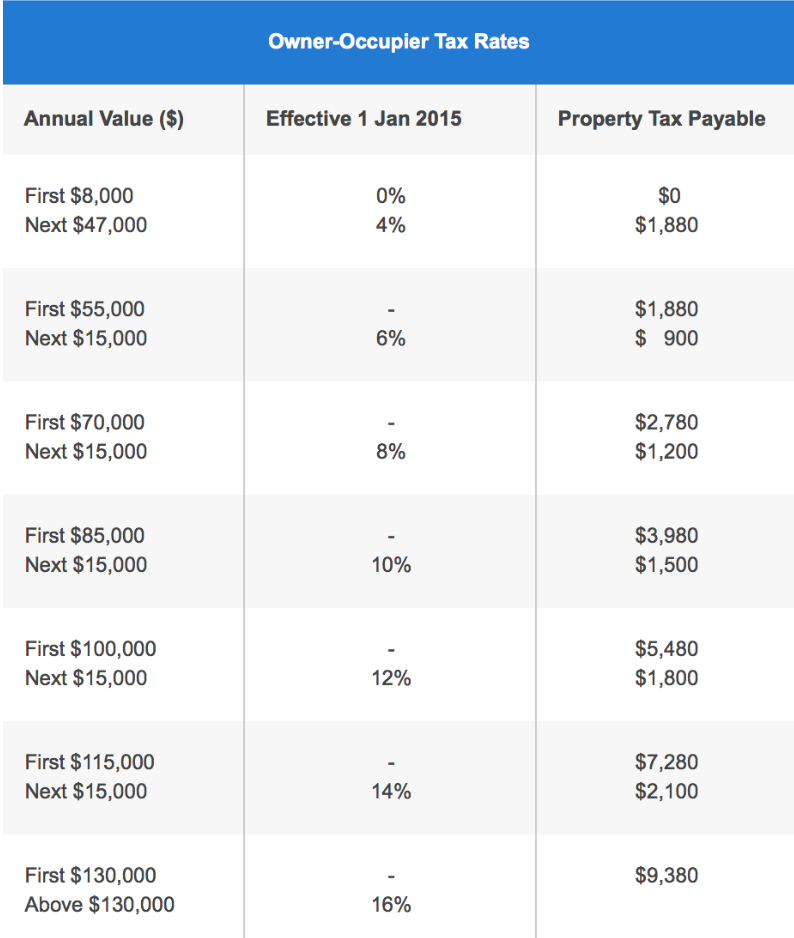

How Much To Pay Rebates Deadline 2021 Update Tinysg

Posting Komentar untuk "How Much Tax Will I Pay 2021"