Income Tax Rebate 2022 Malaysia

Last reviewed - 14 December 2021. The minimum EPF monthly contribution rate for employees Malaysian citizens and permanent residents is currently at the reduced rate of 9 by default for contributions made from January to December 2021.

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Special individual income tax relief for domestic tourism expenditure up to RM1000 is extended until the Year Of Assessment 2022.

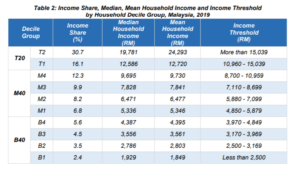

Income tax rebate 2022 malaysia. Some of the easiest tax reliefs to leverage are. Malaysia has extended the expiry of existing income tax exemption on interest or profit earned from deposits for corporate investors in. This was announced by Finance Minister Tengku Zafrul during the tabling of Budget 2022.

PERSONAL TAX 1. The minister said to promote the development of the local EV industry the government proposes to provide full tax exemption for import duty excise duty and sales tax for electric vehicles. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

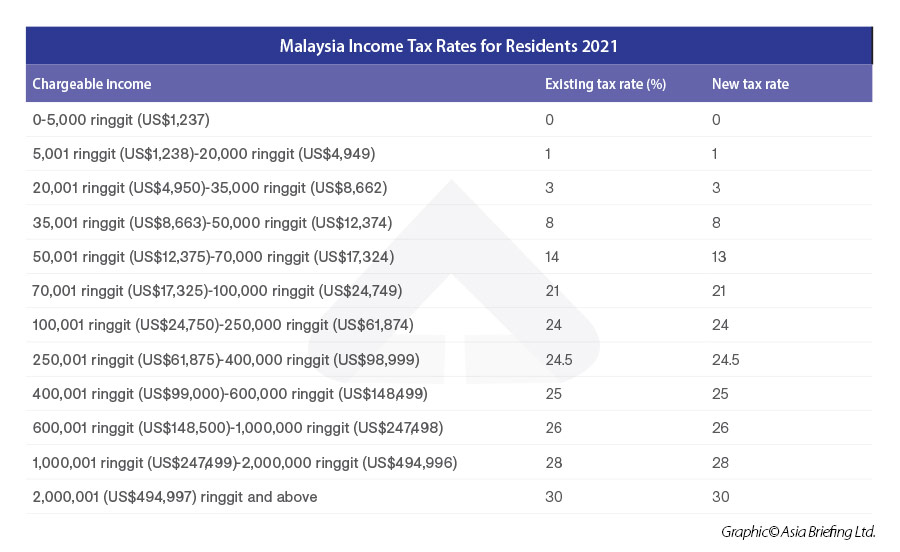

Malaysia Residents Income Tax Tables in 2022. He also announced a 100 road tax exemption for EVs. Income Tax Rates and Thresholds Annual Tax Rate.

Effective from January 1 2022 Malaysian residents will be taxed on their foreign-sourced income that is received in Malaysia. Individual and dependent relatives. Repeal of income tax exemption.

Gone are the days of queuing up in the wee hours of the morning at the tax office to. This income tax calculator can help estimate your average income tax rate and your salary after tax. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income. Income tax deadline 2021. Additionally the gomen also intends to.

Income Tax Rebates For Resident Individual With Chargeable Income Less Than RM35000. Year Of Assessment 2001. If your chargeable income after tax reliefs and.

I surmise that this is like a promotional offer. 150 Tarikh Kemaskini. You can file your taxes on ezHASiL on the LHDN website.

Individuals chargeable income does not exceed MYR 35000. January 13 2022. Under this relief you can claim a maximum of RM500 a year.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. How to file your personal income tax online in Malaysia. The Finance Act 2021 was published 31 December 2021 and the effective date is 1 January 2022.

Purchase of basic supporting equipment for disabled self spouse child or parent. Tax on income from outside of Malaysia. Any excess is not refundable.

Budget 2022 unveiled by Malaysias Finance Minister on 29 October 2021 contains some significant tax proposals that include measures that would impose tax on foreign-source income that is derived by Malaysian residents and remitted to Malaysia and a special tax for year of assessment YA 2022 on companies that derive chargeable income of more than MYR 100. During the transitional period from 1 January 2022 to 30 June 2022 foreign-sourced income of tax residents remitted to Malaysia will be. Scope of individual income tax relief for full medical check-up expenses is expanded to cover the cost of check-up or consultation service related to mental health from a psychiatrist psychologist and counsellor.

Wef 1 January 2022 foreign-sourced income of tax residents will no longer be exempted when remitted to Malaysia. Income tax relief of RM2500 is given on the cost of purchase and installation rental and hire purchase of facilities as well as payment of subscription fees for EV charging facilities. The next thing you should do is to file your income tax do it online.

Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8000 Restricted 3. Read a January 2022 report prepared by the KPMG member firm in Malaysia. There are 21 tax reliefs available for individual taxpayers to claim.

Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop. If the foreign-sourced income is received in Malaysia by residents during the period of Jan 1 2022 to June 30 2022 the Malaysian government is offering a low rate of 3 of the gross amount. You just need to be aware of these reliefs and make a point of keeping the receipts when you expend money in these areas.

How many income tax brackets are there in Malaysia. For more details check out our detail section. Tax rebate for self.

TaXavvy Budget 2022 Edition - Part 1 12. The income tax system in Malaysia has 12 different tax brackets. Extension of reduction in EPF contribution rate from 11 to 9.

An income tax rebate is calculated at the end section of your BE form after youve determined the amount of tax charged on your chargeable income. Individual - Other tax credits and incentives. Through this measure the government hopes to comply with the scope of the OECD Forum on Harmful Tax Practices and could help remove Malaysia from the European Unions grey list of tax havens.

Special income tax rate of 15 given to non-residents holding key positions in companies relocating their operations to Malaysia will be extended for applications received by MIDA until 31 December 2022. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020. The tax measures in the Finance Act are substantially similar to the tax provisions as provided in the Finance Bill 2021 November 2021 including.

Tax relief of RM8000 on medical expenses for self spouse or child suffering from a serious disease extend to 2022. Tax reliefs and rebates.

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Income Tax Breaks For 2020 The Star

Budget 2022 Less Revenue Bigger Deficit As Country In Post Covid Recovery

Crowe Malaysia Updated The Tax Relief For Parental Facebook

Posting Komentar untuk "Income Tax Rebate 2022 Malaysia"