Income Tax Relief 2021 Budget

116-260 appears in this act. The COVID-Related Tax Relief Act of 2020 was enacted as Subtitle B to Title II of Division N of the Consolidated Appropriations Act 2021.

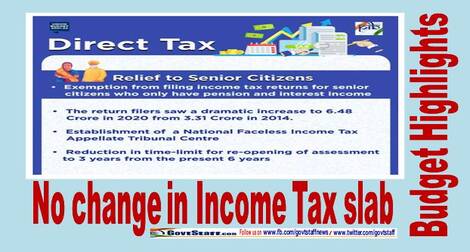

Budget 2021 22 Relief To Senior Citizens No Change In Income Tax Slab Central Government Staff Rules Circulars And Orders Govt Staff

The obligation to file Form 990-T is in addition to the obligation to file the annual information return Form 990 990-EZ or 990-PF.

Income tax relief 2021 budget. As per the notification CII for FY 2021-22 shall come into effect from April 1 2022 and will be applicable to assessment year 2022-23 and subsequent assessment. Much of the COVID-19 tax relief provided in PL. The Office for Budget Responsibility has published figures estimating freezes to the income tax personal allowance and higher-rate threshold for four years will bring 13 million people into the tax system and create one million higher-rate taxpayers by 202526.

Part II should be read together with Part I. 2021 Tax Brackets Due April 15 2022 Tax rate Single filers Married filing jointly Married filing separately Head of household. Also Income Tax Exemptions are available under Sec10 of Income Tax Act 1961 such as PPF Interest or any payment from Statutory Provident Fund- Sec 1011 Gratuity - Sec 1010 - Upto Rs.

An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF. However any tax paid till 31 st March will be treated as Advance Tax. For FY 2021-22 or AY 2022-23.

Its provisions are summarized in Table 1 with other selected COVID-19-related tax provisions. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. At the time of income tax returns filing next year ie.

If you have a golf club membership that also has gym facilities it would not qualify for. Latest Update Income Tax Changes Due to Covid19 The Central Board of Direct Taxes CBDT department has issue. Maturity or Bonus amount received under a Life Insurance Policy -.

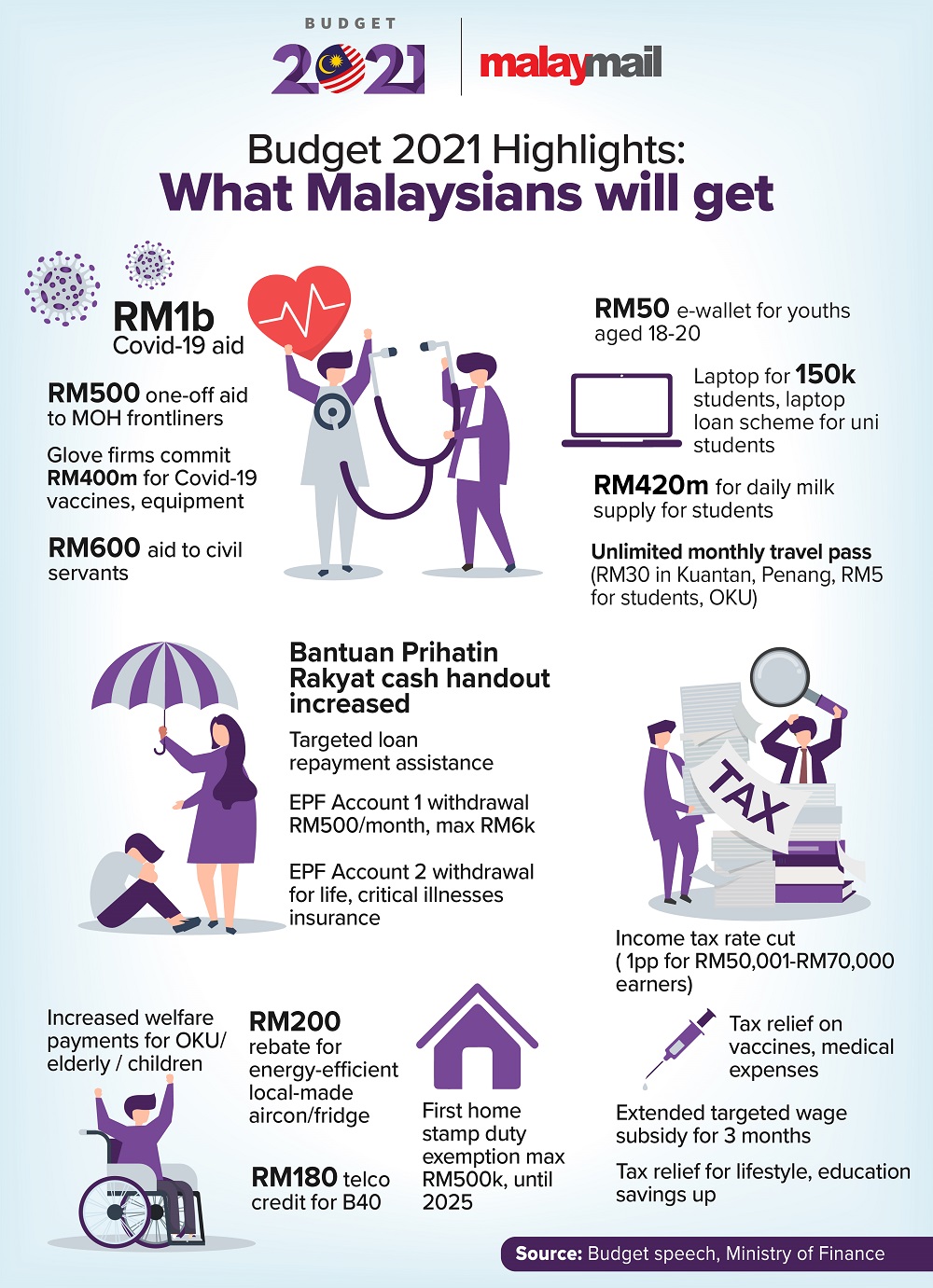

This CII number will be used to arrive at long-term capital gains such as from the sale of debt mutual funds flat etc. The maximum income tax relief amount for the lifestyle category is RM2500. Budget 2021 also proposes to amend the exception in the Income Tax Act whereby a tax preparer is allowed to a file a maximum of 10 paper income tax returns of corporations and 10 paper income tax returns of individuals per calendar year to instead allow only a maximum of 5 paper returns of each type per calendar year.

Presumptive Income are also required to pay Advance Tax on or before 15 th March of the previous year. An organization must pay estimated tax if it expects its tax for the year to be 500 or more. Highlights of Budget 2022 Part II Tax Espresso Special Edition 2 Budget 2022.

Part ll covers changes proposed in the Finance Bill 2021 which were not announced in the Budget Speech and not covered in our Highlights of Budget 2022. Do also take note. The Assessee who are covered under 44AD and 44ADA ie.

Ttcs Insights To Budget 2021 Thannees

Alan Tudge Mp In Budget 2021 We Re Delivering More Tax Relief For Australians Especially For Low And Middle Income Earners To Find An Estimate Of How Much Tax You Will Save

Opinion Where Is The Tax Relief For The Poor Low Income Workers Clarkcountytoday Com

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Ttcs Insights To Budget 2021 Thannees

Posting Komentar untuk "Income Tax Relief 2021 Budget"