Internet Subscription Tax Relief Malaysia Maxis

Buying reading materials a personal computer smartphone or tablet or sports equipment and gym memberships for yourself spouse or child allows you to claim for tax relief. Further Education Fees Self.

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can Claim For 2020 Buro 24 7 Malaysia

2500 Purchase of breastfeeding equipment.

Internet subscription tax relief malaysia maxis. Each unmarried child and under the age of 18 years old. Apart from that an income tax relief of up to RM2500 will be granted to individuals for the purchase installation rent hire purchase as well as subscription fees for EV charging facilities. Payment of monthly bill for internet subscription.

Ii Purchase of a personal computer. Yes only on the 20GB quota. Hopefully this relief will be extended in the upcoming.

And for a limited time only customers who sign up for this bundle from now until 30 November 2021 can enjoy the subscription for free for the first year. I Purchase of books journals magazine printed newspaper and other similar publications except banned reading materials for self spouse or child. If you have selected to make these payments through Maxis your purchase or subscription will be charged to your Maxis bill on a monthly basis or as a one-off charge.

From 2017 Malaysian taxpayers will be able to claim tax relief from smartphone and tablet purchases as well as internet subscriptions under a revamped lifestyle tax relief announced at Budget 2017. You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income.

1 The types of breastfeeding equipment that are entitled to this income tax relief in Malaysia are the breast pump kit manual and electronic ice pack breast milk collectionstorage equipment and a cooler setbag. The special individual income tax relief is given in addition to the existing lifestyle tax relief of RM2500. 28 rows The maximum income tax relief amount for the lifestyle category is RM2500.

So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed newspapers smartphones and tablets internet subscriptions as. 4G mobile operator Maxis Berhad announced its Third Quarter 3Q21 financial results late last month.

Theres even a tax relief for alimony payments. The Telecommunications service provider lost some 20000 mobile subscriptions during July. Up to RM3000 for self spouse or child.

Additional relief on top of lifestyle relief for purchase of personal computer. Under PENJANA a special individual income tax relief of up to RM2500 will be given for the purchase of handphone notebook and tablet. Every time you fill in the LHDN e-Filing form youll be eligible for an automatic tax relief of RM9000.

Customers can choose to sign up for the 2-in-1 Internet Security Bundle to enjoy both at just RM15 for the first year. Broadband Fee Tax Relief for YA2010 to YA2012. In support of the development of the local electric vehicle industry the government has announced that EVs will be fully exempted from import duty excise duty and even sales tax.

Payment of monthly bill for internet subscription Under own name 2500 Restricted Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use Additional deduction for purchase made within the period of 1st June 2020 to 31st December 2020. Broadband fee tax reliefdeduction is only effective for year of assessment 2010 2011 and 2012 only. Interest expended to finance purchase of residential property.

Additional relief for expenditure related to cost of purchasing sports equipment entryrental fees for sports facilities and registration fees for sports competitions. You can claim a tax relief of up to RM7000 if you pay for your own further education courses in a recognised higher learning institution in Malaysia. For the full list of personal tax reliefs in Malaysia as of the.

Subject to the following conditions. However with effect from year of assessment 2008 the mobile phone telephone bills and Internet subscription paid by your employer will be exempted from tax. Internet subscription paid through monthly bill registered under your own name.

I was previously made to understand by my tax agent that I would need to withhold taxes in respect of hotel accommodation and air fare expenses reimbursements made to nonresidents rendering. Special relief in addition to lifestyle relief for purchase of mobile phone personal computer or tablets for YA 2020 and YA 2021. I Purchase of books journals magazines printed newspaper and other similar publications except banned reading materials for self spouse or child.

Ii limited to one residential unit. The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves. Ii Purchase of a personal computer smartphone or tablet for self spouse or child.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. I the taxpayer is a Malaysian citizen and a resident. In previous years Malaysians could only enjoy tax relief on computers and laptops of up to RM3000 which can only be claimed once every three years.

Charge to Bill is not subjected to the 6 Service Tax in your Maxis bill however your subscription may be subjected to the 6 Service Tax by your service or application provider. Additional Mobile Internet Options. Personal tax reliefdeduction of up to a maximum RM500 per year is allowed for broadband subscription fee incurred and registered under the individual tax payers name.

If you elect for joint assessment the deduction allowed is restricted to RM3000. Relief of up to RM10000 a year for three consecutive years from the first year the interest is paid. RM 8000 each.

Lifestyle tax relief. Yes part of lifestyle relief. The self claimed Malaysias No1 Network now has a mobile subscriber base of 1165 million down from 1167 million subscriptions it had in 2Q21 June 2021.

Mobile Internet Package Allocation.

Yes S March It Is About Time To File Your Income Tax Facebook

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Ringgitplus Com

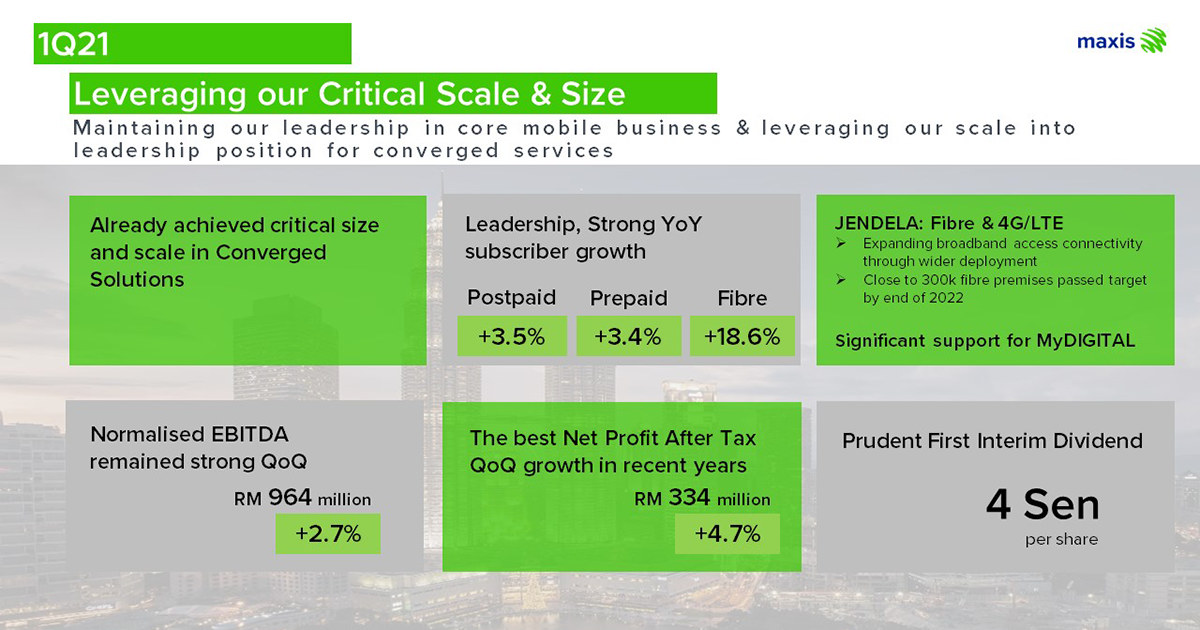

Maxis Solidifies Its Converged Solutions Leadership Position And Delivers Strong Earnings Growth In Q1

Tax Relief 2020 Wtf Why Changed

Posting Komentar untuk "Internet Subscription Tax Relief Malaysia Maxis"