How To Apply Private Retirement Scheme

It can be implemented by both the public and private sectors. For starters PRS is a voluntary contribution scheme where you can contribute as little or as much as you want.

Affin Hwang Am X Mr Money Tv Retirement Planning Campaigns Affin Hwang Asset Management

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

How to apply private retirement scheme. A voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. The objective is to improve living standards for Malaysians at. You contributions will be maintained in two separate sub-accounts.

Like regular unit trust funds these fees will apply. For example if you invest RM1000 a 3 sales charge means that youll actually invest RM970 while RM30. So before you get into full panic retirement planning mode lets see what this PRS thing is really about.

Full withdrawal from both sub-account A and B can be made upon. Lets take a look at why you ought to consider saving for retirement with this scheme. Retail MYR Denominated Negotiable Instruments of Deposit NID Sukuk.

Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your. Any Individual can register as a.

This is the upfront charge youll pay when you invest. How to Apply for Voluntary Retirement Scheme If you want a Voluntary Retirement so you have to go to the concerned authority of the company ie. Rather than an entitlement a government-provided benefit a pension might be best viewed as an individual insurance policy in which a contributor pays a fixed monthly premium in order to collect monthly benefits at some future date.

Guidelines for Online Registration. The PRS is a great way to save money and get some tax breaks. VRS stands for voluntary retirement scheme whereby an employee is offered to voluntarily retire from services before the retirement date.

Funds under PRS are neither capital guaranteed nor capital protected. Contribute to PRS and enjoy. The scheme allows companies to reduce the strength of employees.

Reaching retirement age 3. The decision of the VR application is at the hand of the Head of. Through the Lease Buyback Scheme LBS you will be able to monetise your flat to receive a stream of income in your retirement years while continuing to live in it.

Private Retirement Scheme PRS Special Mudharabah Investment Account-i. Sir i have completed my 15 years of my servicei am a member of eps scheme from 2005 july From that time my epf contribution is being contributedMy question is that i am now at the age of 46if i retired now how much pension i will get backif i retired on 58 then how much pension i will get at that timepreviously pension contribution was rs 541- and now 1250-so pl. VRS is also known as Golden Handshake.

Head of the Department. Permanent departure from Malaysia. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Complements the mandatory contributions made to EPF. NPS Trust welcomes you to eNPS which will facilitate- Opening of Individual Pension Account under NPS only Tier I Tier I Tier II by All Indian Citizens including NRIs between 18 - 70 years Making initial and subsequent contribution to your Tier I as well as Tier II account For Account opening you need to.

Your employer must automatically enrol you in a workplace pension scheme if youre over 22 and under State Pension age and earn more than 10000 a year. If you are eligible to pay taxes you may be interested in the fact that contributions made to your PRS account can be claimed for taxes. Private Retirement Schemes PRS is a voluntary long term savings and investment scheme designed to help you save more for your retirement 1.

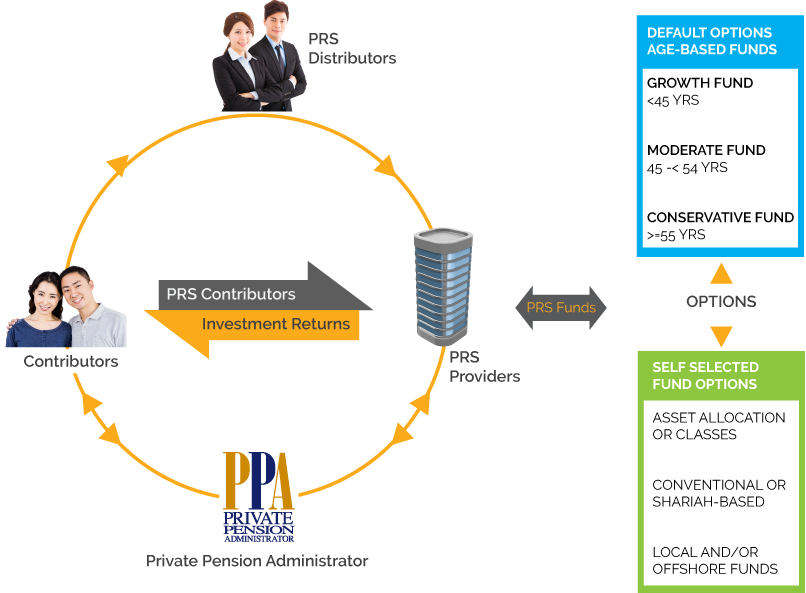

Private retirement scheme prs Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to voluntarily supplement their retirement savings under a well-structured and regulated environment. A Private Retirement Scheme PRS is a defined contribution private scheme that complements the Employees Provident Fund EPF and other retirement plans.

The Private Retirement Scheme PRS was introduced in 2012 to encourage us to build our retirement income beyond just the EPF. Steps to invest in the scheme can be pretty straight forward. Additional contributions into your funds could be done through PRS Online Top Up PPAs online service for the convenience of all PRS Members.

You can sell part of your flats lease to HDB and choose to retain the length of lease based on the age of the youngest owner. First decide the amount then either make payment to your respective PRS Providers through direct debit or online fund transfer. This posting describes my application for the 厚生年金 kosei nenkin or private pension.

You can make pre-retirement withdrawal. Secondly PRS is privately run by financial institutions with no guaranteed returns unlike the government-owned EPF which guarantees you. Up to RM3000 tax relief per year.

The Private Retirement Schemes or PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. The simplest way is to apply for national insurance retirement pension and AFP early retirement pension in the private sector is online at Din pensjon. All citizens of India between the age of 18 and 60 years as on the date of submission of his her application to Point of Presence POP Point of Presence-Service Provider POP-SP can join NPS.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. You are allowed to claim up to RM3000 for PRS contributions each year for a total of 10 years. What is Private Retirement Scheme PRS.

What is Private Retirement Scheme. Established under the Capital Markets and Services Act CMSA 2007 PRS is regulated and supervised by the Securities Commission Malaysia SC to ensure robust regulation and supervision of the PRS industry. The AFP early retirement pension application is part of the application form for national insurance retirement pension.

Save More With Private Retirement Schemes

Structure Of Private Retirement Schemes Prs Private Pension Administrator

A Guide To The Private Retirement Scheme Prs

Principal Private Retirement Scheme Members Can Apply To Withdraw Cash Nestia

Infographics Private Retirement Scheme Prs Investing For Retirement Infographic Retirement

Posting Komentar untuk "How To Apply Private Retirement Scheme"