Compensation For Retrenchment In Malaysia

The lump sum payment may be described by the employer as compensation for loss of employment ex-gratia contractual payment retrenchment payments or gratuity etc. Employers are required to disclose information such as the reasons for the retrenchment number of workforce number of workers involved in voluntary separation scheme etc.

What Hr Needs To Know About Retrenchment Procedures In Malaysia

If unfair dismissal is established the Industrial Court may order reinstatement or compensation in lieu of reinstatement and this will include back wages of a maximum of 12 months for a.

Compensation for retrenchment in malaysia. Less than 2 years. 20 days of salary. 15 days of salary.

Giving official retrenchment letter which includes reason of retrenchment effective period of retrenchment and compensation payment. If you have worked two years or more but less than five years you will. The following are the legal obligations that an employer must do in a retrenchment exercise.

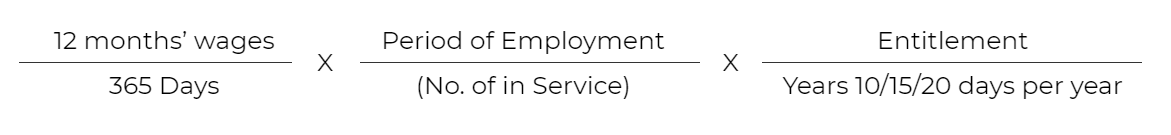

The Malaysia retrenchment benefits for EA-eligible employees are as follows. Thus in retrenchment the employer has to first retrench all foreign employees of a. The following free calculator is provided by Low Partners to simplify the calculation of Retrenchment Benefit.

Say an employee earning RM 1900 who has worked for 6 years is about to get retrenched. Redundancy as Precondition for Retrenchment. There is so much of confusion when comes to the calculation of Retrenchment Benefit notice required if the employer decides exercise retrenchment.

Retrenchments are often but not necessarily the result of economic downturns and are commonly understood as being part of a companys business strategy to deal with business. For employees who earn not more than RM2000 monthly AND manual workersThe length of notice period depends on the employees length of employment according to the Employment Act 1955 EA and the Employment Termination and Lay Off Benefits Regulations 1980 which governs the retrenchment exercise of this group. According to the Malaysian Employers Federation MEF more than 20000 employees were retrenched in 2015 as at September 2015.

Ranbaxy Malaysia Sdn Bhd. Offer the affected employees with suitable compensation accordingly following working contract or Employment Act 1955 Labour Ordinance Of SabahLabour Ordinance Of Sarawak. Retrenchment Benefits The amount payable is as follows.

For whatever the reasons a retrenchment exercise was carried out these are 4 basic legal principles that every employers or employee should know. Malaysias Human Resources Minister says that his ministry expects retrenchments to continue into 2017. A voluntary separation scheme VSS is a scheme offer where an employer invites and offers the employee to resign voluntarily without the implications of a retrenchment while still receiving fair compensation from it.

Many businesses in Malaysia are facing financial difficulties which have been exacerbated as the outbreak continues and a natural consideration is whether they can legally undergo cost-cutting measures such as downsizing and retrenchment. Whilst details remain unclear in the context in which the employees were asked to leave compensation notice period etc it is an opportune time to discuss the general law in Malaysia relating to retrenchment. Retrenchment can also be done by way of the company introducing a Voluntary Separation Scheme VSS to its employees where the parties mutually agree to discontinue their employer-employee relationship with the payment of a compensation package.

According to the Inland Revenue Board Malaysia LHDN when an employment ceases the employer may make a lump sum payment to the employee. How Is Retrenchment Compensation Calculated In Malaysia. Please answer the question.

Hamidah Marsono Faculty of Law Universiti Teknologi MARA 40450 Shah Alam Malaysia Tel. RM10000 for every completed year of service ie. 7 Things You Should Know about Retrenchment in Malaysia Latest reports show that 31476 Malaysian employees were retrenched or laid off between January and September this year.

12 months This amount is only applicable for loss of employment occurred in 2020 and 2021. 5 years and above. 12 months Termination in 2020 and 2021.

Can employers retrench their employees due to the COVID-19 outbreak. Kamaruzaman Jusoff Yale University Yales Centre for Earth Observation 21 Sachem St New Haven CT. For employees who do not fall.

In this case the Court may order reinstatement or compensation in-lieu of reinstatement and back wages of a maximum of 12 months of the employees last drawn salary for a probationer or a maximum of 24 months for a confirmed employee. There has been a wave of retrenchments in Malaysia which started last year and looks to continue through 2016. Employee Retrenchment Benefit Calculator.

Employers are required to submit an employment notification retrenchment form PK Form to any Labour Office failure of which carries a punishment of a fine of RM1000000. The order of selection is non-citizen casual temporary and lastly permanent employee. Employers are required to submit an employment notification retrenchment form PK Form to any Labour Office failure of which carries a punishment of a fine of RM1000000.

10 days of salary per year of employment 2 - 5 years. 13 Reporting Retrenchment to the authorities. It goes without saying that retrenchment is subjected to scrutiny by the Industrial Court of Malaysia.

In this case the Court may order reinstatement or compensation in lieu of reinstatement and back wages of a maximum of 12 months of the employees last drawn salary for a probationer or a maximum of 24 months for a confirmed staff. If you are retrenched within two years you will receive 10 days of wages. RM20000 for every completed year of service ie.

Ganesh Beloor Shetty v. The Court concluded that the dismissals were unfair and awarded each employee backwages of 14-15 months and compensation in lieu of reinstatement of one months salary per year of service. 10 days wages for each year of employment if less than two years.

Employment Law Retrenchment In Malaysia Chia Lee Associates

What Is Form Pk L Co Chartered Accountants

Know The Difference Layoff And Retrenchment

1thinking Retrenchment In Malaysia

Posting Komentar untuk "Compensation For Retrenchment In Malaysia"