Difference Between Resident And Non Resident Company In Malaysia

Malaysia has 69 effective Double Taxation Agreements DTA. 2The applicant has been staying in Malaysia on a valid long term pass.

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

NA 15 NA Non-resident individual or company.

Difference between resident and non resident company in malaysia. A Singapore resident company is one for which the control and management of the business is exercised in Singapore while a company which is not resident in Singapore will not be subject to its taxation system in Singapore eg. Is there any restriction. For income tax purposes the rate of tax will depend on the employees residence status.

Resident company are exempt from tax in Malaysia. However payment in ringgit by the resident to the non-resident must be made into an external account of the non-. An Individual will be considered Non-Resident for Income Tax purpose if the individual is physically present in Malaysia for less than 182 days during the calendar year regardless of the citizenship or nationality.

If the time spent in Malaysia is as follows. In Malaysia the principal difference between a resident and non-resident is that the non-residence is taxed at a rate of 30 without being eligible to. If the individual is Resident in regard to Malaysian Tax Law the individual is subjected to normal income tax.

Non Resident status is deemed for a company with more than 50 shareholding owned by foreigners. A Malaysia Branch Office is considered a non-resident company for tax purposes. A non-citizen of Malaysia who has obtained permanent residency status in Malaysia and is ordinarily residing in Malaysia.

For withholding tax refund due to DTA payee must forward application for refund to the Director Non Resident Branch together with the following details. FAQs related to resident companies A. 31 Non-resident individual means an individual other than a resident individual.

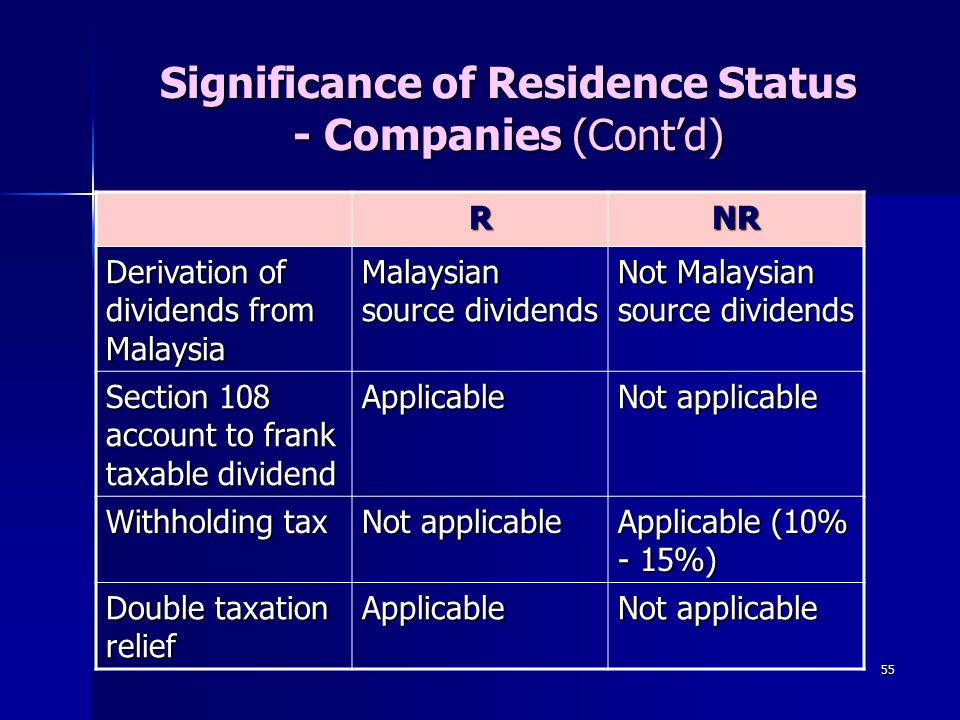

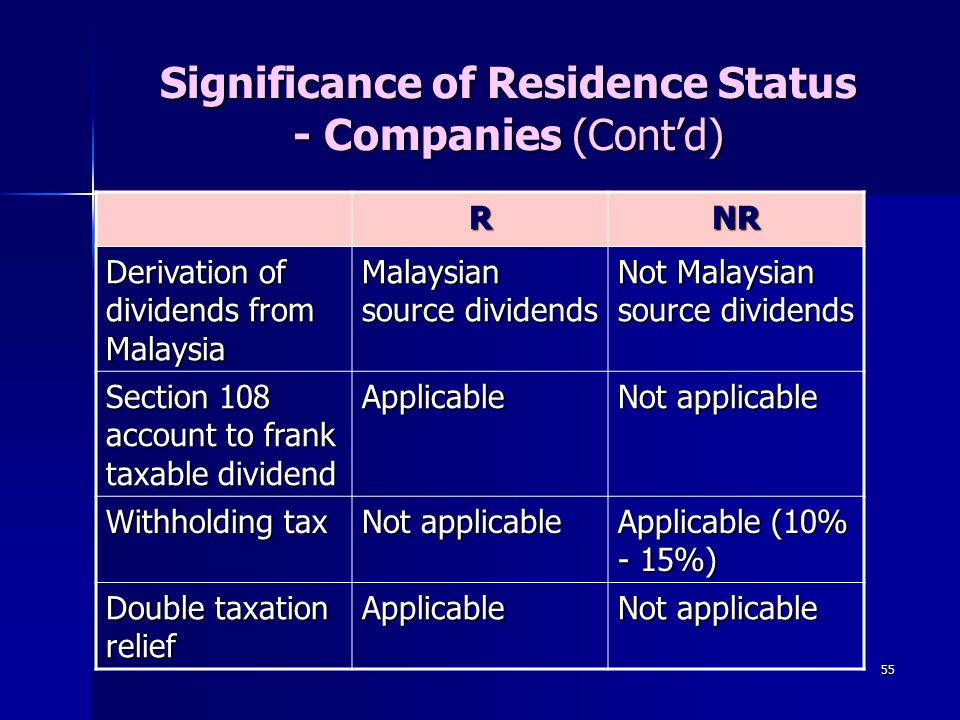

Dividends distributed by a non-resident company are not deemed derived from Malaysia. The tax implications depend on the residential status of the individual tax assessee. Payment can be made in foreign currency or ringgit.

Resident aliens are treated as US. Resident Individuals is defined as an individual resident in Malaysia for the basis year for a Year of Assessment YA as determined under Section 7 and subsection 71B of the Act. Section 108 ITA account A resident company was required to deduct tax under section 108 ITA from dividends deemed derived from Malaysia under the imputation system.

3For Category 3 the applicant has resided in Malaysia for at least three 3 years on a valid long term pass. Non-resident Individual means an individual other than a resident individual. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

Non-resident working in Malaysia. For this purpose if the individual who qualified as a resident by the virtue of section 6 1 of the act satisfies both the following conditions then it is a resident but ordinarily resident. Citizens for tax purposes they are taxed on their worldwide income.

Section 108 ITA 1967 account to franked dividends A resident company is required to deduct tax under section 108 ITA 1967 from dividends deemed derived from Malaysia under the imputation system. If it satisfies either one or none of the following conditions then it is a. A Change in Tax Residency Status in Malaysia Context.

So for those that fall under the non-resident tax rate here we have overview of all the tax rates. For non-resident status for Malaysia Sdn Bhd companies the corporate tax rate will be a flat rate of 24. An individual is a resident alien of the US.

Besides withholding tax of 10 3 is applicable on payments made to the branch for services performed in Malaysia as branch is a non-resident for tax purposes. As a resident company we need to pay our overseas supplier for the purchase of goods or services. Branch office of a Foreign Company.

I conduct business with both Malaysian resident and non-resident companies ii conduct shipping operations to anywhere including Malaysia iii transact in any currency and iv offer products and services in non. The current tax structure is as follows. Non-resident companies are not eligible for tax incentives for new start up or resident companies.

Because of certain benefits which are available only to a resident company many. Tax residence is based on time spent in Malaysia and not nationality - a Malaysian who lives and works overseas can be considered a non-resident. Broadly the following criteria are used to establish residency status.

CONDITIONS TO APPLY FOR A RESIDENCE PASS OTHER CATEGORIES 1The applicant must have a valid travel document or passport with a validity of at least six 6 months. Tax resident certificate of the payee from the tax authority of the country where the payee is resident. Non-residents pay a flat 28 on taxable income so it is advantageous for your employee to qualify as a resident.

32 Resident individual is an individual resident in Malaysia for the basis year for a year of assessment as determined under section 7 and subsection 71B of the ITA 1967. You are considered as a non-resident under the Malaysian tax law if you stay less than 182 days within Malaysia within a calendar year regardless of your citizenship or nationality. Resident means A citizen of Malaysia excluding a citizen who has obtained permanent resident status in a country or a territory outside Malaysia and is residing outside Malaysia.

The 182 days period can be consucative period or not. The resident status of. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

In accordance to LBATA amendments and BEPS regulations a Labuan offshore company can also now do business in Malaysia. Dividends distributed by a non-resident company are not deemed derived from Malaysia. 5 or NA if paid out of foreign source income NA NA Belarus Last reviewed 30 May 2021.

For tax purposes if they meet either the green card test or the substantial presence test for the calendar year. Another advantage of the resident status is that deductions from income are available while non-residents cannot use those to reduce their taxable income. The most important factor for determining expatriate tax liability in Malaysia is residency status which essentially refers to the amount of time an employee spends in the country.

15 or NA if paid out of foreign source income 15 NA Resident company. A resident Indian has to file returns only in. Offshore companies in Labuan can.

Resident Vs Non-Resident. Find out why foreigners prefer to set up Labuan International Company for their business activities in Malaysia. Significance Of Residence Status 41 Residence status for income tax purposes.

Resident company are exempt from tax in Malaysia.

Tax Guide For Expats In Malaysia Expatgo

Residence Status Of Companies And Bodies Of Persons Main Criteria That Determines The Tax Treatment Asq

Residence Status Of Companies And Bodies Of Persons Main Criteria That Determines The Tax Treatment Asq

Resident Status In Malaysia Fundacionfaroccr

Taxplanning What Is Taxable In Malaysia The Edge Markets

Posting Komentar untuk "Difference Between Resident And Non Resident Company In Malaysia"