Epf Withdrawal 10000

Here is a look at when you are eligible to withdraw money from this pension account and how you can withdraw it. According to the act your EPF withdrawal is bound to attract a Tax Deducted on Source TDS if you have withdrawn an amount of more than 50000 and have worked for a period of 5 years or less.

Epf Time For A Rethink On Taxing Withdrawals Before Five Years Times Of India

While we empathise with the rakyats struggles during the present times further withdrawals from their retirement nest egg may cause bigger problems in the future particularly after retirement the.

Epf withdrawal 10000. According to my payslips total epf deduction on Nov 2014 Mar 2015 is rs9000- rupeesbut downloaded UAN. The new COVID variant Omicron is milder but cases are still rising. Though the National Savings Certificate scheme has a lock-in period of 5 years premature withdrawal is possible under the following circumstances.

Do you have UAN. Instead of coming to the EPF for the hearing the companys lawyers officials will settle the cases through video conferencing. After the completion the software will be used in Delhi and UP.

The EPF will release control of the amount invested in the FMI when a member reaches age 55 or has made a full withdrawal through Leaving Country Incapitation Pensionable EmployeesDeath WithdrawalAny investment transaction made is. You will get 85 current rate of interest in EPF scheme every year on this amount deposited with EPFO. An EPF Employees Provident Fund member can withdraw hisher PF balance partially for different kinds of purposes like.

This interest rate may change as EPFO decides on it once every financial year. Public Provident Fund can also be called a savings cum. From January 1 2022 you can file a belated return till March 31 2022.

To be about 50000 families per year including an increase in claims taking into account estimated death of about 10000 workers which may occur due to COVID it added. Aur lekin 10700- nahin a raha hai woh to reject ho jata hai. These EPF withdrawal rules are stated under section 192A Finance Act of 2015.

For purchase of House Flat Site Construction of house to meet marriage expenses etc. Usse 10000- withdraw kar liya hai. Employees Provident Fund EPF is a scheme under the Employees Provident Funds Miscellaneous Act 1952.

Until 2021 the maximum penalty a taxpayer could face for missing the ITR filing date was Rs 10000. So every month your investment in the fund will reduce by 10000. The Employees Provident Fund Organisation EPFO has allowed employers to delay deposits in EPF accounts.

Use the above SWP calculator to know how much you can withdraw from your lumpsum investments. The amount left every month after withdrawal will continue to remain invested. In the claim form select the claim you require that is full EPF settlement EPF part withdrawal loanadvance or pension withdrawal under the tab I Want To Apply For.

How to Withdraw EPF Money Using UMANG Mobile App. If the NSC holder or holders in case of joint holders pass away. EPFO Portal Login EPFO Online Transfer.

THE Malaysian Financial Planning Council MFPC supports the governments decision against further Employees Provident Fund EPF withdrawal schemes. As per the income tax rules its mandatory for banks to deduct tax at source TDS in case of the interest is earned more than 10000 in a financial year. Recently EPFO Unified portal launched a facility to submit EPF Form 15G for PF which allows the.

This limit was raised in the budget of 2016. There are three scenarios upon which 100 of the EPF can be withdrawn. EPF Office Addresses EPF Withdrawal for Repaying Home Loan.

Families of workers enrolled with Employee State Insurance Corporation ESIC who have died due to. Employees who ceases to be EPSpension member will get Employers 833 contribution in PF. And India recorded 317532 new Covid-19 cases 491 deaths in the last 24 hours pushing the total death toll to 487693 as.

Else you would have to make 2 EPF withdrawal requests -one for company A and one for company B. Lets assume that you decided to withdraw an amount of 10000 per month. Hi Sreekanth my office deducted epf from nov 2014 to march 2015 financial year 2014-2015 of rs1800month in my salary and i continuously working with same company now i downloaded UAN passbook from epf website just two days back.

An EPF subscriber can also take EPF advance for the purpose of medical treatment of self family members. EPF e Passbook EPF Contribution Rules. The Employees Provident Fund Contribution should be paid till the date of his leaving the service irrespective of the age of the member.

As of now to make a partial. The Employees Provident Fund EPF corpus also has a pension component kept in the Employees Pension Scheme EPS account. And would have to meet Regioanl EPFO office about company A.

Public Provident Fund PPF is a government-initiated tax-saving investment option used by the citizens of India. The maximum withdrawal amount is the lesser of the following. How to Check EPF Balance Online.

Under this scheme the employee and employer contribute 12 each of the employees basic salary as well as dearness allowance towards EPFAt present the interest rate on EPF deposits is 850 pa. The combined amount ie. If any order is given by the court of law.

So what will happen if you cut the EPF on 15000 If they cut the epf at 15000 then they will give 12 of 15000 employee So that is friends 1800 rupees 12 of their 15000 will also be given by their companies or Employer So here both will give 12-12 Which will be 1800- 1800. Managed by the Employee Provident Fund Organisation of India EPFO the Employee Provident Fund EPF is an employees fund wherein the employee and the employer have to contribute an equal pre-decided amount of money which can later be. PPF was introduced in 1986 by the National Savings Institute of the Ministry of Finance to initiate savings in form of investment along with the benefit of return on it.

In the Corona era social distancing will be effective with the e-court system. About 10000 new and old cases are currently pending in UP alone. If yes then your total years of contribution to EPF is more than 5 years and you can withdraw from EPF with withdrawal being tax free.

Partial withdrawal from PPF account is allowed after completion of the 6th year ie. PPF Interest Rate 2022- All You Need to Know. On the other hand if he had invested in a bank FD and got Rs 1 lakh interest on a principal of Rs 10 lakh the entire Rs 1 lakh would be considered as income and would be taxable.

UAN Balance Check by SMS UAN Registration Apply PRAN Card Online. 10000 is then deposited with EPFO. Select PF Advance Form 31 to withdraw your fund.

How to do Full or Partial EPF Withdrawal Online. Visit the EPFO official portal. When The Tax Is Applicable.

Only 10 of his withdrawal Rs 10000 is considered as income and the balance Rs 90000 is considered as capital withdrawal. Online EPF Withdrawal. The beginning of the 7th year onwards.

PF Withdrawal Online. 50 of the account balance at the end of the previous year is calculated from the year in which withdrawal is made.

Epf Withdrawals New Rules Provisions Related To Tds

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules

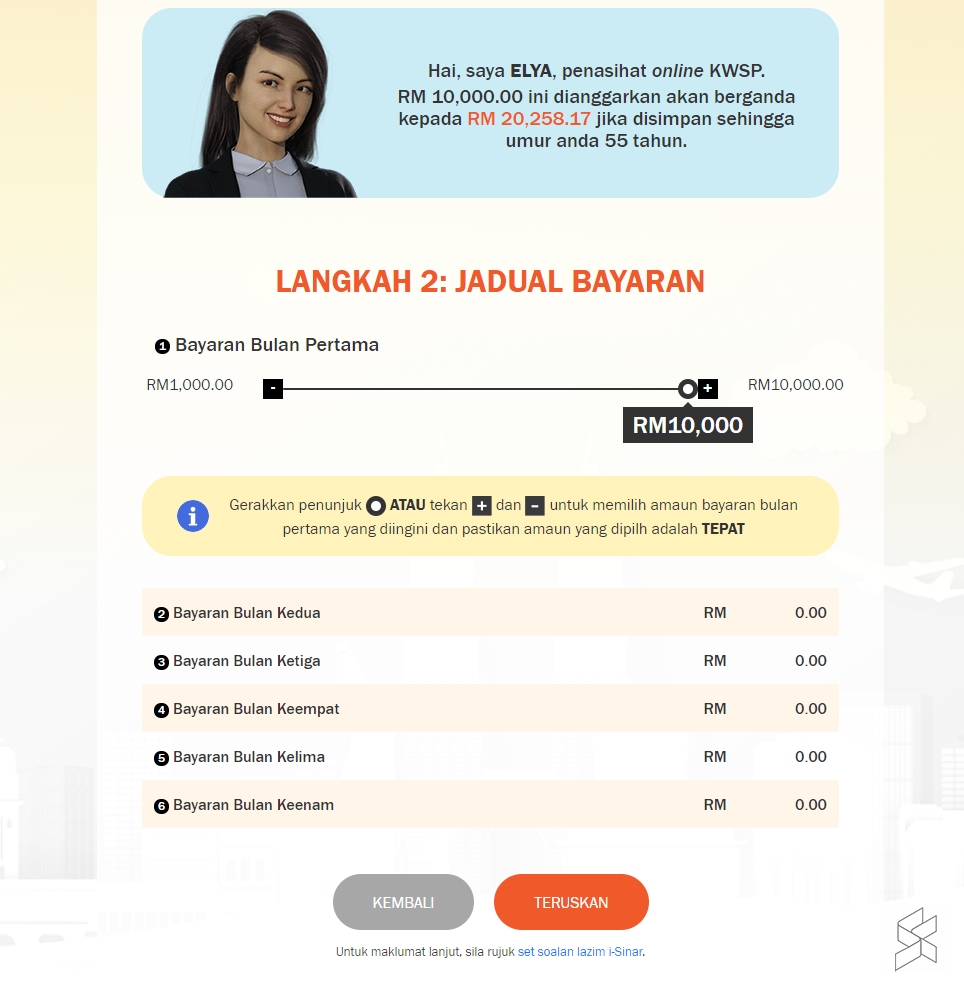

Epf I Sinar Applications Are Now Open Here S How To Apply Soyacincau

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Status How These Epfo Members Lose Money Via Epf Passbook Balance Claim Don T Do This Zee Business

Posting Komentar untuk "Epf Withdrawal 10000"