How Are Share Traders Taxed

For a share trader. While capital gains on most financial assets are taxed alike its worth noting that gold and other metals are considered collectibles with long-term gains taxed at a.

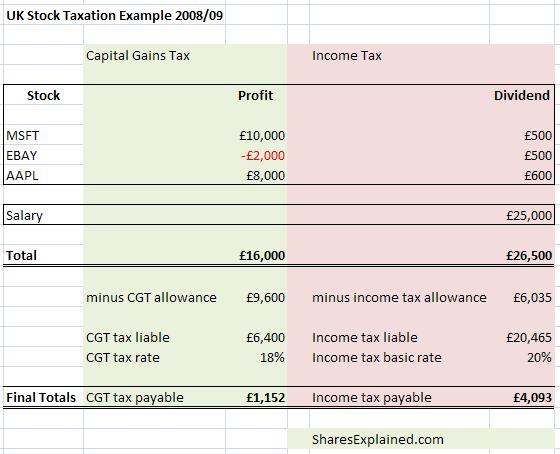

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

The rate of Income Tax on trading in equity share depends on the income head.

How are share traders taxed. Overall gains from intraday trading are treated as speculative income and taxed as ordinary taxable income. Your trading account can help you track gains or losses from intraday trading daily and estimate the annual tax on intraday trades. Under the current FIF regime most taxpayers will generally be either taxed on a maximum return of 5 of the market value of the shares or if the shares lose value during the year they will not be taxed.

Your losses and costs are treated as deductible expenses in the year they are incurred. Awarded the Best Online Trading Platform by Influential Brands 2020. If your DRIP allows you to purchase additional shares at a discounted price youll be taxed the difference between the reinvested cash and the fair market value of the stock.

Ad A global leader in trading and investing with local service from our Singapore office. It is added to your salary and taxed according to the income tax slab you fall in. Receipts from the sale of shares are dealt with as income.

However if treated as Capital Gains Income below are the tax rates. D maintains the books of account for share trading then no tax audit is required in the present case as from the aggregate turnover of 210 crores 170 crores shall be offered to tax on a presumptive basis and remaining turnover of share trading that is 40 lakh is within the prescribed limit of section 44AB. Trade 19000 shares at Competitive Prices on our award-winning platform.

If you reinvest dividends through a dividend reinvestment plan DRIP you have to pay taxes as though you received the cash. Dividends and other similar receipts are included in assessable income including any. You can also check with your broker or professional tax expert to confirm the tax on trading.

1 Taxation liability for investors there are fixed tax rate of 10 15 or 20 for short term and long term capital gain. Treated as Capital Gains Income. What is the basic difference between being a trader and investor with respect to taxation on share trading.

Costs incurred in buying or selling shares are an allowable deduction in the year in which they are incurred. Sharesights Traders Tax report calculates any taxable gains using one of four methods. Ad A global leader in trading and investing with local service from our Singapore office.

The circular states that. Listed shares and securities. If you change from an investor to a trader or vice versa the treatment of your profits or losses will also change.

Awarded the Best Online Trading Platform by Influential Brands 2020. Again depending on how long the trade is held open from the time of option exercise shares were acquired to when the writer sells back the shares the trade could be taxed on a long- or short. Ordinary dividends are taxed at your normal income tax rate.

First-in first-out FIFO First-in last-out FILO Minimise capital gain sell highest priced shares first. Your gains are treated as ordinary income. Your shares are treated like trading stock in a business.

Ad Speculate on Share Price Movement with CFDs. If the taxpayer chooses to treat the shares and securities as stock in trade the profit will be considered business income irrespective of the holding period. The common and intuitive approach is to consider a person with a long term perspective as an investor and a person with a shorter term perspective as a trader.

Trade 19000 shares at Competitive Prices on our award-winning platform. So if youre wondering that intraday trading taxable under which head the answer is business income. But from a taxation standpoint there is a deeper significance to this distinction.

On the other hand short-term trading profits on assets held less than one year are taxed like income. Regarding shares and securities held for more than 12 months the taxpayer can offer the income as capital gains. If you can satisfy the ATOs definition of being a share trader you can claim any gains from the share market as your personal income and any losses as a tax deduction.

Taxes on intraday share trading are very different from delivery trading. There are three types of tax you have to pay when trading shares capital gains tax income tax and stamp duty. If you are a share trader.

If it is considered as a Non-Speculative Business Income it is taxed at income tax slab rates. Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report. For trader income will be taxable at slab rate.

Gains earned from long term investing are treated differently. Losses can exceed deposits. Losses can exceed deposits.

However you need not worry about calculating stamp duty as it is dealt with by your broker when you enter a trade. Ad Speculate on Share Price Movement with CFDs.

Understanding The Tax Implications Of Stock Trading Ally

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

A Beginner S Guide To Online Stock Trading

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

Understanding The Tax Implications Of Stock Trading Ally

Posting Komentar untuk "How Are Share Traders Taxed"