Is Stock Trading Income Taxable

Heres our shortlist of the best stock brokers hand-picked by our team of experts. The companys stock was up by 12 in midafternoon trading against the nearly 2.

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

At least theres no explicit fee.

Is stock trading income taxable. Interest Income and Your IRA. Sum of absolute values of profit or loss. Chapter 11A Trade profits.

Taxable income includes all types of compensation whether they are in the form of cash or services as well as property. The US Stock Market is worth more than the next 7 stock exchanges combined. A trader should prepare financial statements and file Form ITR 3.

Other disposals not made in the course of trade. Angel One - Indias largest broker introduced ZERO cost brokerage services for trades executed in cash delivery and only Rs20 per order will be charged for. Meaning of trading stock 172AA.

Microsoft is worth more than the entire Brazilian stock market. Gone are the days of expensive stock broker commissions or any commissions for that matter among many online brokerage accounts. Simpler trading stock rules.

Preferred stock also called preferred shares preference shares or simply preferreds is a component of share capital that may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument and is generally considered a hybrid instrumentPreferred stocks are senior ie higher ranking to common. If you held the stock for less than one year thats a short-term gain so. Claiming previous year losses.

Some brokers still find hidden ways to make money. Social Security 2022. The Internal Revenue Service considers most interest that you receive or that is credited to an account that you can access to be taxable income in the year you.

All businesses must account for the value of their trading stock at the end of each income year closing stock and at the start of the next income year opening stock. By doing this you could remove all of your gains from your investments and further reduce your taxable income up to 3000 per. General trading stock rules.

The stock does not produce any immediate income as long as you hold the stock in the year you acquire it. Simpler trading stock rules for small businesses. Consumables used in manufacturing trading stock such as cleaning agents or sandpaper.

Using stock for private purposes. Offsetting current year losses. Alimony items involved in barter trading and income from ones hobby are also miscellaneous taxable income.

Over the last 10 years 82 of fund managers failed to beat the market. Account for private use. Your best bet is to go with a discount broker since these have reduced commissions and as little as 0 to 500 minimums to open an account though this does come at the expense of expert financial.

This stock trading app is a zero-commission trading platform offering everything from stocks bonds Bitcoin futures and ETFs. Accounting for trading stock. I The individual has deposited an aggregate amount exceeding.

But because it increases your taxable income dont forget to pay taxes on that interest when owed. Basically youre trying to sell floundering non-qualified investments at a loss to offset any gains youve had. A REIT is required to invest at least 75 of its total assets in real estate and distribute 90 of its taxable income to investors.

Trading stock supplied by trader. Stock options that are granted neither under an employee stock purchase plan nor an ISO plan are nonstatutory stock options. The second thing you can do to reduce your taxable income is a strategy called tax-loss harvesting.

Other income is non-taxable not taxable exempt or tax-free. The interest income reported on Schedule B should be added to your other income to determine your total taxable income. Trading stock and the treatment of proceeds from the sale of software.

Changes in trading stock. When youre looking for a cheap online stock trader dig deeper than just stock and ETF trades since all online trading platforms offer these for 0. Some income is called taxable which means it forms part of the total income that you have to pay tax on though sometimes no tax may be due if the income falls within your allowances or is taxed at 0.

Trading Turnover for Options Trading is the sum of Absolute. Learn about the top brokerage companies and get access to ETFs fractional shares research tools and more. Trading NFTs could also create taxable events.

This is assuming that it is not distributed in a retirement account such as an IRA 401k plan etc in. Refer to Publication 525 Taxable and Nontaxable Income for assistance in determining whether youve been granted a statutory or a nonstatutory stock option. Types of REIT investments may be available in the following security types.

This means you do not include the income in your total. Generally speaking dividend income is taxable. Trading Turnover for Futures Trading is the Absolute Profit ie.

Traders can claim expenses directly related to trading income. Its even considered as one of the best ETF apps in the market. TD AmeriTrade offers the entire spectrum of the financial investment service.

Chapter not to apply where cash basis used. How Taxable Income Will Increase in Relation to COLA. Unless a particular income is expressly exempted by law from tax liability.

Since 1986 it has nearly tripled the. If you think about an investor who buys an NFT they probably had to take their dollars to. In a taxable account that would be added to your income for the year.

By law an individual who may not have taxable income is also mandated to file a tax return if he meets any of the below conditions. You do not have to pay tax on all of your income. Trading stock appropriated by trader.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Transfers of trading stock between trade and trader. Earning interest income is always a good thing.

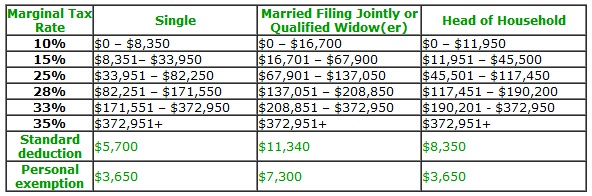

Work out taxable income. Trading News Political News. These securities invest in real estate by either purchasing properties directly or holding mortgages.

That means no fee whatsoever when you buy a stock mutual fund or exchange-traded fund ETF online. Income Tax provisions for Trader having non-speculative business income. The US stock market is 46 of the entire worlds stock market capitalization in 2022.

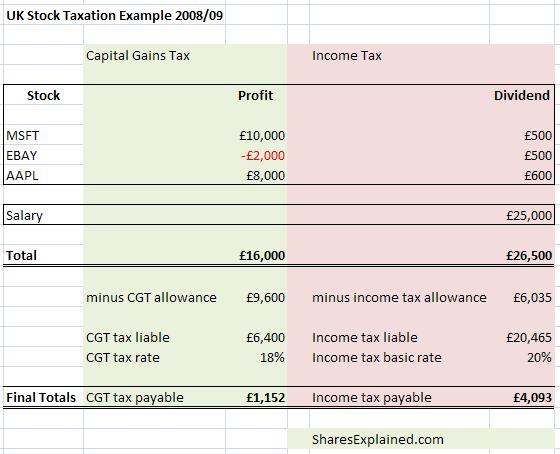

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Understanding The Tax Implications Of Stock Trading Ally

Taxation Of Income Earned From Selling Shares Do I Need To Pay Tax

Understanding The Tax Implications Of Stock Trading Ally

Posting Komentar untuk "Is Stock Trading Income Taxable"