Vehicle Sales Tax Exemption Malaysia

This means locally-assembled car prices ought to come down by 10 while CBU prices will be down by 5. Government extends SST exemption period to June 30 2021 100 on new CKD cars 50 for CBU.

Sales Tax Exemption Will Continue Until June 30 2021 News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

EXEMPTION FACILITIES IN THE AUTOMOTIVE INDUSTRY 22.

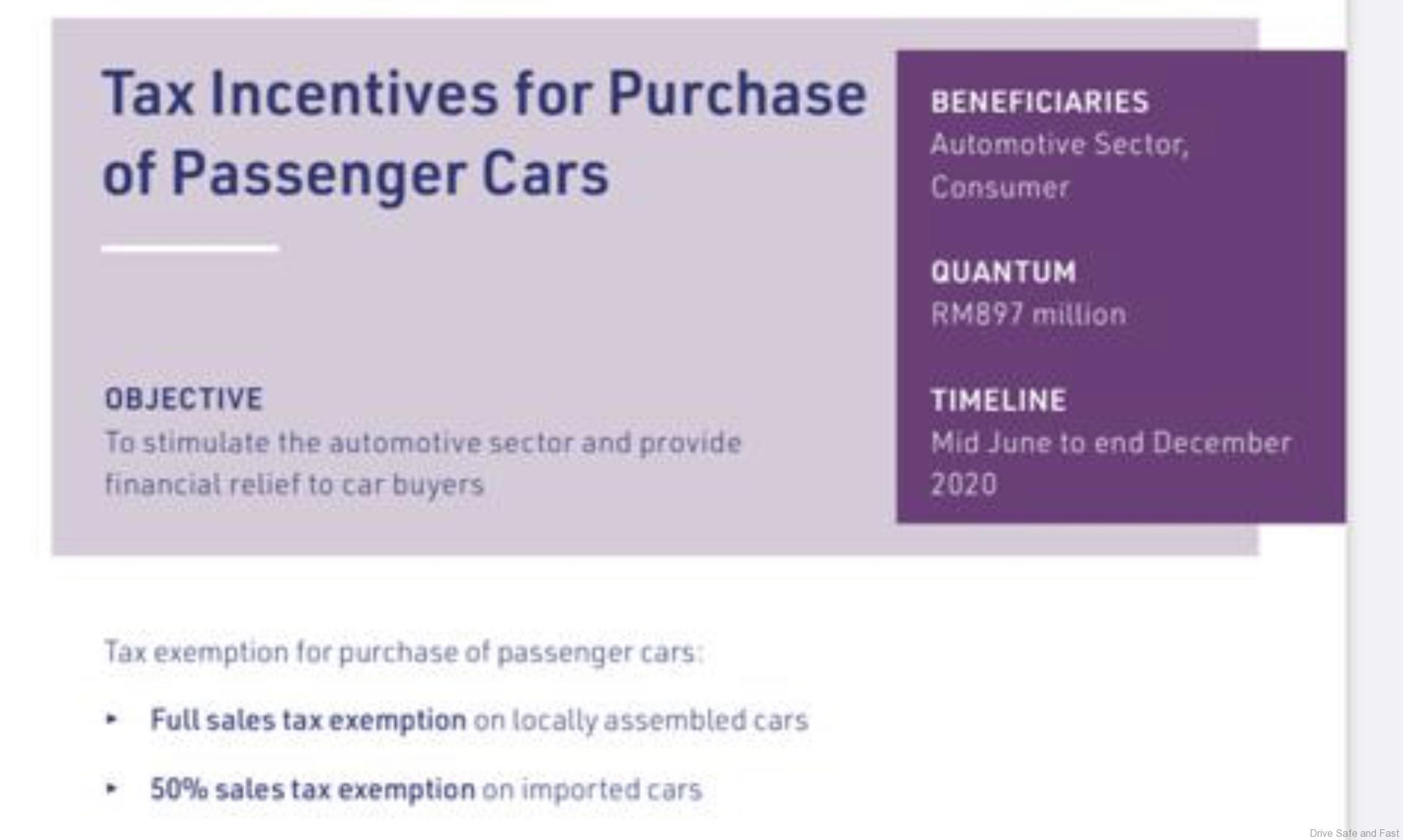

Vehicle sales tax exemption malaysia. The sales tax exemption currently in place for Malaysian consumers was first Budget 2022. Government extends SST exemption period again to Dec 31 2021 100 on new CKD cars 50 for CBU. Starting the 15th of June and ending on the 31st of December 2020 locally-assembled models will get 100 sales tax exemption while fully-imported models will receive 50 sales tax exemption.

The sales tax exemption for passenger cars including MPVs and SUVs will be extended until June 30 next year the Ministry of Finance MoF said. The government has announced that there will be another extension to the new vehicle sales tax. However do note that other taxes like excise and import duties still apply.

The government had previously given a sales tax exemption for the purchase of new vehicles for the period of June 15 to December 31 2020. Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the exemption will now also cover completely knocked down CKD as well as completely built up CBU multi-purpose vehicle MPV and sports utility. Vehicle sales tax exemption extended until June 2021 MoF.

In his short-term economic recovery plan speech earlier this evening prime minister Tan Sri Muhyiddin. The 50 sales tax exemption for imported vehicles announced by the government will not have much impact on car sales as the amount involved is too modest. This means buyers of locally-assembled CKD cars will be exempted from paying the 10 percent sales tax upon purchase.

KUALA LUMPUR Oct 29 The government has agreed to continue the passenger vehicle sales tax SST exemption until June next year to encourage buyers. The current exemption of the 10 percent sales and services tax SST for new locally-assembled passenger cars imported cars are taxed at a discounted 5 percent rate in Malaysia will expire by 31-December 2021. You can refer to our article for a deeper look at how much you would save thanks to the sales tax exemption.

Sales tax exemption on cars extended to June 30. 50 sales tax exemption for the purchase of imported cars also referred to as completely built-up CBU cars Currently the sales tax for vehicles is set at 10 for both locally assembled and imported cars. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

Buyers who registered their cars on or after 1-January 2022 will have to pay more irrespective of when they placed their orders. In a statement today the MOF said the full sales. The Sales and Service Tax SST exemptiondiscount for new cars has been extended to 31-December 2021.

100 sales tax exemption on new CKD cars 50 exemption for CBU until end of the year PM. Completely Knocked Down CKD vehicles are granted a 100 reduction in the sales taxes on new vehicles which normally stands at 10 for both imported and locally assembled vehicles while Completely Built-Up CBU vehicles will be eligible for a 50 sales tax exemption. KUALA LUMPUR Dec 29 The Ministry of Finance MOF has announced the extension of the vehicle sales tax exemption period by a further six months until June 30 2021.

A 50 sales tax exemption is levied on completely built-up imported passenger cars including new and used MPVs and SUVs the MOF was quoted as saying. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the. The Ministry of Finance MOF has announced the extension of the vehicle sales tax exemption period by a further six months until June 30 2021.

As it stands sales tax rate are both CKD and CBU are 10. It was reported then that Malaysia sales tax for vehicles was set at. The government had previously given a sales tax exemption for the purchase of new vehicles for the period of June 15 to Dec 31 2020.

Sales tax exemption is given for raw materials and components used directly in the manufacturing process of goods manufactured from the initial stage of manufacturing until the finished products is finally packaged and ready for export. When the sales tax exemption was first introduced in June 2018 vehicle sales. To reduce the cost of vehicle ownership the Government will extend the 100 sales tax exemption on CKD locally assembled passenger vehicles and 50 on CBUs imported including MPVs and SUVs.

In a new twist the government has now announced via a memo issued to the Malaysian Automotive. With the exemption in place it means that the sales tax is fully waived for locally assembled car or charged at 5 for imported cars. The Sales Tax Goods Exempted from Tax Order 2018.

The sales tax for vehicles in Malaysia is currently set at 10 for both locally assembled and imported cars so the exemption means that the sales tax is fully waived for locally assembled cars and charged at 5 for imported cars.

Sales Tax Exemption For Ckd 100 And Cbu Cars 50

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Sales Tax Exemptions 50 For Cbu And 100 For Ckd Vehicles Autobuzz My

Government Extends Sst Exemption Period Again To Dec 31 2021 100 On New Ckd Cars 50 For Cbu Paultan Org

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Paultan Org

Posting Komentar untuk "Vehicle Sales Tax Exemption Malaysia"