Banking Industry In Malaysia Pdf

Amin Jan Maran Marimuthu Muhammad Pisol binMohd Mat Isa and Pia A. The author gratefully acknowledges.

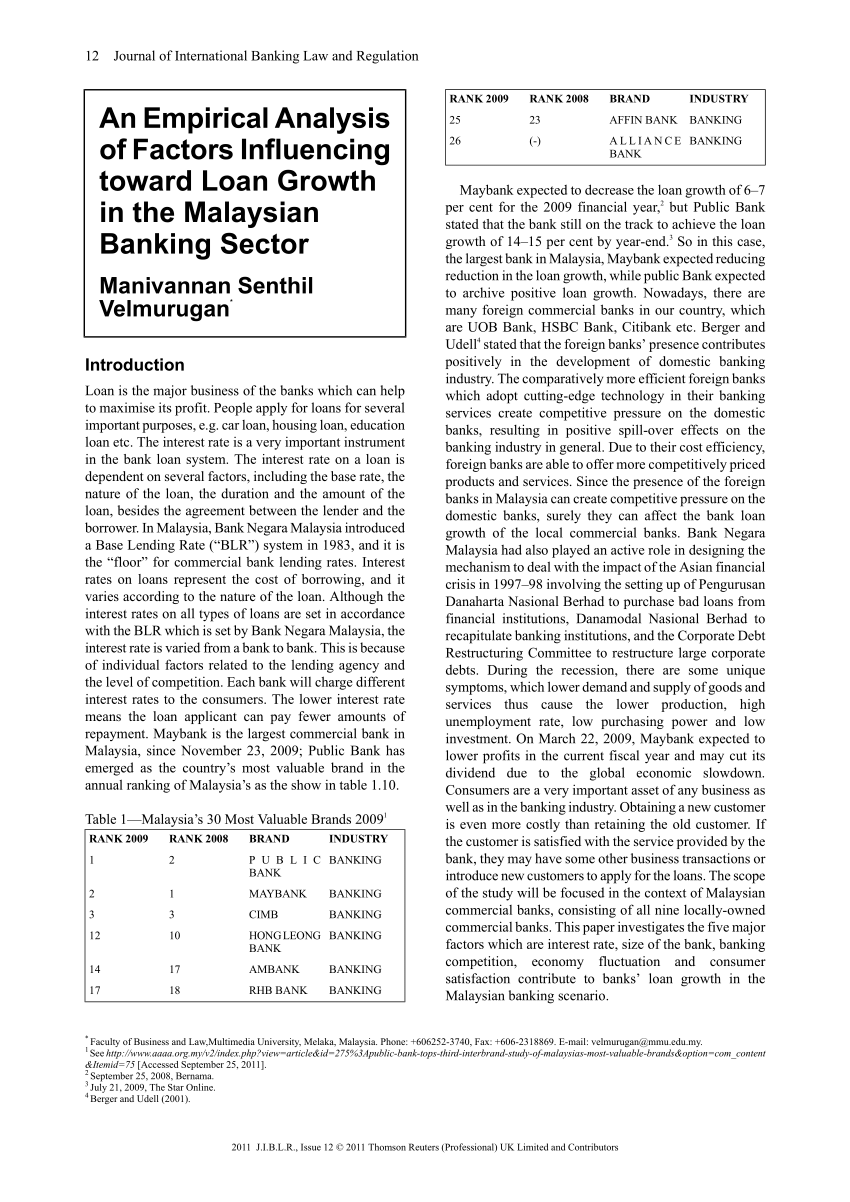

Pdf An Empirical Analysis Of Factors Influencing Toward Loan Growth In The Malaysian Banking Sector

In contrast to many studies on voluntary bank mergers and acquisitions the merger efforts by BNM.

Banking industry in malaysia pdf. Keynote address by Dr Zeti Akhtar Aziz Governor of the Central Bank of Malaysia at the Malaysian Banking Financial Services Summit 2002 - Gearing up for excellence held in Kuala Lumpur 20 May 2002. BNM is governed by the Central Bank of Malaysia Act 2009. A Conceptual Review From The Islamic Banking Industry In Malaysia.

Chapter 1 straits settlements-The beginning The roots of banking in Malaysia can traced back to the existence of the British merchant communities in Penang and Singapura dating back to the 19th century when what was known as the Straits Settlement a standalone British colony encompassing PenangSingapura. The development of Islamic banking industry in Malaysia is divided into three different phases Mohammed et al 2015. Watson 2013 the turnover rate of employees in the banking industry in Malaysia remains high.

Explore the history with our visual compilation of images courtesy of the following contributors. 3 DRIVERS AND CHALLENGES OF MALAYSIA BANKING SECTOR 31 Size Growth 32 Asset Allocation trends 33 Expansion strategies 34 Cost control 35 Profitability 36 Support to Economy 4 OUTLOOK OF COMMERCIAL BANKING INDUSTRY IN MALAYSIA 41 Total Assets and Liabilities Forecast 2005-2020 42 Aggregate Loans Forecast 2005- 2020. EVIDENCE FROM MALAYSIA MARKET BY HAU HUEY TING JAOW AI NI LEE CHEI THAI LEE ZHI WEI LOO MUN HAR A research project submitted in partial fulfillment of the requirement for the degree of BACHELOR OF BUSINESS ADMINISTRATION HONS BANKING AND FINANCE UNIVERSITI TUNKU ABDUL RAHMAN FACULTY OF BUSINESS AND.

The first phase is called the familiarization phase it is a period when. History and Development of Malaysian Banking Industry. Download Full PDF Package.

Open banking allows banks to use customer data to create personalized products and services for customers. The Financial Institutions comprise Banking System and Non-bank Financial Intermediaries. 2 Sum or simple average of Brazil Chile Colombia Mexico and Peru.

Malaysia has succeeded in implementing a dual banking system and has emerged as the first nation to have a full-fledged Islamic system operating alongside the. Malaysias banking sector is dominated by local banks that controlled 80 of total sector assets as of end-2019. The banking industry is no.

Banking industry withstand the potential financial strain. CUSTOMERS SWITCHING BEHAVIOR IN BANKING INDUSTRY-EMPIRICAL EVIDENCE FROM MALAYSIA Dr Ramaiyer Subramaniam Faculty of Business and Law Multimedia University 75450 Melacca Malaysia Email. Non-performing Loans NPLs As indicated by Bank Negara Malaysias base standard the advance delegated non-performing when the intrigue and chief defaulted for six months from the first day of default Amanda 2019.

Ladies and Gentlemen The drive for excellence in the banking industry is a matter of priority given that the well being of the. Banking industry will now have to survive in an era. Yet moving away from legacy technology to adopt open-banking systems remains a demanding task.

The monetary institutions are the central bank Bank Negara Malaysia BNM and the commercial banks including Bank Islam. 21 BANK NEGARA MALAYSIA CENTRAL BANK Bank Negara Malaysia BNM is a statutory body which started operations on 26 January 1959. 1 Sum or simple average of Korea Malaysia the Philippines and Thailand.

This act paved the way for the establishment of the first Islamic banking institution in Malaysia and it also authorised the central bank or Bank Negara Malaysia BNM to supervise and regulate Islamic banks similar to the existing licensed banks. Looking back the pre-corona world was largely uneventful. A third of the 53 banks operating in the country in 2019 were foreign owned.

606-252 3968 Dr Jayalakshmy Ramachandran School of Business The University of Nottingham 43500. As of the end of 1997 the licensed banking system consists of 35 commercial banks of which 22 are do-. Banking industry - three dimensions of consolidation processes in an emerging economyfl.

Its Malaysian Story book of HSBC Bank Malaysia published by Editions Didier Millet. Malaysian Banking Industry NPS Performance in Comparison with Others The Malaysia banking industry NPS of 41 outperforms the Global Ipsos NPS banking benchmark of 30 for face-to-face fieldwork driven by a significantly higher Promoter base. The banking industry can be divided into the conventional financial and Islamic financial systems which are have their own role and important in the economy.

In this study we examine the factors that affect employee turnover intention in the banking industry. For this analysis a panel regression methodology will be applied to investigate the performance of these commercial banks within Malaysians banking system empirically. Although the IBA is.

118 Vladimir Goryunov Bank of Russia. This implies a need to understand the key determinants of employee turnover intention as the main contributor to the high turnover rate in Malaysia. Malaysia has mobilized close to 18 of its GDP.

Abstract This paper aims to propose a framework for measuring sustainability practices. The insurance industry was brought under the supervision of BNM from 1 May 1988. The literature review is presented based on the variables studied in this current paper.

Omnichannel strategy for a 360-degree customer view Customers across industries want seamless experiences. History of the Banking Industry in Malaysia. This indicates strong industry performance with some banks having achieved an.

Banks are playing the crucial role of transferring the cash from the Federal subprime crisis was quite different from. Banking in Malaysia has come a long way since the 19th century. 21 Malaysia Banking Industry Malaysia banking system comprises of monetary and nonmonotery institutions.

Islamic banking industry in Malaysia was Islamic Banking Act 1983IBA. 2009 that investigates the factors influencing the profitability of the Malaysian banking industry. Chapter 5 Financial System of Malaysia 51 Financial System Structure in Malaysia The Malaysian financial system is structured into two major categories Financial Institutions and Financial Market.

The bank mergers and acquisitions in Malaysia in the late 1990s and early 2000s was pushed by BNM to strengthen the banking industry that was highly fragmented with a large number of small finance institutions Sufian Ibrahim 2005. Banking SectorMalaysia Soo-Nam Oh Soo-Nam Oh is Economist at the Asian Development Bank. Various provisions temporarily relaxed certain bank regulations and accounting rules to give banks more leeway to deal with losses resulting from the pandemic and temporarily granted broader authorities to regulators to deal with potential instability in the banking industry.

Out of the total 26 are commercial banks 16 are Islamic Banks and 11 are investment banks.

Pdf Financial Performance Of The Malaysian Banking Industry Domestic Vs Foreign Banks Semantic Scholar

Pdf Malaysian Regulation Versus E Banking

Pdf Employee Retention In The Malaysian Banking Industry Do Flexible Practices Work

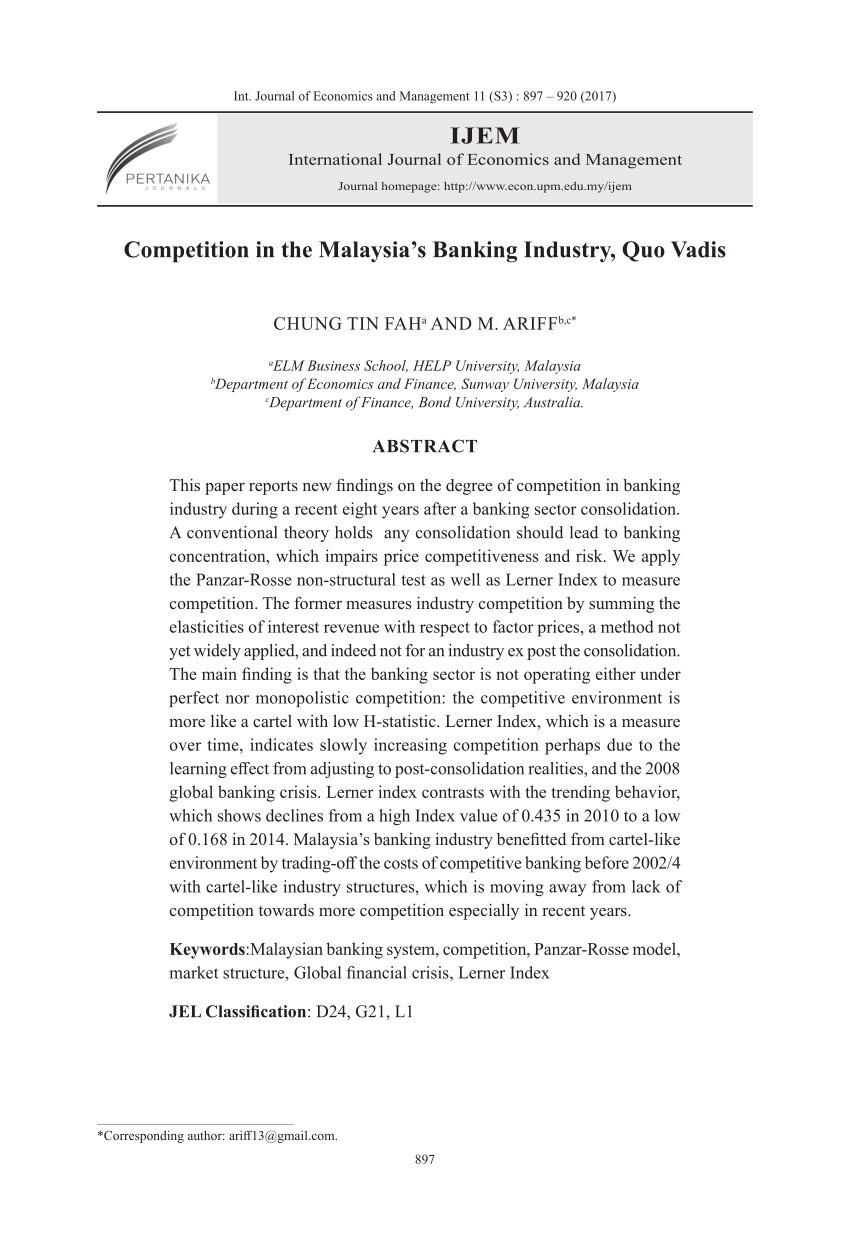

Pdf Competition In The Malaysia S Banking Industry Quo Vadis 18 Ijem S3 2017 R2 Competition In The Malaysia Banking Industry

Pdf Covid 19 And Malaysian Banking Industry Problems Faced By Bank Marketing And Strategies To Promote Services And Bank Brands

Posting Komentar untuk "Banking Industry In Malaysia Pdf"