Is There Inheritance Tax In Philippines

This was welcome news that will stand to benefit many Filipinos and Filipino-Americans in Hawaii who have inheritance or properties in the Philippines with titles that have not been transferred to their names mainly because of dread of steep estate taxes penalties and interests considering the years that have gone by coupled with inaction. In the Philippines the government refers to inheritance tax as estate tax.

This Is What Happens When You Don T Pay Your Estate Taxes

Rather it is a tax imposed on the privilege of transmitting property upon the death of the owner.

Is there inheritance tax in philippines. The Rules on Inheritance in the Philippines Simplified. The Fair Market Value FMV on the date of death of the decedent is your basis as the beneficiary. Understanding it is crucial in estate planning to secure your properties.

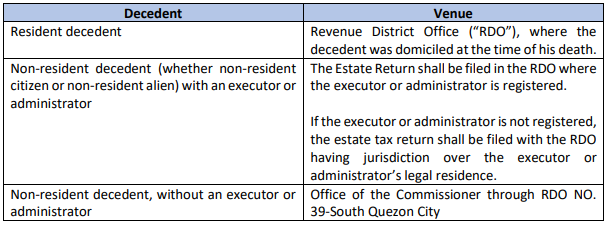

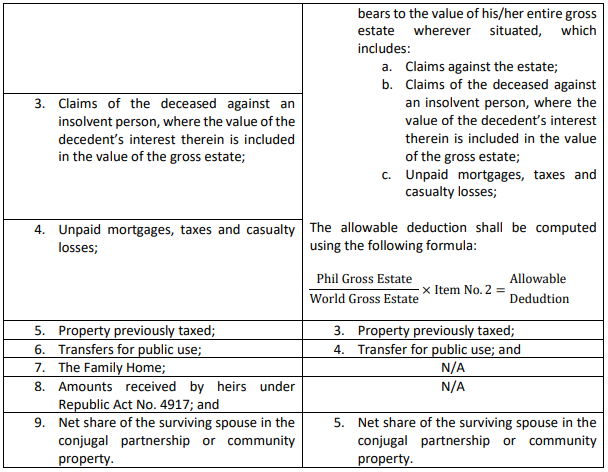

This article discusses about computing and paying Estate Tax under the TRAIN Law in the Philippines. In the Philippines a graduated tax rate determines estate taxes. The estate tax of every decedent whether resident or non-resident of the Philippines is computed by multiplying the net estate with six 6 percent.

How is inheritance tax calculated in the Philippines. This isnt a tax on a property. However an estate tax of 6 is.

An inheritance tax is used interchangeably with estate tax in the Philippines. Rather its a tax on the transmitting of the estate of the. Love descends then ascends and then spreads.

An individual who inherits real estate in the Philippines is required to pay an estate tax in order to legally transfer the property to their name. Inheritence is not taxable but the disposal of the property may create capital gains tax. Residency in the Philippines has several advantages including the fact that foreign income is tax-free and that its relatively easy to obtain permanent residence there.

On one hand descends means that the children inherit first and in case of predecease the childrens children succeed. The surviving spouse inherits like a child. Good news to all those with property inheritance but have not yet settled the estate taxes.

There is a pending Tax Amnesty bill in Congress House Bill HB 8554 the proposed Tax Amnesty Act of 2018 covering tax liabilities for taxable year 2017 and prior years with or without tax assessments that have remained unpaid as of Dec. It is defined by the Bureau of Internal Revenue BIR as thus. Whats inheritance tax in the Philippines.

How much is the estate tax. Headline inheritance tax rate There is no inheritance tax in the Philippines. In the Philippines inheritance tax is the same as estate tax.

Inheritance tax is a tax placed on estates or assets that are passed on via a will of a deceased or the law of succession. It is not a tax on property according to the Bureau of Internal Revenue BIR of the Philippines. In the Philippines the government refers to inheritance tax as estate tax.

Rather its a tax on the transmitting of the estate of the deceased upon death to the heir. Php 50000000 x 8 Php 4000000. An estate inheritance or probate lawyer in the Philippines is a licensed member of the Integrated Bar of the Philippines who has gained years of experience in advising the representative known as an Executor if there is a will or an Administrator if there is no will designated by a deceased person known as the decedent or by the court.

Whoever has obtained permanent residence will be able to settle down in the Philippines permanently and will be able to enter and leave the country as many times as they want. As of January 1 2018 the Philippine Tax Code imposes an estate tax at the rate of six percent 6 based on the net value of the estate whether the decedent is. Inheritance tax is a tax placed on estates or assets that are passed on via a will of a deceased or the law of succession.

Im US Citizen inherited Foreign Money from Sale of Deceased Fathers Property in PhilippinesHe was Filipino citizen. This isnt a tax on a property. The estate tax imposed under the NIRC shall be paid by the executor or administrator before the delivery of the distributive share in the inheritance to any heir or beneficiary.

Basics of Tax in the Philippines. However an estate tax of 6 is imposed on the assets of the decedent taxpayer. If you have a Php 100-million estate your beneficiaries may need to pay up to Php 20 million in taxes.

153 rows There is no inheritance tax in the Philippines. Estate tax is a tax on the right of the deceased person to transmit hisher estate to hisher lawful heirs and beneficiaries at the time of death and on certain transfers which are made by law as equivalent to testamentary disposition. All Taxes are paid in Phil.

This applies to succession settlement of estate inheritance estate planning since Estate tax is a liability to be paid in relation to. You dont have to pay for separate taxes when assets are transferred you only need to settle the fees for the estate tax. Total Estate Tax Php 1500000 Php 4000000 Php 5500000.

Here is how inheritance rules are simplified. In the Philippines inheritance tax is the same as estate tax. Estates with a net value below Php 200000 are exempted while those valued more than the amount may incur a 5 to 20 tax rate.

Where there are two or more executors or administrators all of them are severally liable for the payment of the tax. If the net value of the estate to be inherited is valued at Php 100000000 the estate tax shall be Php 1500000 plus Php 4000000 or eight percent of Php 500000 which totals Php 5500000.

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

Understanding Inheritance And Estate Tax In Asean Asean Business News

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

Posting Komentar untuk "Is There Inheritance Tax In Philippines"