Overview Of Property Industry In Malaysia

The rising prices of property are perhaps the main concern of aspiring homebuyers. RM500000 - RM1mil25502 24583 -36.

Currently industrial properties can get a rental yield of 9 to 10.

Overview of property industry in malaysia. The real estate market in Malaysia has somewhat stalled or declined in recent years due to several factors that have affected the economy. Malaysias average house price stood at MYR 432220 US103106 in Q1 2021. Picture by Choo Choy May.

Print advertisement is the most common marketing method used by real estate companies in the Kiang Valley especially for small-sized companies. In terms of value transactions were down 9 y-o-y to MYR 6587 billion US1571 billion last year. The Malaysian construction industry is expected to be supported by the governments plan to improve its transport network tourism infrastructure and increase the volume of renewable projects.

Last published date. The industrial property sector in Malaysia continues to serve as a ray of light in the countrys glum real estate whilst hospitality retail and other tourism-reliant sector s battle the harsh effects of the pandemic shared Foo Geen Jen the group managing director of CBRE WTW during the press launch of Restart the Uneven Recovery Real Estate Market Outlook 202 1 report. The Malaysian retail sector recorded the largest dip in sales during the second quarter of 2020 with a negative growth rate of 309 in retail sales when compared to the same period in 2019.

Stringent lending regulations have also made it harder for them to seek financing. With a prosperous and rapidly growing tourism industry a stable economy and very low property prices Malaysia offers an amazing potential for foreign investors. Malaysias sanitaryware market is expected to witness significant growth owing to an increase in construction activities and a rise in need for commercial and industrial establishments.

RM1mil8295 8347 06. RM300000 - RM50000038624 40731 55. Breakdown of residential transactions according to price range Price Range 2017 2018 Growth RM300000122263 123724 12.

Detached house average prices were down by 11 y-o-y to MYR 661623 US157849. The IoT industry is expected to contribute 22 billion to the gross national income of Malaysia by 2020 and 98 billion by 2025. Despite safe management measures that seemed ever-changing dependent on the number of the COVID-19 cases in the community Singaporeans have shown.

Industry to the Malaysian economy is significant. Internet of Things. Terraced house average prices rose by 2 y-o-y to MYR 400252 US95491.

Up-to-the-minute news from our press teams providing the latest developments within Savills and across the property industry. Yet with a morose outlook property developers are pushed to become more innovative in terms of products and marketing to reach and satisfy the needs of potential buyers. And in 2021 the property market is widely expected to start recovering on the.

Malaysias strategic location at the heart of Southeast Asias market of about 676 million people and a combined gross domestic product GDP of US3 trillion opens commercial opportunities for companies looking to expand their regional and global supply chain and operations. Thursday 10 Dec 2020 1017 AM MYT. Last year residential property transactions in Malaysia fell by 86 to 191354 units from a year earlier in contrast to a 6 increase in 2019 amidst the pandemic according to JPPH.

It is strategically located on important routes for seaborne energy trade1 Malaysias energy industry is an important sector of growth for the economy. There is now one home for every 54 people compared with the average household size of 41 although the statistics are skewed by foreign workers being densely packed in rented homes or hostels. Malaysia is in an excellent position to seize the economic opportunities generated in IoT due to the countrys high penetration rates in mobile and internet an established EE sector and strong support from various government.

New hotels are coming up and they are able to maintain an occupancy rate of 70 but the problem is that hotel room rates in Malaysia have not been high historically. In 2017 for example prices increased by 5 on average the lowest rate since 2009. Malaysias property market remains soft in 2020 sees better outlook on affordable housing in 1H 2021.

Despite this importance still the Malaysian construction industry has not reached the target yet. According to the PropertyGuru Market Index PMI Q3 2019 asking prices for properties across the board declined in three out of four major markets in Malaysia namely Kuala Lumpur Selangor and Penang. Perhaps the clearest indicator of market sentiment is seen in pricing movements moving into 2020.

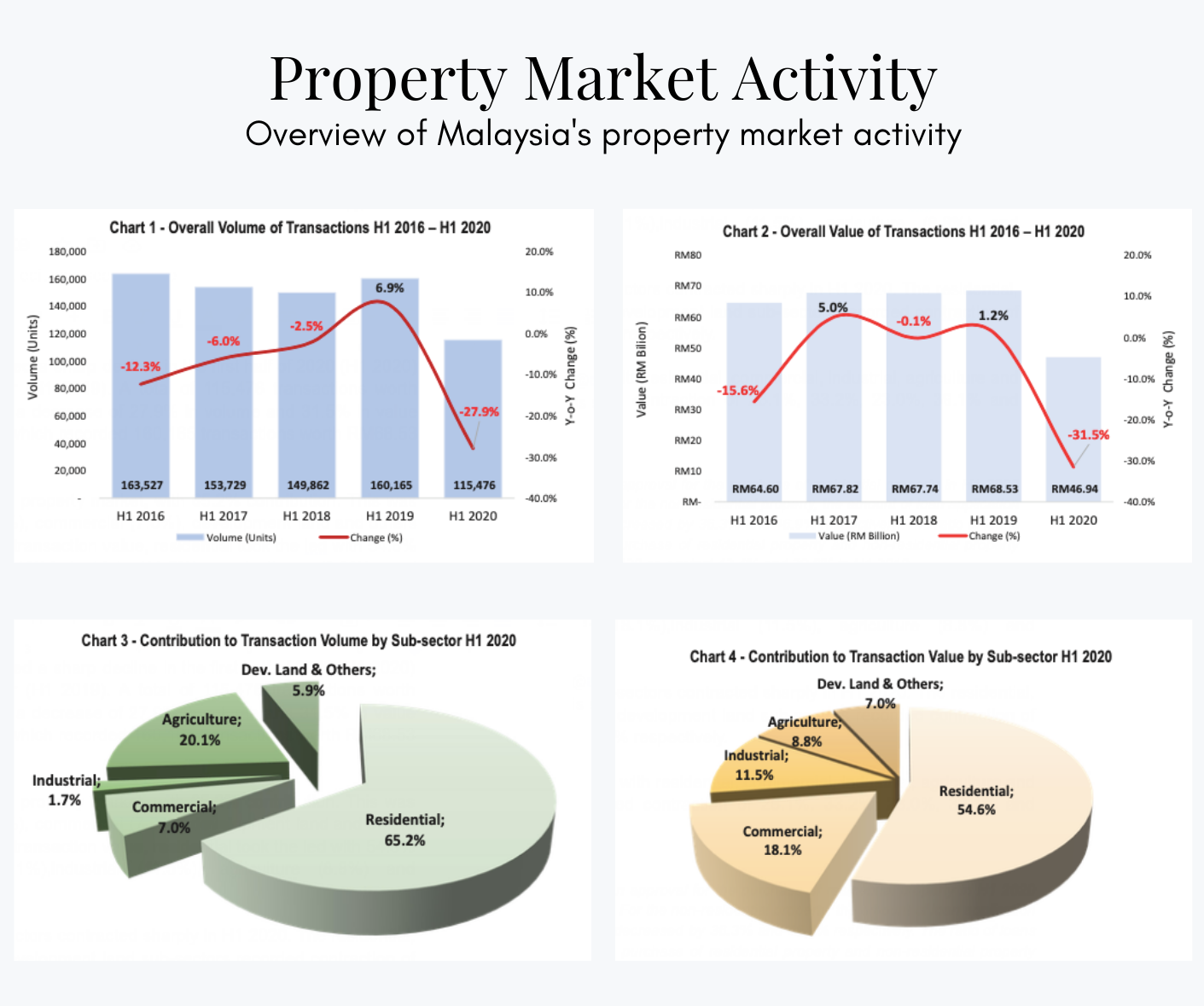

Commercial property and staff housing- Malaysia is now seen to be a compelling location. According to the National Property Information Centre NAPIC the property markets performance recorded a sharp decline in the first half 1H of 2020. However the Malaysian market performed better than expected in 2020 placing it in a good position to make positive gains in the coming year albeit at a gradual and cautious pace.

In 2020 the COVID-19 pandemic was expected to cause an overall subdued property market. 2021 has been a prosperous year for the Singapore property market which has displayed incredible resilience in the face of the COVID-19 pandemic. All in Malaysia had a total supply of 602 million homes in 2019 comprising 573 million houses 38134 SoHo units and 253056 serviced apartments.

Overview 2 The Malaysian Oil Gas Industry May 2016 Indonesia Malaysia Thailand Vietnam Brunei Philippines 0 500 1000 1500 2000 2500. In 2014 crude oil. High-rise residential properties average price fell by 08 y-o-y to MYR 338628 US80789.

Malaysias white sandy beaches its open-minded natives its rapidly growing economy and the low costs of living are only some of the reasons why investment in Malaysias property is a good decision. The transition of Malaysia from a developing country to a developed country was considered in vision 2020 whereby an average construction contribution of 60 in growth domestic product GDP per annum was required. Insurance companies are major investors in real estate worldwide and are gradually increasing their activity in.

Aged care is a very young industry in Malaysia and still lacks critical mass but the potential for growth is there Smaller intelligent homes. Malaysias property market has been in decline since 2012 and weve seen modest price increases. All these characteristics could lead to the conclusion that the real estate agent industry in the Kiang Valley is very competitive.

Singapore Property Market Outlook 2022 Overview. Overview Malaysia is the second-largest oil and natural gas producer in Southeast Asiaand is the fifth-largest exporter of liquefied natural gas LNG in the world as of 2019. We see a similar trend in the number of transactions with only 311824 transactions in 2017 a record low since 2012.

The sector has been underrated Foo said adding that hotel is also a growth sector due to the increasing arrivals of affluent tourists. Physical retailing recorded a sudden dip during the late first quarter of 2020.

Malaysia Residential Property Market On The Way Up Says Real Estate Group Save Malaysia I3investor

Property Market Likely To Stay Flat The Star

Investment Analysis Of Malaysian Real Estate Market

What Is The Impact Of Covid 19 On Malaysia S Property Market Iproperty Com My

Malaysia S Property Market Is In A 2020 Tailspin Is There Hope For Sabah In 2021

Posting Komentar untuk "Overview Of Property Industry In Malaysia"