How To Reduce Epf Contribution

Proposals to lower Employees Provident Fund contributions as a way of cushioning the impact of the Covid-19 outbreak on businesses and workers can be both a. Do not lower your EPF contribution.

Bt Buzz How To Deal With Epf Reduction Businesstoday

If you do not wish to reduce your contribution members are required to opt-out by submitting a form to their respective employers.

How to reduce epf contribution. Paying less EPF contributions will increase your taxable income. If you opt for lower contribution where should you invest. Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz when presenting Budget 2022 in Parliament today said the initiative would involve about RM2 billion.

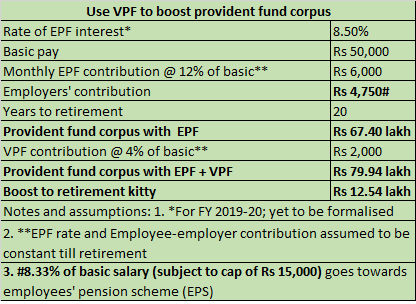

You and your employer need to transfer 10 or 12 of your basic salary to contribute towards EPF. Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021-22 to levy income tax on interest earned on employees contribution towards the Employee Provident Fund or EPF if the sum is above Rs 25 lakh a year starting 1 April 2021. If someone does reduce herhis contribution she should scale it back to the 12 level as soon as she can recommends Sanjay Kumar Singh.

If the proposal does go through then here are a few options for you to invest in if you plan on reducing your EPF contribution. EPF contributions to be deducted at 12 from 1 August 2020. Helping Provide Insights Into Participant Behavior To Provide An Appropriate Plan Design.

- A A. Statutory PF contribution of both employer and employee will be reduced to 10 each from the existing 12 each for all establishments covered by EPFO for the next three months. Relying entirely on EPF for retirement needs is never the right approach.

If you look at the Cost-to-Company CTC breakdown provided by your employer you will find that the EPF contribution of your employer is a part of the CTC. As announced during the Budget 2021 the Employees Provident Fund EPF employee contribution rate will be reduced from 11 to 9 for the period between January to December 2021. During this period your employers EPF contribution will.

Tax-saving components of your CTC. The federal governments move to extend the period for the reduction in the Employees Provident Fund EPF contribution rate from 11 to 9 in the recently announced Budget 2022 is seen as positive for economic development according to the Malaysian Employers Federation MEF executive. However if you are a woman you only need to contribute 8 of your basic salary for the first three years.

KUALA LUMPUR Oct 29 -- The period to reduce the Employees Provident Fund EPF contribution rate from 11 per cent to 9 per cent will be extended until June 2022. Pay on account of EPF contributions and employer shall also have his liability reduced by 2 of wages of his employees. The current tax-free limit on EPF contributions and insurance premiums is RM8000.

Members who want to maintain their contribution rate at 11 will need to apply to opt-out by filling up the Borang KWSP 17A Khas 2021 form which is available on the EPF website wwwkwspgovmy starting 1 December 2020. November 02 2021 1356 pm 08. Ad PGIM Defined Contribution Helps With Retirement Ready Solutions.

This new statutory contribution rate for employees applies only to members below 60 years old who are liable for contribution. In case the proposal to reduce the contribution rate goes through one would have to explore alternative investment avenues such as equity mutual funds and Public Provident Fund PPF to create a corpus for retirement. There are possibilities this shall increase your taxable income.

News About EPF contribution. The equity-linked savings scheme ELSS is a mutual fund scheme that qualifies for tax deduction under Section 80C of the income tax Act. KUALA LUMPUR Nov 2.

The government understands the financial. KUALA LUMPUR 5 March 2020. 13 May 2020 0518 PM IST Written By.

So you wont spend it. If Rs10000- is monthly EPF wages only Rs1000- instead of Rs1200- is deducted from employees wages and employer pays Rs1000- instead of Rs1200- towards EPF contributions. Employees Provident Fund EPF would like to inform that for the year 2021 the employees share of the statutory contribution rate will be reduced from 11 per cent to nine 9 per cent.

The completed form will need to be submitted to the members employer for online registration from December 14 onwards. EPF contribution reduced take-home pay to go up Premium The facility of lower EPF contribution will be applicable for next three months 1 min read. Lower EPF contribution to increase your tax liability reduce PF accumulation The reduced contributions to the Employees Provident Fund EPF would ensure higher liquidity in the hands of both.

Take-home salary to go up as govt reduces employee EPF contribution for next three months Employee EPF contribution cut. Now if the EPF rate comes down to 10 your employers contribution to the fund also reduces. This means your CTC comes down automatically.

This has created confusion amongst people regarding whether they should continue contributing towards a. The monthly PF contributions of both employers and employees were reduced from 24 to 20 for May June and July according to the announcement by the Finance Minister. With reference to the Governments announcement on the 2020 Economic Stimulus Package on 27 February 2020 with regards to the new statutory contribution rate for employees the Employees Provident Fund EPF would like to clarify that the employees share of the statutory contribution rate will be reduced from 11 per.

If the money is kept at EPF you cant touch it. There is speculation that the EPFO may reduce interest in provident fund deposits for this fiscal year 2020-21 from 85 percent as provided for 2019-20 because of more withdrawals and lesser contribution by members this fiscal mainly due to the Covid-19 pandemic.

How Does A Lower Epf Contribution Impact Your Retirement Savings Tomorrowmakers

Reduction In Epf Contribution From 12 To 10 Impact Of The Move Faq Youtube

Reduction In Epf Contribution Opt For Vpf To Make Up For The Decline In Your Kitty

Epf Contribution Reduced From 12 To 10 For Three Months

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Posting Komentar untuk "How To Reduce Epf Contribution"