Income Tax Relief Malaysia 2022

Well Budget 2022 is fixing that by making allocations to also provide the same RM4000 tax relief if you voluntarily make contributions to your EPF account. A recent addition for the year of assessment 2020.

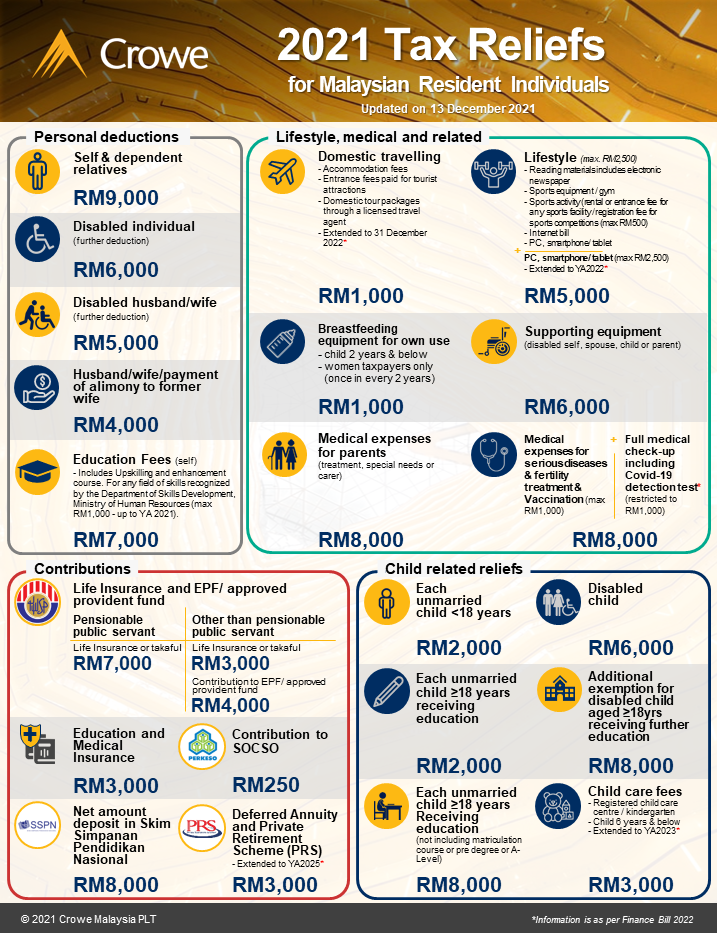

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Learn the top 20 things every American.

Income tax relief malaysia 2022. The maximum income tax relief amount for the lifestyle category is RM2500. During the transitional period from 1 January 2022 to 30 June 2022. This relief is applicable for Year.

Speaking in Parliament on Monday Feb 14 he said the Economic Expansion Incentives Relief from Income Tax Amendment Bill will definitely help to reduce the barriers. The ongoing special tax relief of RM2500 which is allocated specifically for the purchase of phones computers and tablets will be extended for a second time from 31. January 13 2022.

The government intends to extend the special individual income tax relief of up to RM2500 on the purchase of mobile phones computers and tablets until 31 December 2022. For the year of assessment 2021 you can now claim Covid-19 test kits and common vaccinations including Covid-19. The government intends to provide individual tax relief and tax deduction to employers on costs associated with taking self-purchased booster vaccines.

Income Tax Rates and Thresholds Annual. Coming to you this year is the additional lifestyle relief. 12 rows Malaysia Residents Income Tax Tables in 2022.

Malaysia Personal Income Tax Guide 2020 Ya 2019. It is proposed that foreign-source income derived by. EXPANSION OF TAX RELIEF ON MEDICAL EXPENSES Current Treatment Income tax relief of up to RM8000 can be claimed on medical treatment.

Ad See the Top 10 Ranked IRS Tax Relief in 2022 Make an Informed Purchase. Compare the Top IRS Tax Relief and Find the One Thats Best for You. Put simply individual taxpayers do not pay tax on income received in Malaysia which is sourced from outside Malaysia.

Income tax online malaysia. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a.

Repeal of the tax exemption on foreign source income from 1 January 2022. According to Section 140B of the Act an assessee must pay additional tax and submit the proof of tax payment. So if you bought a computer that costs more than that you can no longer include your gym.

On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022. The eFile tax app handles all related foreign income tax forms and tax. This is the largest ever state budget worth.

Updated Return Section 140B. Wef 1 January 2022 foreign-sourced income of tax residents will no longer be exempted when remitted to Malaysia. Years of Assessment 2022 and 2023 2.

In the new Permai stimulus package announced today the government has extended the special tax relief of RM2500 on purchases of phones computers and tablets to. Up to RM2500 for yourself your spouse and child. A one-off special prosperity tax rate for certain super profits generated in 2022.

Compare the Top IRS Tax Relief and Find the One Thats Best for You. According to the Inland Revenue Board LHDN. Ad See the Top 10 Ranked IRS Tax Relief in 2022 Make an Informed Purchase.

If the foreign-sourced income is received in Malaysia by residents during the period of Jan 1 2022 to June 30 2022 the Malaysian government is offering a low rate of 3.

Crowe Malaysia Updated The Tax Relief For Parental Facebook

Ttcs Tax Reliefs Ya 2020 Thannees

Malaysia Bigest Budget 2021 As New Covid 19 Cases At Its Highest Rightways

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Income Tax Relief Items For 2020 R Malaysianpf

Posting Komentar untuk "Income Tax Relief Malaysia 2022"