Socso Contribution For Foreign Worker 2020 Table

47 rows Socso Contribution Table 2021 for Payroll System Malaysia A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. User Manual Advertisement on.

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

There is often much confusion around the exact amount to be paid by the employer and employee towards the SOCSO fund.

Socso contribution for foreign worker 2020 table. This insurance regulated by the Employment Insurance System Act 2017 and also administered by the EIS SOCSO protects workers between the ages of 18 and 60 who. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Socso has provided a comprehensive Contribution Rate table for employers and employees contributions.

SOCSO Contribution chart. Contribution rates are capped at an assumed monthly salary of RM400000. How To Contribute Socso For Foreign.

75 of the staff will contribute 0 while of the workers will. Beginning Jan 1 2019 employers must make Socso contributions for their foreign workers and this involves the 18 million foreign workers that we. Foreign Workers Non-Residents Expatriates in Sabah No.

A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. On January 1 2018 SOCSO introduced the EIS PERKESO portal to help employers to manage their records update and make contributions. Accordingly consistent with this change the employees social security exemption for foreign workers has been.

How To Register Foreigner To. Both the rates of contribution are based on the total. In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and the employee is.

Its now easier to make payments to Socso via online banking. Employers who hire foreign workers will be strictly monitored to ensure that their foreign workers would also be protected under the Social Security Organisation Socso scheme effective. If the expiry date extends beyond 2019 the Employment Injury Scheme will automatically apply to all Malaysian employers who employ foreign workers starting from January 1 2020.

The 12-digit KSPA NO. The amount paid is calculated at 05 of the employees monthly earnings according to 24 wage classes as in the Contribution Table Rates below along with the 175 contribution of the. Contribution Table Rates The contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee.

Foreign Employees Socso Follow Second Category Table Youtube. GAJI BULANAN JENIS KEDUA - BENCANA PEKERJAAN SAHAJA JUMLAH CARUMAN OLEH MAJIKAN SAHAJA 26. In simple terms there are two categories of the SOCSO fund.

Employee Insurance System EIS Contribution Table 2021. Socso Contribution Table 2021 for Payroll System Malaysia A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. Draft Advertisement Form.

Covered under SOCSOs Employment Injury Scheme. Beginning Jan 1 2019 employers must make Socso contributions for their foreign workers and this involves the 18 million foreign workers that we have in the country however employers will be. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity.

How To Register Foreigner To Socso. Azman said some 104400 domestic workers involving 15000 workers with citizenship and permanent resident status as well as 89400 foreign workers were expected to. 12-digit KSPA No which is compulsory for the submission of employee contribution record.

How To Foreign Workers Socso Payment Youtube. Employers are required to contribute 125 percent of an employees monthly wages to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month and capped at MYR 4940. All foreign workers must register to obtain the Foreign Worker Social Security No.

Contribution Rates Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Hiring Outcome Report.

Employees are not required to make a contribution. FAQ - Advertisement On MyFutureJobs For The Hiring Of Foreign Workers Non-Residents Expatriates in Sarawak No. 12021 12 July 2021.

Contribution Payment Per Month. Socso Contribution For Foreign Worker 2019 Social Security Coverage Extended To Foreign Workers He Said The Scheme Would Not Only Benefit Foreign Workers But Would Kustimna. MYFutureJobs Employer Portal User Guide.

Malaysian Permanent Resident under 60 years old Employee. Must be referred to when dealing with SOCSO Table 2022 on all matters related to foreign workers despite any subsequent changes to the workers. 12021 12 July 2021.

Foreign Employees Socso Follow Second Category Table Youtube. In accordance with the Act a company must contribute to SOCSO for its employees using the SOCSO Contribution Table Rates. Socso Table 2019 For Payroll Malaysia Smart Touch Technology.

For foreign workers including expatriates only employers are required to contribute to SOCSO. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary. Rate of Contribution Self-Employment Social Security Scheme Act 789 No.

The maximum eligible monthly salary for SOCSO contribution is capped at RM4000.

Social Protection For Foreign Worker

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

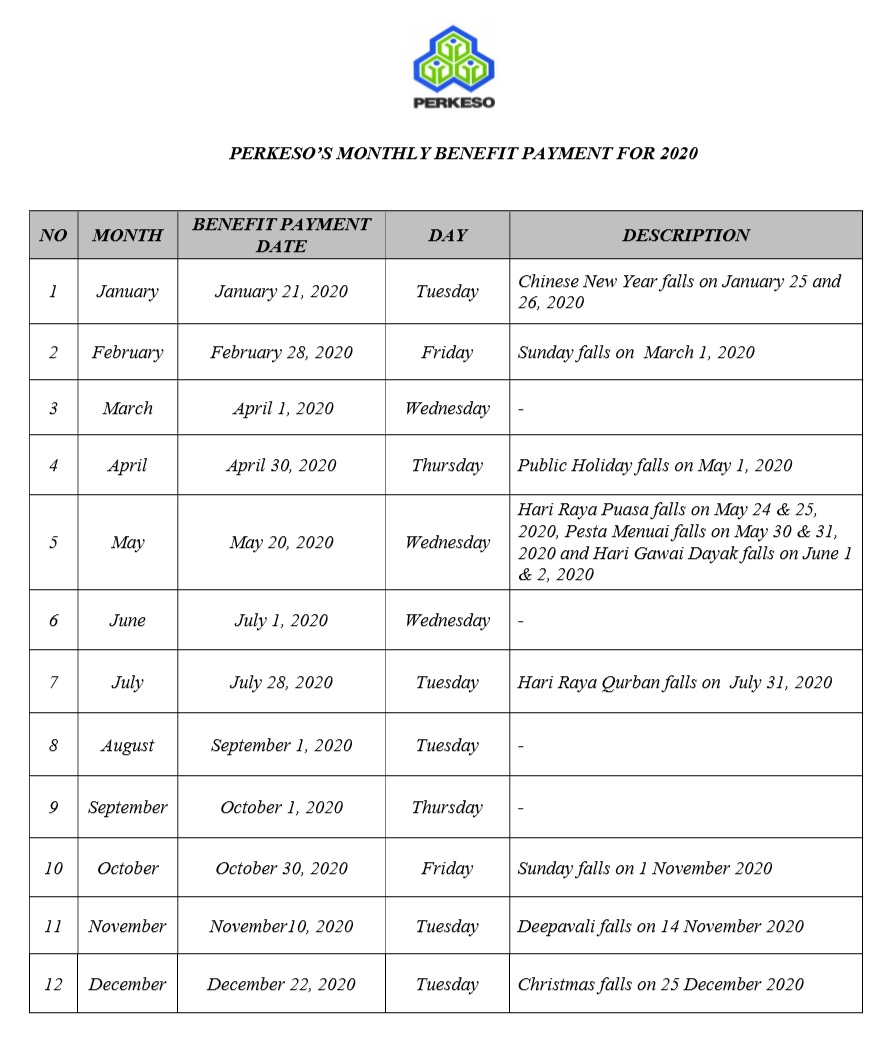

Socso S Monthly Benefit Payment

Posting Komentar untuk "Socso Contribution For Foreign Worker 2020 Table"