Group Personal Pension Scheme Tax Relief

The individuals contributions are made net of basic rate income tax from pay thats already been taxed. In theory an employer can pay any amount of pension contribution to a registered pension scheme in respect of one of their employees or an ex-employee regardless of their salary.

Group Personal Pension What Is It And How Does It Work Royal London Royal London

The extra tax relief available depends on the total personal contributions paid and the members total income.

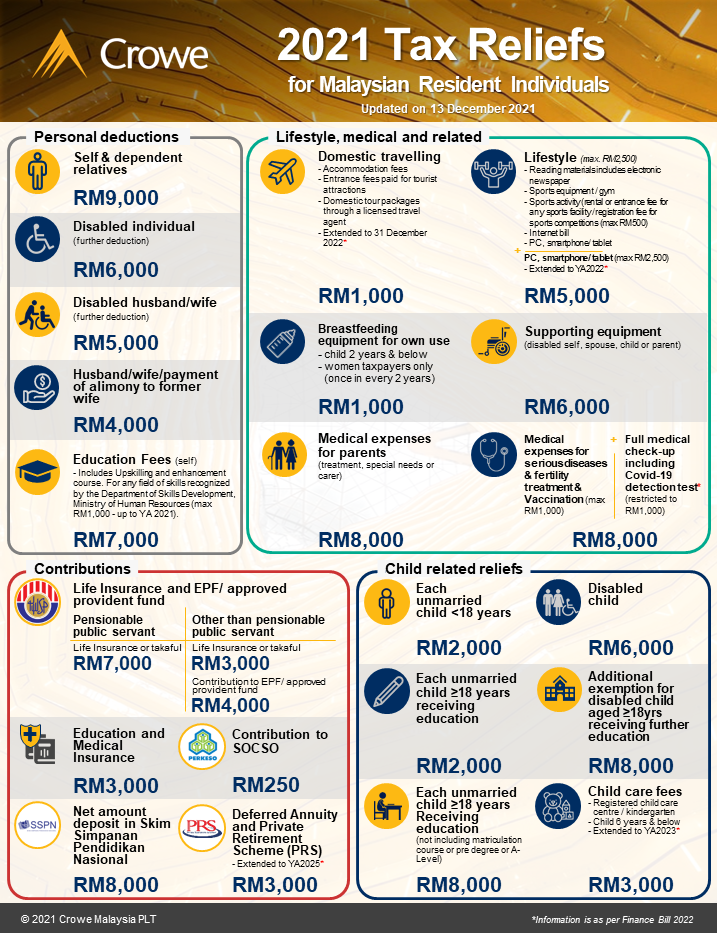

Group personal pension scheme tax relief. Limits on tax relief and tax charges on contributions a In respect of each tax year any contributions paid by you or by a third party on your behalf must not exceed the maximum on which we can claim basic rate tax relief. As the pension scheme provider gives basic rate tax relief at source the member claims any higher rate and additional rate tax relief from HMRC. If youre a basic-rate taxpayer you will receive 20 tax relief on your personal pension payments 40 if youre a higher-rate taxpayer and 45 for all additional-rate taxpayers.

What benefits are. Although its arranged by your employer you have a contract directly with the pension provider. The problem is that tax relief is not automatic and it is up to the employers local inspector of taxes whether or not the employer receives tax relief on the entire contribution.

You dont need to do anything. GROUP PERSONAL PENSION GPP OR MASTER TRUST WHAT SUITS YOUR NEEDS. TAX RELIEF AND SALARY EXCHANGE SALARY EXCHANGE The default method of making pension contributions is through salary exchange.

100 of your relevant UK earnings. TAX RELIEF Its important your employees arent missing out on tax relief. How relief at source works Under relief at source employee pension contributions are taken from an employees pay after tax and national insurance have been deducted.

Higher-rate taxpayers can claim 40 pension tax relief. This method is likely if youre a member of a group personal pension group self-invested personal pension or group stakeholder pension scheme but could also apply to other types of personal pension schemes. When can benefits be taken.

Basic-rate taxpayers get 20 pension tax relief. Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. 1 up to the amount of any income you have paid 21 tax.

This is called relief at source. Tax relief on pension contributions is given in the UK primarily to encourage pension saving. Relief at source is always used for Group Personal Pensions GPPs.

This is the method of tax relief that is applied to an Aviva workplace pension. Contributions to Personal Pensions generate direct tax savings. In a group personal pension the provider will always claim tax relief on your contributions from the government at the basic rate.

Aviva claims tax back from the government at the basic rate. Ad There is now a total deficit of over 90bn and this could mean your pension is at risk. So for example if your employer.

A pension plan provides you with a tax-efficient way of saving for your future. Personal contributions receive tax relief in different ways depending on the type of pension scheme or arrangement they are being paid to. Members will get tax relief based on.

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. A group pension pension is a workplace pension scheme thats arranged by your employer. The GPP is a Defined Contribution Plan sometimes referred to as a Money Purchase Pension.

Choosing your workplace pension scheme is an important decision to make. The net pay arrangement is commonly used for occupational pension schemes whereas relief at source is used for personal pension. The scheme administrator then applies to HMRC for the basic rate tax relief and adds this to the individuals pension fund.

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. Your pension scheme provider will claim this for you at the basic tax rate or 20 of your total GPP pension contributions and add this to your pension pot. As the employer youve got responsibilities.

More people are transferring-out of UK Defined Benefit Pension Schemes than ever before. The amount you receive is based upon your current marginal rate of tax. A group personal pension is a type of workplace pension set up by your employer.

Its a type of defined contribution pension where you build up a pension pot over time and use those savings to fund your retirement. Eligibility residency 5. This is the higher of.

How does the tax relief work. Additional-rate taxpayers can claim 45 pension tax relief. Contributions are made net of basic rate tax relief which means that you will only actually contribute 80 net for every 100 of contributions paid.

Under this method the Company make your payments by adjusting your contractual pay. 3600 or such other amount as may be permitted by HMRC. Personal pensions including group personal pension SIPP and stakeholder pension schemes Relief at source.

How does a group personal pension work. The extra tax relief due is given by extending the basic rate tax band. The pension provider then claims back basic rate tax at 20 from HMRC and adds this to your pot.

Tax relief increases your pension contributions. The government encourages you to save towards your pension by offering income tax relief on any contributions you may make. Theyll then add this to your pension pot.

THE CALOR GROUP PERSONAL PENSION SCHEME GPP 2. Youll get tax relief on contributions you make to a group personal pension. Depending on your age and salary youll be automatically enrolled into your employers group personal pension.

Higher rate taxpayers can claim additional tax relief through their tax return. If youre a higher or additional rate taxpayer in England Wales and Northern Ireland or an intermediate higher or top rate taxpayer in Scotland and paying into a personal or group personal pension you can claim back additional tax relief via your self-assessment. This is money that would otherwise have gone to the government as tax.

Its a collection of individual pension plans and one of these plans will belong to you. Contributions and tax relief 6. 2 Group Personal Pension Plan GPP Guide - updated 06042017 10 Introduction The Wood Group Group Personal Pension Plan the GPP is a tax efficient way to build up a pot of money that you can use in later life.

Pension benefits summary gpp scheme 0616 page 3 of 11 page 3 of 11 pension benefits summary contents group personal pension 1. This is a way of paying into the Scheme and saving on National Insurance NI.

Tax Relief On Pension Contributions St James S Place

Iras Srs Contributions And Tax Relief

Iras Central Provident Fund Cpf Cash Top Up Relief

Tax Relief On Member Contributions

Do You Know How Tax Relief On Your Pension Contributions Works Low Incomes Tax Reform Group

Posting Komentar untuk "Group Personal Pension Scheme Tax Relief"